Downgrade class-action protection for directors

Moves will protect companies from the prospect of being hit with a class action over earnings guidance.

The federal government has moved to provide company directors and management with protection from continuous disclosure obligations in the face of the COVID-19 economic shock, which could have left them exposed to class actions.

Late Monday, Treasurer Josh Frydenberg, said the government would temporarily amend the Corporations Act so that companies would only be liable for legal action over their statements to the ASX if they had acted “recklessly or negligently” in informing the market about price sensitive information.

This would help protect directors from “opportunistic” class actions for statements made under continuous disclosure requirements which could prove to be wrong as a result of the COVID-19 crisis. The changes will remain in place for six months.

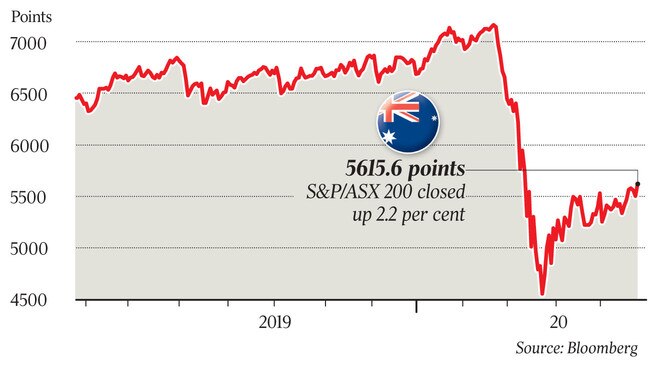

It comes after hundreds of ASX-listed companies have scrapped or withdrawn their guidance given uncertainty around how COVID-19 lockdowns have impacted their earnings.

It also represents a further clamp on the burgeoning class action industry after the government last week outlined plans to require litigation funders to be licensed by ASIC.

In addition the Morrison government last month launched a parliamentary committee inquiry, which will examine all aspects of the class action system. The committee will report by the end of the year.

Business Council of Australia CEO Jennifer Westacott said the move would allow companies to “keep markets well informed” during the COVID-19 crisis without fear of “opportunistic class actions” by shareholders. She said it would “give company directors the space they need to more confidently provide guidance to the market during this uncertain period”.

“Left unchecked, this issue would have hampered business confidence and performance, which would have adversely impacted on the broader community at a time when business needs certainty to power the recovery, rehire workers and create jobs.”

She said the priority should be on keeping Australians in work and “laying the groundwork to create new jobs”.

“We congratulate the Treasurer for acting to help protect Australians from the uncertainty caused by the COVID-19 crisis.”

Mr Frydenberg said it had been more difficult for companies to release reliable forward guidance to the market as a result of the uncertainty generated by the coronavirus crisis.

“The government will amend the Corporations Act so that companies and officers will only be liable if there has been ‘knowledge, recklessness or negligence’ with respect to updates on price sensitive information to the market,” he said.

He said the heightened level of uncertainty as a result of the crisis exposed companies to the threat of “opportunistic class actions for allegedly falling foul of their continuous disclosure obligations if their forecasts are found to be inaccurate”.

He said fear of class actions in the current environment meant that companies could be holding back from making forecasts about earnings or other forward looking estimates.

This would limit the amount of information available to investors during the period.

Slater & Gordon Head of class actions Ben Hardwick warned the changes could have an impact on shareholders rights.

“While this move is only temporary, this is a slippery slope to the Morrison government permanently watering down the laws that hold corporate Australian to account”.

Mr Frydenberg argued the changes would make it harder for class actions to be taken against companies and their officers during the coronavirus crisis “while allowing the market to stay informed and function effectively”.

The changes were aimed at allowing companies to “more confidently provide guidance … during the COVID-19 crisis”.

The move follows lobbying by the Australian Institute of Company Directors which has been concerned about the potential for class actions against directors as a result of the continuous disclosure requirements during the COVID-19 crisis, particularly amid concerns litigation funders are fuelling the volume of class actions.

“We have been asking the federal government for a safe harbour to forestall opportunistic class actions if statements provided by companies later prove to be inaccurate as a result of the virus,” AICD chief executive Angus Armour said.

“In the current uncertain environment it is hard to be accurate. The government’s announcement is a strong step towards helping corporate Australia recover from COVID-19 and rebuild the economy.

The changes would still allow regulators to “discipline firms that have done the wrong thing”.

Listed litigation funder Omni Bridgeway recently told investors that funding applications had increased 18 per cent in the half year to December.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout