Markets under pressure as Covid-19 tightens its grip

Australian shares remain a better bet than US and European peers but are being pulled lower amid an explosion in volatility due to COVID.

Australian shares remain a better bet than US and European peers but are being pulled lower by derisking and deleveraging in global markets amid an explosion in volatility due to COVID.

Notwithstanding this downward pull as investors question the V-shaped recovery assumption amid record US and European COVID numbers and new lockdowns, as well as US election uncertainty and delays in US fiscal stimulus and coronavirus vaccines, Australia has outperformed since its fiscal stimulus was confirmed in the budget, the Reserve Bank flagged more asset buying is on the way and Victoria has reopened its economy.

But with the S&P 500 dropping 3.5 per cent – its biggest fall since June – the VIX volatility index surged to a four-month high of almost 41 per cent, forcing risk parity investors to trim exposure to risk assets no matter what their qualities, including gold and Australian shares.

“Everything we can see points to a partial risk parity derisking event,” Credit Suisse macro strategist Damien Boey said. “Risk parity investors, optimised for prevailing volatility levels and cross-asset correlations, are exper-iencing a ‘value-at-risk’ shock.

“That is, they are getting wrong-footed on their risk optimisation assumptions. They are not only being forced to consider re-allocating their portfolios – they are having to outright derisk and deleverage their portfolios.”

This can lead to indiscriminate, forced selling, resulting initially in defensive exposures outperforming but, later, crowded exposures underperforming, and may be in the early stages.

“Looking ahead, the risk is that risk parity derisking and deleveraging takes on a life of its own, without adequate intervention from policy makers, notably central bankers,” Boey warned.

More fiscal stimulus will be needed, but it’s not clear if the will is there yet in Europe, while overdue US fiscal stimulus will not occur until potentially well after the election.

Lockdowns in major European nations will again force investors to reassess oil demand, and a plunge in crude prices could threaten the US junk bond market. And falling shares prices will tighten financial conditions – already at the tightest in four months – forcing corporate bond investors to reprice risk.

“The good news is that the Fed and other central banks are already conducting QE,” Boey said.

They are well placed to step up government bond purchases to limit bond volatility and prevent a widespread liquidation event. Moreover, the Fed has been curiously absent from the credit scene in recent months, and could easily choose to resume corporate bond purchases again.

“The issue is that it may take a little while to settle the VIX, given that the US election is not that far away, and investors are extremely nervous about contested or gridlocked outcomes that the Fed cannot directly insure them against,” Boey said.

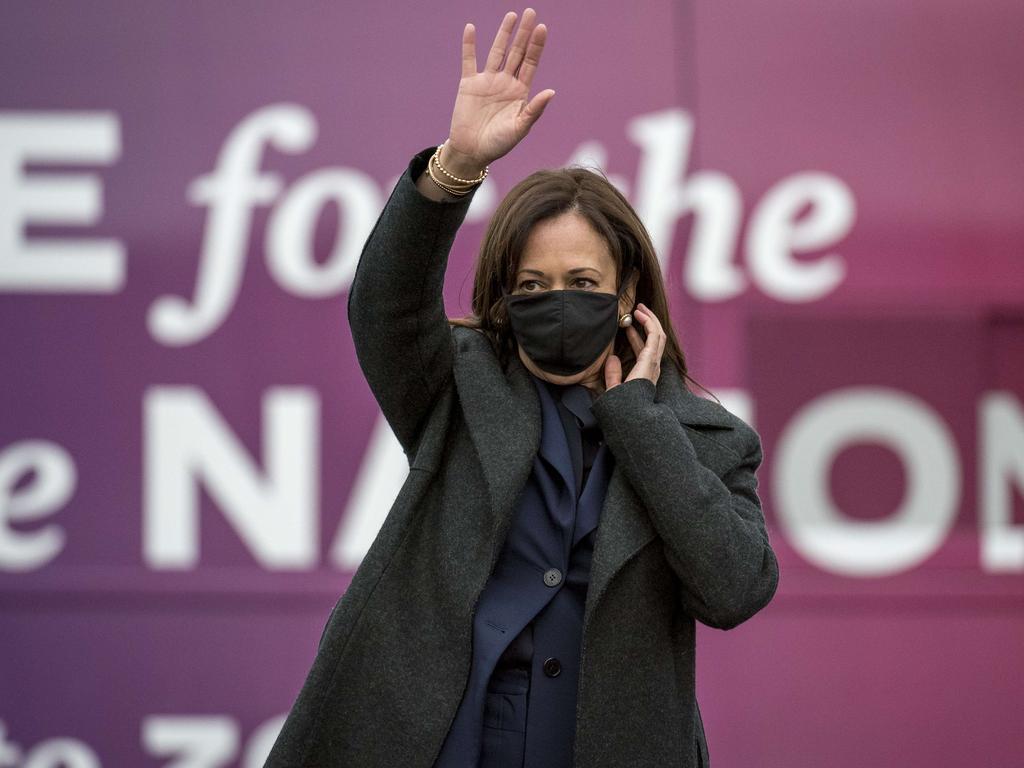

Meanwhile, a Democratic sweep would be the “most positive” scenario for Australian equities but that’s the “most negative” scenario for US equities, according to UBS.

Of the three most likely scenarios – Republicans winning the White House and keeping hold of the Senate, a Democratic sweep of the White House and Congress, and Democrats getting the White House but failing to get the Senate – betting markets and opinion polls favour a Democratic sweep.

While historically Australian equities have outperformed in the year after an incumbent US president was re-elected, a Democratic sweep may be best for Australian equities.

“Australia could benefit from stronger US economic growth under a Democratic sweep, particularly given the higher weight to cyclicals,” UBS Australia equity strategist Pieter Stoltz said.

“Furthermore, while higher tax rates in the US could drag on S&P 500 EPS, it would make Australia a relatively more attractive place to invest with the corporate tax rate differential potentially narrowing from 9 per cent to as low as 2 per cent.”

Aussie companies with US operations that could be hit by a US corporate tax increase include ResMed, Aristocrat, United Malt, James Hardie, Boral, BlueScope, Sims Metal, QBE, CSL, Brambles, Ansell, Orora, Breville, Macquarie, Sonic, Cochlear, Incitec Pivot, Orica, Nufarm, Appen and Altium.

But industrials such as Amcor, Orora and Ansell would benefit from higher US growth, assuming large-scale US stimulus on a Democratic sweep. Infrastructure stimulus would boost Incitec Pivot’s high margin US explosives business, and Sims Metal and BlueScope could benefit from an increase in steel prices on the back of construction stimulus, according to Stoltz.

UBS global equity strategists view a Biden win with a Republican Senate as best for US equities, as it would likely result in Biden’s trade policy effectively combined with Trump’s status quo on tax policy. “The status quo would also be good for US equities because taxes not increasing outweighs trade policy risks,” they say.

A Democratic sweep would be the worst outcome for US equities due to an expected lift in the corporate tax rate to 28 per cent from 21 per cent, doubling in GILTI tax, a 15 per cent minimum tax on book income and higher social security taxes more than offsetting the positive effects of stimulus on EPS. UBS analysis suggests the full implementation of Biden’s tax plan could wipe 7.8 per cent of the earnings per share of S&P 500 companies.

Interestingly, amid reports that California-based Ares Management is circling AMP, Morgan Stanley strategists see scope for inbound and outbound corporate takeover activity to take off.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout