Nick Bolton tackles Tesla and Elon Musk over ‘worthless’ bitcoin

Gen Y investor Nick Bolton accuses Elon Musk of “staggering hypocrisy” in his pro-environment positioning after the Tesla boss made a huge bitcoin play.

In his determination to understand volatile markets, Nick Bolton has immersed himself in some unusual activities, like spending $5000 on two specialised computer servers in China to mine bitcoin and track the mania fed by Tesla chief executive Elon Musk.

Bolton, who has a short position in the electric vehicle maker and has previously shorted bitcoin, is now sufficiently abreast of the issues to express his considered view about the cryptocurrency’s worth — probably absolutely nothing, he says, which is a little less than its current valuation of $US1 trillion ($1.3 trillion).

He also accuses Musk of “staggering hypocrisy” in his pro-environment positioning, given Tesla’s revelation that it had bought $US1.5bn of bitcoin after switching to a more flexible investment policy.

“Bitcoin is one of the world’s most significant and offensive polluters,” the Gen Y investor says.

“It emits significantly more greenhouse gas emissions than New Zealand, all for its pointless (and usually criminal) endeavours.

“It’s one thing to pollute for a legitimate need like air travel, but quite another for the totally arbitrary programming logic of bitcoin that incentivises its miners.”

Bolton’s most famous investment play was as a 26-year-old, when he pitted himself against the likes of Macquarie Bank, Leighton and Deutsche Bank in the 2009 BrisConnections saga.

He outplayed the three giants, banking a $4.5m cheque from Leighton in return for handing over voting rights that could have held sway over the $4.8bn Airport Link toll road in Brisbane.

The proceeds of his bitcoin mining activities are inconsequential compared to the so far-unsuccessful short positions he has taken in the crypto market.

Research, he says, is the real purpose of the mining, so he can understand the mechanics of a seemingly anarchic asset.

Miners — like Bolton, albeit at a tiny scale — are paid in Bitcoin for effectively doing the work of auditors.

They secure the network and process every bitcoin transaction by solving a computational problem, enabling them to chain together “blocks” of transactions; hence the name of the system’s “blockchain” backbone.

From his own experience, Bolton says viable bitcoin mining requires a power price of below US6c per kWh, and the only country you can reliably get a price that cheap is China, which burns “some of the dirtiest coal you could imagine”.

“The marginal cost of mining bitcoin at current prices means that miners could spend over $20bn a year on the cheapest, dirtiest power,” he says.

“Inevitably, mining competition will bring marginal cost up to the bitcoin market price, so the higher the price goes, the worse it is for the environment and global productivity.”

Bolton sees Musk as a tremendous opportunist who has benefited from a wave of “green euphoria” sweeping across the world.

He doesn’t begrudge him his opportunism but draws the line at a level of hypocrisy which most Australians would find uncomfortable.

In January, Musk offered $US100m to fund a competition seeking new ways to remove carbon dioxide from the air or water.

It later transpired that, in the same month, Tesla had changed its investment policy, freeing the company up to buy bitcoin.

The details were announced on February 8, by which time the vehicle maker said it had not only spent $US1.5bn on the digital currency but would soon start accepting bitcoin as payment for its vehicles, initially on a limited basis.

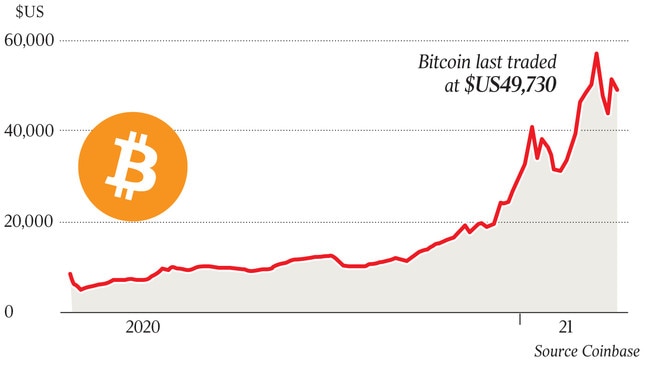

The disclosure lit a fuse under bitcoin, which soared 30 per cent in a week to almost breach $US50,000.

While some identified Musk’s opportunism, others were concerned about the entrepreneur’s promotion of bitcoin and the cryptocurrency market on social media platforms prior to Tesla’s market-changing investment.

In late January, he changed his Twitter profile to a single word: #Bitcoin.

But then, showing the same anarchic spirit of the crypto market, he tweeted in mid-February that the price of bitcoin and a smaller rival “do seem high”.

The post was partly responsible for the biggest decline in Tesla’s share price since last September.

Arguably, bitcoin is not a security, which could mean that trading in the cryptocurrency falls outside the domain of the Securities and Exchange Commission.

Bolton, however, wonders if the Australian Securities & Investments Commission would tolerate such conduct.

He also wonders if the entire bitcoin market is sustained by nothing more than the hopes and dreams of its participants.

“Last Christmas I started some deep research on the new foundation of the industry,” he says.

“I learned that the price is driven by parties borrowing money that may or may not actually exist, at high cost, in extraordinary volumes at up to 100:1 leverage to bid bitcoin.

“This has worked tremendously well on the way up and should work equally poorly on the way down.”

The focus, in the meantime, is on the inherent contradiction between Tesla’s claimed green credentials and its support for a cryptocurrency with a shocking environment record.

“The irony of Tesla endorsing this industry is just mind numbing,” he says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout