Day of reckoning looms as AGM season gets under way

A reality check for corporate Australia looms as the annual meeting season gets under way amid pockets of earnings pressure from rising interest rates and falling house prices.

A reality check for corporate Australia looms as the annual meeting season gets under way amid pockets of earnings pressure from rising interest rates and falling house prices, and mixed impacts from a sharply weaker dollar.

Two-thirds of the top 200 companies have AGMs and most of the banks have full-year earnings reports in the next couple of months, giving them a chance to update the market on how earnings are tracking amid Australia’s fastest-ever rate hikes and a housing market downturn, as well as an 8 per cent fall in the Australian dollar against the greenback so far this financial year.

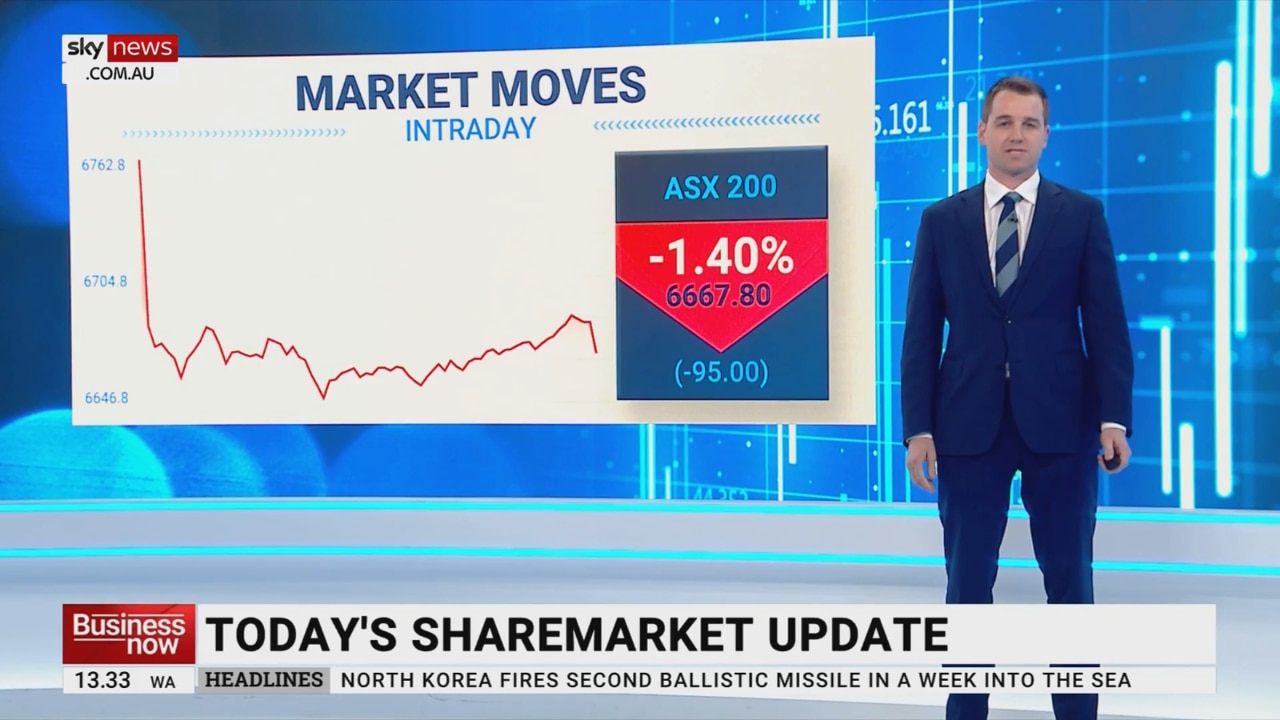

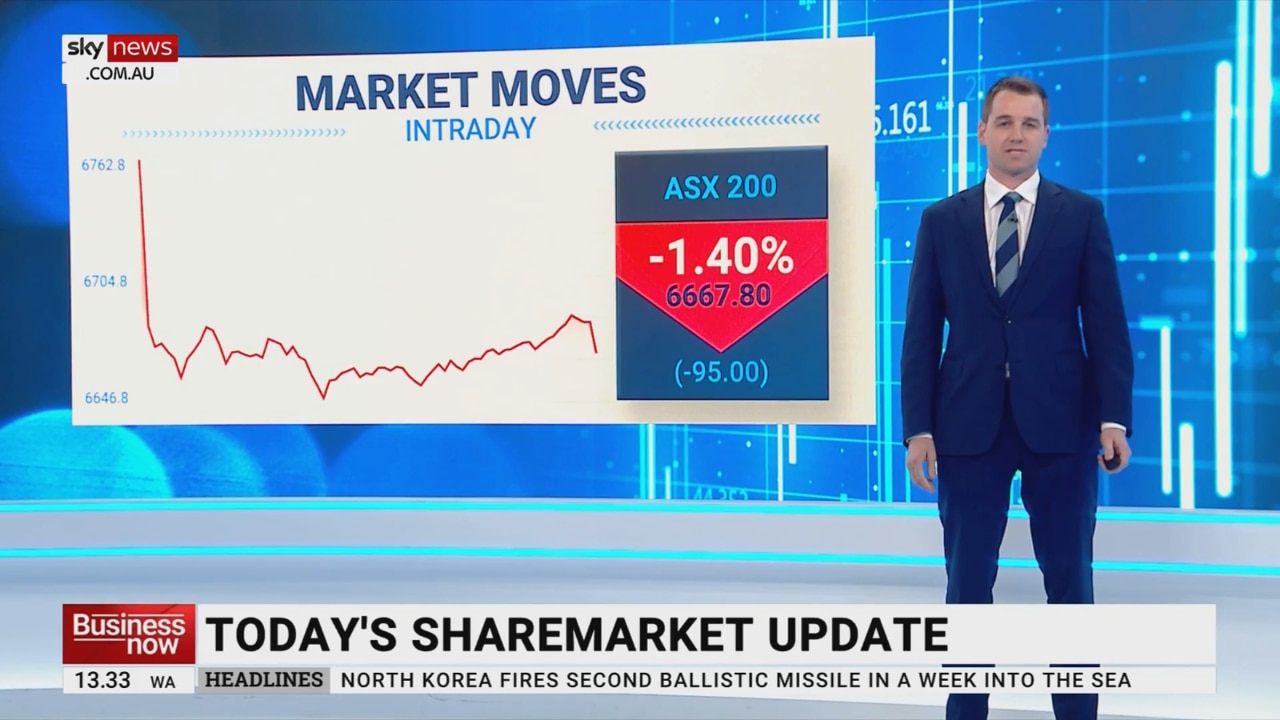

The sharemarket is broadly prepared for a fall in earnings as the 12-month forward price-to-earnings ratio of the ASX 200 benchmark index is at 13 times – well below its long-term average of about 16 times – after peaking at a record near 21 times in late 2021.

But even at the current index level of 6667.8 points – 13 per cent off a record high of 7628.9 that was tested early this year – the market may not have adequately factored in a global slowdown and potential recession, as most central banks are rapidly raising rates to clamp down on inflation, although the Reserve Bank slowed the pace of hikes last month.

“In our view, there is a laser focus from investors on the next round of updates to ascertain when the resilience in recent data and trading gives way to a consensus expectation of weaker growth,” Morgan Stanley Australia equity strategist Chris Nicol said.

“There is a heightened level of impatience regarding what many see as an inevitable slowdown in activity and necessary adjustment to estimates and growth rates.”

Recent data and corporate updates suggest that both consumers and households have been “quite resilient” to cost of living and interest rate pressures, yet exposed sectors in the market have “derated” in anticipation of a domestic slowdown, according to Morgan Stanley.

“Our view remains that the tightening in both monetary policy and now also emerging in fiscal settings will work in bringing down aggregate demand,” Nicol says. He sees economic growth slowing to less than half its 2022 pace in 2023.

The slowdown is expected to be driven by lower consumption, but it’s an “open question as to when this will be more fully reflected in outlook narrative and influence bottom-up estimates”.

“Australia is relatively well positioned amid rising inflation, but economic growth will slow and profit margins will come under pressure,” says Hamish Tadgell, who runs SG Hiscock & Co’s high-conviction fund. “In a higher inflation regime, you need some exposure to commodities, and the Ukraine war has seen a structural shift in terms of European energy and global gas flows.”

Tagdell also likes Covid-reopening trades like CSL and IDP Education, and “leverage to rising rates” via shares in companies such as Computershare and to some degree the banks.

He’s also focused on companies that are less vulnerable to earnings downgrades in a challenging macroeconomic environment. Essential infrastructure operators like Chorus and TPG Telecom, and services providers such as Cleanaway and Qube, are favoured for their ability to pass on rising costs.

Nicol sees four areas of focus for investors when gauging the expected slowdown and tactically positioning for the AGM season.

The consumer discretionary sector has “derated meaningfully”. In many cases, there has been some lessening of revenue expectations for 2023.

But margin forecasts mostly remained static and in many cases above pre-Covid norms.

“Trading updates accompanying their full-year results in August were reasonable and in some cases positively distorted by previous Covid restrictions,” Nicol notes. “Given the solid run of data since then, a large, broadly based drawdown in activity and trading to date is unlikely.

“Any cracks will be punished, for sure, but possibly the better test for consumer intent leading into Christmas will be the Black Friday sales later in November.”

Perhaps more significantly, the housing market has clearly turned down, and possibly the most stress from tightening will be seen in housing-linked sectors.

“House prices are declining at a record annualised pace and the issues around weather, wages and labour supply have not significantly eased,” Nicol says.

He’s watching for signs of weakness in the home-building pipeline and the forward sales of houses, as a lower capacity for debt and tougher servicing assessments faced by consumers limits their risk appetite and borrowing ability. This has implications for banks, but Morgan Stanley expects bank earnings to stay resilient for now, as they’re “benefiting initially from rising rates” via a recovery in margins.

“Indeed, the move by the RBA to temper the size of hikes back to the conventional norm of 25 basis points will kick the credit cycle risk debate further down the road,” Nicol says.

“Outlooks must calibrate a much higher terminal cash rate than expected in August, but with a lag in the tightening impact on the employment pulse likely, any miss versus expectations in upcoming results would be a surprise to consensus positioning.”

At the same time, the dollar’s sharp fall since June will be a “decent tailwind for US dollar revenue-exposed stocks”, although less so for those with euro and pound exposures. For other companies, the focus will be on the cost of imported goods and hedging.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout