Market on edge amid virus fears

As the local market prepares for a sharp fall, fears about the economic impact of the coronavirus are growing.

Concern about potential economic fallout from the worsening spread of the new coronavirus looks set to weigh on the local sharemarket when trading resumes after the Australia Day long weekend.

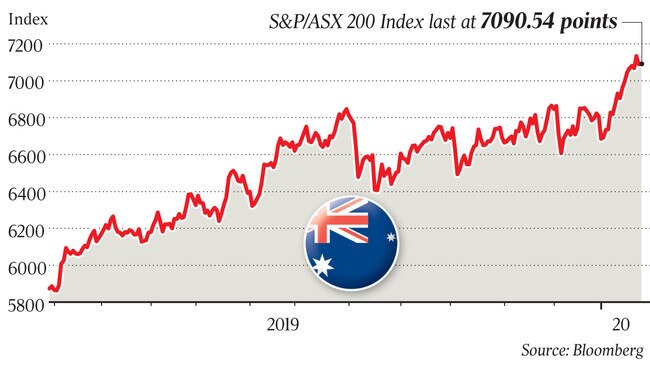

Futures were pointing to a 1.2 per cent fall in Australia’s S&P/ASX 200 share index amid risk aversion and safe-haven demand as China struggled to control the deadly virus that’s killed at least 80 and spread globally, despite extreme measures including the effective quarantine of 40 million people.

S&P 500 futures were down 1 per cent on Monday night after the US benchmark tumbled 0.9 per cent on Friday -- its biggest fall in more than three months. Japan’s Nikkei 225 dived 2 per cent on Monday while China, Hong Kong, Korea and Taiwan were closed for holidays. China FTSE A50 futures fell 5.7 per cent.

It came as investors and economists gauged the potential economic impact of the virus.

“It’s increasingly probable that China’s effort has failed to contain this viral outbreak,” AxiCorp chief market strategist, Stephen Innes said.

“The biggest threat to the global economy is not just because the disease spreads quickly across countries through global travel, but also, because any economic shock to China’s colossal industrial and consumption engines will spread rapidly to other countries through the increased trade and financial linkages associated with globalisation.”

In currency markets, the Australian dollar hit a seven-week low of US68.00c and a three-week low of 73.99 Japanese yen. The US dollar rose 0.7 per cent to a four-week high of 6.9810 yuan. Gold hit a three-week high of $US1588.68 and US 10-year bond yields hit a three-month low of 1.62 per cent.

WTI crude oil tumbled 2.4 per cent to $US52.90 a barrel and London Metal Exchange copper dived 1.5 per cent to $US5,835.50 a tonne -- adding to a string of losses in recent days -- while Singapore iron ore futures dived 6.6 per cent to $US85.00 a tonne.

But OANDA senior market analyst Jeffrey Halley said it was important to note that Japan was the only major Asian market open on Monday, so “liquidity was at a premium across all asset classes.”

“Thus, any moves, especially on Monday morning, can be exaggerated,” he said.

But the Wuhan virus is expected to cast a shadow over financial markets this week.

“With asset markets pumped up on hopes of a global post-trade deal recovery and cheap central bank money, an unexpected growth shock leave them particularly vulnerable to a potentially strong downward correction,” Mr Halley said.

“The world’s central banks, having slashed rates to the bone in 2019, have a severe ammunition shortage on the monetary policy front to offset a growth shock. Fortunately for the world, two central banks that do are the two most important, the US Federal Reserve and China’s PBOC.”

It comes ahead of a Federal Reserve meeting on Wednesday and a Bank of England meeting on Thursday.

Wilson Asset Management chairman Geoff Wilson said he saw “significant risk” for inbound tourism from China, given estimates of over 1.4 million people injecting over $12bn into the economy.

“The companies that are plugged into the tourism sector - obviously they’ll all be getting impacted,” he said. “The difficult thing for them is following on from the bushfires over the Christmas period.

“From our portfolio, we’ve largely avoided travel companies.

“That’s largely been a factor of the negative impact of the bushfires and not understanding the magnitude of them. That’s how we’ve positioned our portfolios already. So this coming on top of that, from the capital preservation perspective, we won’t change the portfolio position.”

Overall it was “just far too early to tell” how much impact it will have on the Australian economy, but “it will have an impact” and could also have ramifications for global economic growth.

“Because the Australian market has been on the longest bull market ever -- and a lot of the performance in the market more recently has been on PE expansion due to exceptionally low interest rates -- if there was a hiccup, the market is more vulnerable now.”

PwC chief economist Jeremy Thorpe said Chinese student and tourism spending in Australia is worth about $9.2bn a year and the economic consequences of a significant reduction in the mobility of people from China could be “sudden and substantial”.

His modelling showed that a complete withdrawal of Chinese tourism and student spending for a year would cause a net reduction (including costs) in Australia’s GDP in the order of $2.3bn.

“It doesn’t shake the whole economy but it’s very concentrated and there would be substantial knock-on effects, particularly from tourism in regional areas.”

“Twenty thousand full-time jobs would disappear, many taking years to come back,” he said.

“We’re not at the point of a complete withdrawal but that’s the size of the prize that’s at risk.”

“In many ways this is bad timing but also because Chinese students who went home for holidays are more at risk of not coming back this year than if this had occurred later in the year.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout