Elon Musk’s Tesla bitcoin play exposes a double standard

Elon Musk will now let you drive a Tesla in exchange for a currency whose carbon footprint dwarfs many that of many nations’.

Elon Musk’s announcement that electric carmaker Tesla will now accept bitcoin as payment has coincided with a searing indictment of the cryptocurrency’s environmental impact.

Bank of America Securities has rated bitcoin’s environmental credentials as “poor”, with the network’s carbon emissions already matching those of Greece.

In a comprehensive, 49-page review, the firm said that a $US1bn fresh inflow of funds into bitcoin could cause emissions to rise by the equivalent of 1.2 million vehicles with internal combustion engines.

The reason is that the network consumes a vast amount of energy, mostly in coal-fired Xinjiang, to run and solve different algorithms, which are used for generating more bitcoin and allowing transactions to occur.

The process is also called mining.

BofA said the link between prices, energy demand and carbon dioxide meant bitcoin was tied to Chinese coal.

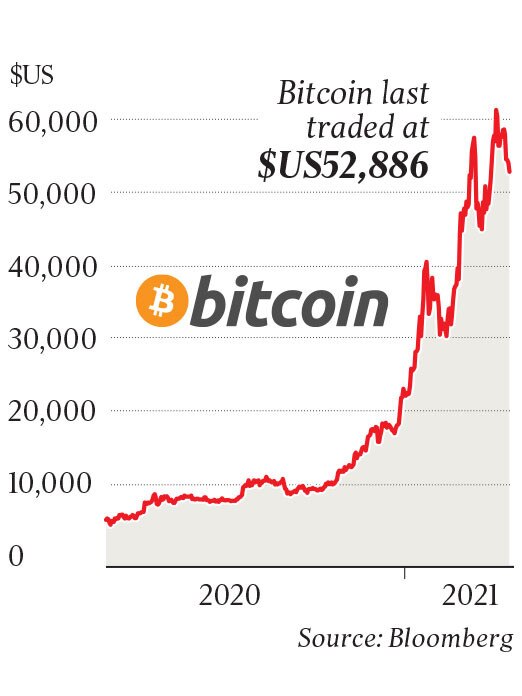

“Should the bitcoin price rise to $US1m (from $US52,180), it may turn into the world’s fifth-largest emitter, surpassing Japan,” the review said.

“On social and governance issues, democratisation of money and anonymity of ownership can be positive, as it is helpful in territories with corrupt financial systems and lowers costs by eliminating intermediaries. But negatives outweigh. Anonymity aids nefarious activities.”

Mr Musk’s Tesla has benefited from an environmental halo effect because of its electric cars.

Earlier this year, however, the group ploughed $US1.5bn of cash into bitcoin, flagging it would soon accept the digital currency as payment for its vehicles.

While the offer is limited to the US for now, Mr Musk confirmed in a tweet that bitcoin would also be accepted in other markets, including Australia, later this year.

‘Staggering hypocrisy’

Gen Y investor Nick Bolton slammed the Tesla founder in an interview with The Australian earlier this month, accusing him of “staggering hypocrisy” in his pro-environment positioning.

“Bitcoin is one of the world’s most significant and offensive polluters,” he said.

“It emits significantly more greenhouse gas emissions than New Zealand, all for its pointless (and usually criminal) endeavours.

“It’s one thing to pollute for a legitimate need like air travel, but quite another for the totally arbitrary programming logic of bitcoin that incentivises its miners.”

Mr Bolton, who has a short position in Tesla and has previously shorted bitcoin, said bitcoin was “probably worth absolutely nothing”.

BofA’s assessment was broadly similar, saying there was no good reason to hold the cryptocurrency unless you felt the price was going to appreciate.

“Bitcoin has become correlated to risk assets; it is not tied to inflation, and remains exceptionally volatile, making it impractical as a store of wealth or payments mechanism,” the review said.

“As such, the main portfolio argument for holding bitcoin is not diversification, stable returns, or inflation protection, but rather sheer price appreciation, a factor that depends on Bitcoin demand outpacing supply.”

Just like with other commodities, BofA said supply and demand drove the price of bitcoin, although there were twists.

Bitcoin output was capped at 21 million coins, with the growth in supply halving every four years and designed to become increasingly tight.

Demand swings were therefore key to price moves, with major institutional announcements and miner reward cuts followed by bitcoin price increases.

The surging price of the digital currency, particularly in 2020, occurred in response to “modest” capital inflows.

“After a detailed analysis, we find that bitcoin is extremely sensitive to increased dollar demand,” BofA said.

“For example, we estimate a net inflow into bitcoin of just $US93m would result in price appreciation of 1 per cent, while the similar figure for gold would be closer to $US2bn or 20 times higher.

“In contrast, the same analysis for the 20 year-plus Treasuries shows that multi-billion money flows do not have a significant impact on price, pointing to the much larger and stable nature of the US Treasuries markets.”

BofA noted its previous view that a surge in trading liquidity was a key feature of the asset.

“Yet bitcoin remains limited by its complex settlement process (crypto mining), and can just handle 14,000 transactions per hour relative to Visa’s stated 236 million,” the report said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout