Handbrake off on $3bn Viva petrol float

Dutch trading giant Vitol and the Abu Dhabi Investment Council will sell up to 60 per cent of Viva Energy for up to $3 billion.

Dutch trading giant Vitol and the Abu Dhabi Investment Council will sell up to 60 per cent of fuel company Viva Energy for as much as $3.01 billion in Australia’s biggest public float for four years as they take profits from the 2014 purchase of Shell’s Geelong refinery, wholesale business and service stations.

The well-flagged float will see Viva, which was bought by a Vitol-led consortium for $3bn and has had another $1bn spent on it, valued at $4.86bn to $5.15bn. This will make it the biggest float on the stock exchange since Medibank in 2014.

Viva plans to list its fuel refining, importing and retail business on July 20 as a direct competitor to the $8.2bn Caltex, which has long been the only local refining company for ASX investors.

While the refining sector was under pressure when Shell sold Viva, margins have rebounded strongly in recent years and, helped by a weaker dollar, have made the nation’s four remaining refineries economic again.

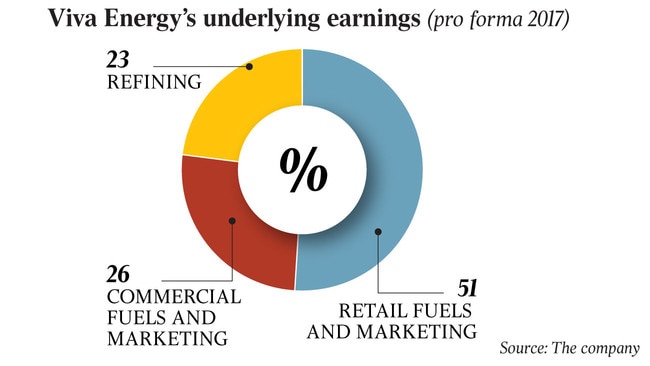

Viva supplies a quarter of Australia’s fuel. Its potential appeal to investors involves growing diesel and aviation demand and, to a lesser extent, the potential for retail convenience store margins to improve. Scott Wyatt, a former Shell Australia refining chief who stayed on after the sale, will remain Viva chief executive. He will also join the Viva board, which will be chaired by former Howard government defence minister Robert Hill.

Mr Hill, who has been a Viva director since 2014, said that in the past four years the Vitol consortium had strengthened the business by investing in the refinery, acquiring Shell’s aviation business and Liberty Petroleum and, in 2016, spinning off petrol station real estate into the Viva Energy Real Estate Investment Trust.

“The effective implementation of these initiatives, together with Viva Energy’s net debt balance of $78 million, puts Viva Energy in a strong position to deliver attractive and sustainable shareholder returns and consistent operating cash flows,” Mr Hill said.

“We have plans for the continued expansion of our retail network and see opportunities to benefit from growth in key commercial sectors.”

The other board members are Jane McAloon, Sarah Ryan, Arnoud De Meyer, and Vitol executives Dat Duong and Hui Meng Kho.

Mr Wyatt said the main reason for the float was to give a return to Vitol and its unnamed partners in the Vitol Investment Partnership in the wake of the $1bn of investment over the past four years. “Shareholders have taken no dividends and only a very small capital return when we did the REIT,” he said.

“Listing the company obviously allows new shareholders to join but also allows our shareholders to make a return on the investment they made some years ago — that’s the fundamental reason we are bringing it to market.”

The Vitol consortium expected to hold between 40 and 50 per cent of the company after the float and had no intentions to sell down further, Mr Wyatt said.

He would not say who the other shareholders were but said Vitol was the largest shareholder and did not own more than 50 per cent of the company.

Filings around the Viva REIT show Vitol and ADIC jointly owned 38 per cent of the trust.

It is understood that ADIC remains a member of the Vitol consortium.

The Viva Energy retail offer opens on June 28 and closes on July 10 with a final price to be announced on July 12 after a bookbuild.

Merrill Lynch, Deutsche Bank and UBS are joint lead managers on the float.

Mr Wyatt said there was the potential to expand production from Geelong and that the company was committed to the next major maintenance turnaround there in 2020.

“We’re committed to that investment and we see a strong future for Geelong,” Mr Wyatt said. He said rapidly changing technology that would increase the proportion of electric cars would be a headwind.

But he stressed this was a long way off, noting 1.2 million new petrol cars were sold last year that would have lives of 10 to 15 years.

He also noted petrol sales only made up 25 per cent of Viva’s volumes, with the rest in areas like diesel to heavy industry and jet fuel to aviation, which showed no signs of being disrupted.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout