Meet the Aussie investors in the world’s hottest stock, Nvidia

The chip maker has surfed the Artificial Intelligence boom all the way to a $US1 trillion valuation this week. Some Australian stock pickers have done very well in the process.

Meet the Australian investors who have big returns from the world’s hottest stock, the company at the heart of the artificial intelligence revolution.

Nvidia this week became the first $US1 trillion ($1.54 trillion) chip company when its shares hit a fresh high on the Nasdaq, alongside only the esteemed likes of Apple, Microsoft, Amazon and Google parent Alphabet.

It might be little known across the general public compared to those other trillion dollar stocks, but there are a few Australian fund managers and investors watching on and quietly feeling vindicated as Nvidia’s stock hit fresh highs.

“We have a strong view that this is like being in at the start of the iphone or the personal computer revolution. AI is really going to change the way that people live and work, and Nvidia is right in the centre of it,” says Tim Richardson, investment specialist at Pengana Capital.

Pengana is among a handful of Australian stock pickers to hold positions in Nvidia according to Bloomberg data, and Richardson also quotes a line from a recent note by Wedbush Securities analyst Dan Ives, who describes Nvidia as “at the core [the] hearts and lungs of the AI revolution”.

Shares in the California-based firm, which started 30 years ago after a meeting in an American Denny’s diner, were above $US400 on Tuesday when it briefly hit $US1 trillion in market capitalisation.

It is up about 180 per cent since January 1 alone, and Nvidia shares have almost quadrupled since hitting a 12-month low last October.

Nvidia has been a direct beneficiary of ever-increasing amounts of data being generated around the world, and the computing power required to process and store the data. With more AI adoption across dozens of industries comes further growth in data generation and the need for increased computing power.

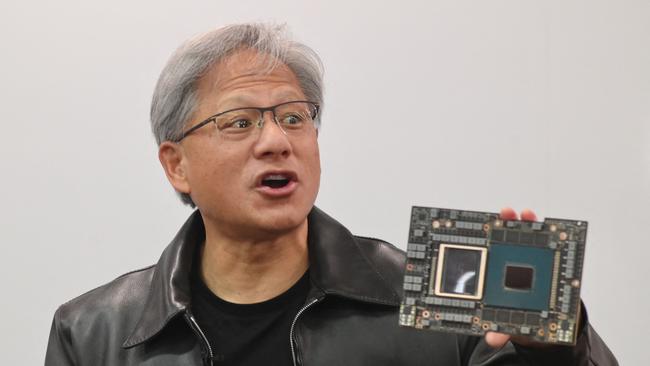

Last year, Nvidia released the H100 chip, one of its most powerful processors costing about $US40,000 each. Soon after, ChatGPT was launched and all of a sudden demand for Nvidia’s product surged given the H100 is the “world’s first computer [chip] designed for generative AI” that creates humanlike words and text, images and other content, according to Nvidia

chief executive Jensen Huang.

Nvidia’s chips have been used in computers, cars and robots, video games and cryptocurrency mining. But “when generative AI came along, it triggered a killer app for this computing platform that’s been in preparation for some time,” Huang said.

Nvidia told the market last week that demand was so high its sales for the July quarter would be 50 per cent higher than previous analyst estimates and demand for its chips rose and spending on data centres by technology companies increased.

Macquarie has almost $1.5bn in Nvidia shares, according to Bloomberg, to make it the largest known Australian shareholder.

BetaShares also has a large exposure via its exchange-traded funds, which the likes of Westpac, Westpac, AMP, ANZ and Commonwealth Bank are also listed as shareholders.

Several superannuation funds also have picked up Nvidia shares, likely as a result of its appearances on various indexes, including VicSuper, QSuper, Telstra Super and IFM Investors.

Sydney quant-driven fund Vinva Investment Group also has a holding.

Then there is Greencape Capital, the Melbourne-based boutique fund manager best known for investing in Australian equities but one that also has a mandate to have up to 10 per cent of its holdings in a handful overseas stocks.

One is Nvidia, which is surfing the AI boom as the producer of the majority of the powerful graphic processing unit (GPU) chips which run on the computers that power generative AI.

Jonathan Koh, Greencape’s portfolio manager who runs the firm’s High Conviction Fund with David Pace, says Greencape has held Nvidia shares since 2017 – a year that started with Nvidia trading at about $US27.00 (Nvidia underwent a four-for-one stock split in 2021).

Koh says it was Greencape’s holding in ASX-listed data centre business NextDC that led him to search for undervalued “adjacency” stocks that could also be worth investing in.

“It may not be our biggest position but it clearly is among our top 10 holdings now,” Koh says about Nvidia, which his firm now has more than $200m invested in.

“And we still think it has a really good runway and it is still early days on how it could perform.”

Koh says he is confident in Nvidia’s future earnings capacity due to its exposure to the gaming industry, an industry it has been a powerhouse in, and also the automotive sector where Nvidia has announced a partnership with Mercedes to work on in-vehicle computing and AI automated driving infrastructure.

Now comes the question as to whether Nvidia is simply the most prominent company in the latest technology fad or if it has staying power.

Victor Smorgon Group, the family office that represents the wealth of the Smorgon family and also takes some outside investment, has been a believer in the AI story.

Its global multi-strategy portfolio, helmed by co-chief investment officers Joseph Sitch and Peter Edwards, maintain the belief in the sector but sold out of their Nvidia holdings in January and took their profits – at least for now.

“There is no doubt that with the increased adoption of AI throughout the global economy semiconductors will be at the heart of this adoption rate, however, discipline needs to be employed around valuation and the multiples one is willing to pay for these businesses, particularly in providing downside protection,” Sitch and Edwards said.

“Nvidia remains on the watchlist, and any meaningful pullback in share price will be viewed as a buying opportunity.”

Pengana Capital has been in Nvidia since December last year via the funds it has with US investment firm Axiom, and though that may look like a relatively short period of time, Nvidia shares have more than trebled.

But Richardson remains a believer in Nvidia.

“Given the uplift in earnings revisions and with the consensus [forecast] earnings, Nvidia is actually trading on a lower price to earnings ratio that it was only a few weeks ago.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout