‘Patient’ Reserve Bank of Australia lays the groundwork for rate rises

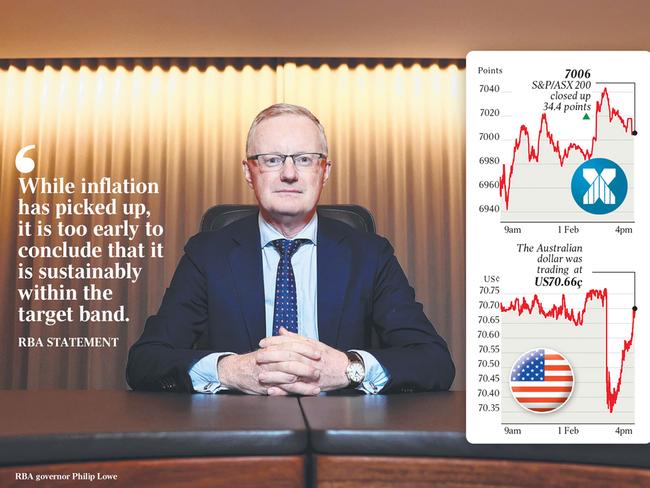

The Reserve Bank has dismissed expectations of aggressive interest rate hikes, sending the dollar down and shares up, despite preparing the way for a rise.

The Reserve Bank has again dismissed expectations of aggressive interest rate hikes, sparking a dip in the dollar and a jump in shares, even as it laid some groundwork to end emergency rate settings.

The circumstances under which rate rises could start, potentially as soon as June, will be the focus of markets when RBA governor Philip Lowe speaks to the National Press Club on Wednesday.

He is likely to keep pushing back against the market pricing of four rate rises this year, but the market will eagerly await Friday’s release of the RBA’s quarterly Statement on Monetary Policy.

If the RBA’s improved economic forecasts – some of which were disclosed on Tuesday – are based on “market pricing”, as per convention, the market will have ample fuel to stay bearish on rates as it awaits upcoming economic data, particularly on employment and wages growth.

While stopping its pandemic-era bond purchase program and boosting its inflation forecasts after surprisingly strong CPI and jobs data last month, Dr Lowe said while inflation had picked up, it was “too early” to conclude that it was sustainably within the 2-3 per cent target band.

“There are uncertainties about how persistent the pick-up in inflation will be as supply-side problems are resolved,” he said.

“Wages growth also remains modest and it is likely to be some time yet before aggregate wages growth is at a rate consistent with inflation being sustainably at target.”

Ending the bond purchases that have swelled its balance sheet to $650bn “does not imply a near-term increase in interest rates” and the RBA was “prepared to be patient” on monetary policy as it “monitors how the various factors affecting inflation in Australia evolve”, he added.

In a surprisingly dovish statement, Dr Lowe said the RBA was “committed to maintaining highly supportive monetary conditions to achieve its objectives”.

Westpac chief economist Bill Evans said: “The board has ceased the bond purchase program and significantly lifted its inflation forecasts but the governor maintains the line that the sustainability of its inflation forecasts can only be achieved with much clearer evidence around wages growth.

“This is likely to preclude an ‘early’ rate hike but does not dissuade us from our August call.”

The central bank has been too pessimistic on the economy during the pandemic.

It has held interest rates so low that houses have become virtually unaffordable on average incomes.

CoreLogic’s national home value index rose 22.4 per cent in the year to January – the highest annual growth rate since 1989 – and the month-on-month change accelerated to 1.1 per cent.

The national median home value rose by $131,236 to $718,146 in the past year.

The household debt to income ratio has rebounded to near record highs around 200 per cent and the RBA-chaired Council of Financial Regulators began tightening lending standards in late 2021.

“Faster-than-expected progress has been made toward the RBA’s goals and further progress is likely,” Dr Lowe said, with core inflation expected to be above the midpoint of the target band through 2023 and the unemployment rate expected to hit a multi-decade low of 3.75 per cent.

Wage growth should pick up further as the job market tightens, but had so far only returned to “relatively low rates prevailing before the pandemic”, and there was “uncertainty about the behaviour of wages at historically low levels of unemployment”, he said.

The central bank would nonetheless “consider the issue of the reinvestment of the proceeds of future bond maturities at its meeting in May”, implying that so-called “balance sheet run-off” or quantitative tightening could start at that time.

It may be too soon to conclude that inflation is “sustainably within the target band”, but that thinking will depend on incoming data, which can change quite quickly as the US has shown.

GSFM investment strategist Stephen Miller said that the earliest one might expect the RBA to lift rates, based on its post-meeting statement, was June, but the RBA was risking “policy inertia” after blowout December quarter CPI data last week led the market to expect a “hawkish pivot”.

“Despite growing evidence to the contrary, the RBA had retained a central scenario that was at one end of the inflation risk continuum, despite accumulating evidence to the contrary of an abundance of upside inflation risk,” Mr Miller said.

“Crucially, wage growth is only expected to pick up gradually even if the RBA is now forecasting that 2022 will see the lowest unemployment rate in almost 50 years. That must be a key uncertainty.”

The RBA’s “patience” as it monitors inflation drivers indicates that policy rate increases are probably some way off, but Mr Miller argues that inflation is already sufficient to warrant a rate hike.

Despite its forecasts to the contrary, the RBA “does not appear convinced that it is ‘sustainably’ within the 2-3 per cent band again (on inflation), curiously in my view, seeming to put greater emphasis on downside inflation risks”, Mr Miller said.

Wages growth remained key to the timing of policy rate lift-off, with the RBA desiring an annual rate of wage growth around 3 per cent before contemplating any increase, he noted.

But with December quarter wages data this month unlikely to see enough growth to warrant a rate hike based on the RBA’s thinking, and March quarter data not due until late May, the “RBA will be relying on data almost five months out of date in its monetary policy deliberations”.

Other signs of wage pressure may therefore be crucial and the RBA should watch wage measures that include bonuses, as that will be more pro-cyclical and more indicative of inflation currents.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout