CSL’s market value can overtake that of CBA: Morgan Stanley

CSL is one of the standout healthcare picks heading into earnings season, according to Morgan Stanley analysts.

CSL is one of the standout healthcare picks heading into earnings season, according to Morgan Stanley analysts, who say its share price could top $350 if their bull case for the stock plays out.

At $350 a share, CSL would boast a market capitalisation of about $160bn, greater than the current market value for Commonwealth Bank, the largest listing on the ASX.

The broker also predicts a scarcity of growth in the large-cap sector on the ASX will help drive the biotech’s share price higher as investors disregard disruption risks. “Given CSL’s superior ASX relative size, liquidity and growth … the market will continue to price delivery of bull case scenarios and longer-term disruption risk will be ignored,’’ the analysts, led by Sean Laaman, wrote in a note to clients.

“We increase the weighting of our bull case from 40 per cent to 45 per cent and reduce our bear case weighting from 10 to 5 per cent.”

The analysts’ bull case assumes success in the biotech’s transplant division, its heart attack therapy — known as CSL112 — trials going to plan, its HAE franchise reaching $US1bn ($1.44bn) in revenue, its haemophilia medicines reaching $1USbn in revenue and efficiency gains in its plasma centres of $US70m a year.

The broker has lifted its price target for CSL to $290 and says it remains overweight due to near-term momentum but will closely watch for signs that the bull case is not playing out.

Healthcare was one of two sectors that saw earnings per share revisions for the 2020 financial year following the 2019 reporting season, the broker said.

“The street expects three-year earnings per share compound annual growth rate for Australian healthcare of 11 per cent v ASX 200 at 3 per cent,” it said.

“For CSL specifically, we expect three-year earnings per share compound annual growth rate of around 13 per cent and envisage that the combination of strong immunoglobulin growth and lower flu returns will see delivery of 2020 net profit above or at the top end of guidance.” The biotech company has the most positive business momentum of the sector, driven by accelerating immunoglobulin growth, they said in a separate note.

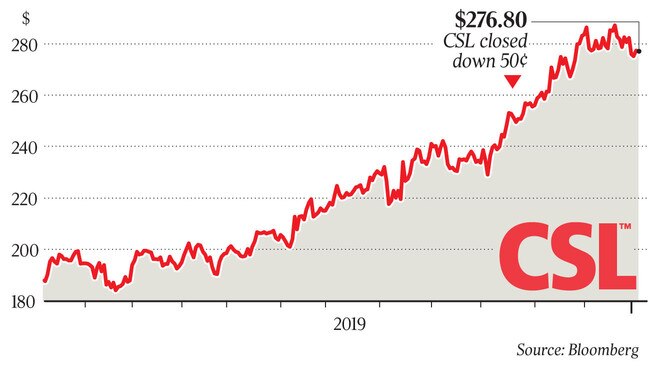

CSL was one of 2019’s best performers on the stockmarket, surging close to 50 per cent to become the second-biggest company by market cap, behind only CBA. It is forecasting another 10 per cent profit growth this year.

CSL shares closed down 0.2 per cent on Monday, at $276.80.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout