Crystal ball gazing: The stocks to watch as new year dawns

The rollercoaster ride of the markets in 2023 demonstrated just how unpredictable picking stock winners can be. Even so, here’s a few to look out for in 2024.

As the experts and soothsayers look at the tea leaves and entrails for another guess at what might happen in the New Year, 2023’s erratic market movements showed how predicting the mood and the intent of the market gods should be left to the Chatbot.

Soaring interest rates meant the sharemarket was supposed to slump as we plunged into recession, but neither happened. The oil price was meant to soar after the Middle East hostilities erupted, but the rally quickly fizzled before a late rally.

The bitcoin price was meant to either collapse or hit $US100,000, but did neither.

Lithium was mean to soar on the ‘‘stronger for longer’’ battery hype, but went flat as a nightman’s hat in the last months of the year.

More predictably, the Ukraine war grinds on – and so does Vladimir Putin, who was meant to have been poisoned or have succumbed to cancer or Parkinson’s disease. (Alternatively, he has been dead for some time and his role as global villain has been fulfilled by a body double.)

The hazards of predicting the unpredictable were reflected in your columnist’s forgettable small-cap share tips for 2023, which resulted in some steep losses among industrial picks such as small retailers and even some sexy battery metal plays.

But we did find a winner in Vysarn (ASX:VYS), which provides pumping and aquifer management systems for the mining sector (the stock almost doubled).

Uranium stock 92 Energy(92E) made a late play to lift our averages by agreeing to merge with Canada’s Atha Corp, a deal that sent 92E shares up 24 per cent. We also lucked it with Breaker Resources, taken over by Ramelius Resources (RMS) at a 40 per cent premium. We have Stockhead resources guru Barry FitzGerald to thank for those.

Following hours of due diligence with shady broker types at Melbourne’s legendary Mitre Tavern, here are our wild stabs at glory for 2024.

Acusenus (ACE)

The camera road enforcement mob won’t win any plaudits from libertarian motorists, but if they can catch more mobile phone-using idiots then good on ’em, we say. Acusensus operates transportable mobile phone and seat belt detection cameras, based on its tech that enables the cameras to peep through tinted windows.

The high-resolution tech reportedly has captured more than these offences, with some motorists engaging in – ahem – intimate activity (and often on their own). The company has contracts with NSW, Queensland and ACT road authorities and recently won its first US phone-seatbelt contract in North Carolina. Acusensus cites $154m of contracted revenue since being founded in 2018, with $40m of new and varied deals over the last year.

Management is vague about the outlook but promises increased revenue this year based on existing contracts. In 2022-23 Acusensus posted revenue of $42m, up 46 per cent and a slender $400,000 net profit. The year has gone relatively well, with September quarter revenue of $12.1m (up 22 per cent) and $2.9m of operating cash flow.

Acusensus shares have lost 80 per cent of their value since listing in January. But they’ve gained about 16 per cent in the December half, so a happy ending is in sight in more ways than one. The company’s $100m market cap is supported by cash of $25m.

Reckon (RKN)

Shareholders in the accounting software veteran thought they had their payday when the company sold its accountant practice management arm for $100m in mid-2022 – more than the company’s market cap at the time. In recent years Reckon has been overshadowed by the likes of “cloud” accounting innovator Xero in its traditional SME domain. But the company is migrating customers to its own cloud Reckon One platform, which could enhance Reckon’s value as a takeover target. In the meantime, Reckon has expanded into practice management systems for law firms in the US and Britain, which broker Taylor Collison dubs a “gem in the making”.

Reckon turned over $28m in the first (June) half, for a $4m net profit and a 2.5c per share dividend. The stock trades on a current year multiple of 11 times and a 4.5 per cent yield, fully franked.

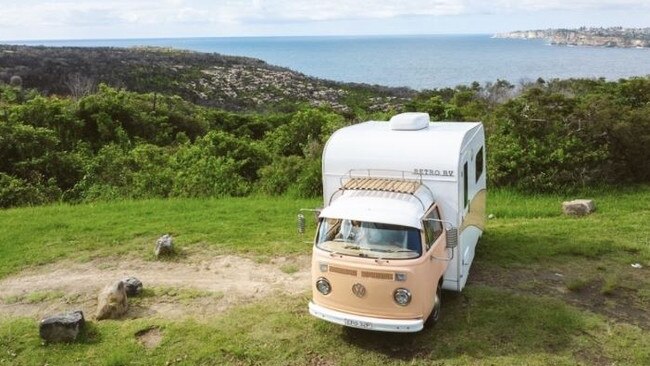

Camplify (CHL)

Does this sound familiar? Spend $100,000 on a recreational vehicle (RV) for the road trip of a lifetime, only for the jalopy to rust in the driveway.

The Airbnb of the campervan world, Camplify intermediates renting deals between van owners and users. Its premise is that 800,000 privately owned RVs in Australia and most of them sit in the driveway for 46 weeks of the year. A year ago, Camplify acquired the Berlin-based equivalent PaulCamper, adding Germany, Austria and The Netherlands to its operations, which already covered the Britain, Spain and New Zealand.

The $47m purchase doubled the size of Camplify’s business overnight and bolstered its position in specialist insurance products.

Camplify recorded total transaction value (TTV) of $146m in the year to June 2023, up 172 per cent. Revenue climbed 133 per cent to $38m, with turnover in NZ surging 1100 per cent.

Camplify facilitates 81,933 bookings at an average fee of $1733. Camplify’s clip of the ticket last year declined to 26 per cent because of the PaulCamper purchase but management hopes to get it back over 30 per cent. The site lists 15,000 RVs here and 18,000 in Europe, a fraction of the market relative to van ownership of 790,000 here and 5.6 million on the continent.

Highcom (HCL)

Formerly known as Xtek, ballistics maker Highcom should be shooting the lights out, but its shares have lost more than a third of their value this year.

Highcom also produces unmanned drones and body armour and helmets, based on its proprietary tech. It has an Ohio-based ballistics division and the company is in the throes of moving its Adelaide-based R&D division to the US. Highcom generated a record $98m of revenue and made a record $5.7m profit in the 2022-23 year. The recent AGM was replete with talk of new contracts – notably with the local Department of Defence – and an overall $375m pipeline of opportunities “at various stages”.

As with the company’s ballistic vests, why have the shares copped such flak? The answer appears to be that cracking the US military establishment is a hard grind and sales have not been as good as expected. Inventories crept up to $25.7m from $16.4m previously. By moving to the US, the company hopes to be seen as an apple-pie US supplier. In fact, it must because by law all kit for the US military must be made there.

Dimerix (DXB)

Having toiled away at a kidney drug for years, in October the drug developer hit the jackpot with a partnering deal for its yet-to-be-approved treatment for the rare disease focal segmental glomerulo-sclerosis (FSGS). Dimerix shares popped more than threefold after the news of the deal with Advanz Pharma Corp, worth up $230m. Given that, why is Dimerix on our list? No one likes to be the dude who funds someone else’s exit.

First, the deal only pertains to European and local regions and does not cover the US, so a follow-up deal is expected.

Second, interim results from the key two-year supporting Phase 3 study are slated for March 2024 – a blink of the eye in a drug development time frame.

Third, Dimerix shares have ceded about one quarter of their gains and no longer capture the full potential. The outcome, admittedly, is binary: the drug will either be approved or it won’t.

Kogan (KGN)

The pure-play online retailer’s shares have lost about 80 per cent of their value since peaking at around $25 in the peak pandemic times of October 2020. The return to normality left Kogan with excess inventory and a suspicion the best times were behind Ruslan Kogan’s creation, which includes brands such as Kogan Mobile, Kogan Travel, Kogan Money and Dick Smith.

But Kogan’s 2022-23 results showed a decent sixfold bounce in underlying earnings, with the inventory position “rightsized” to $68m. The company also has no debt and cash of $65m to support its $540m valuation.

Analysts are tracking the rollout of the Kogan First loyalty program, which has attracted 401,000 subscribers in its early days.

4D Medical (4DX)

The lung imaging house had a bonza end to 2023 on the back of contract wins, approvals and reimbursement deals in the US.

The final stanza was this month’s $38.5m purchase of US med tech outfit Imbio, funded by a $35m placement. A leader in lung and heart artificial intelligence, Imbio is generating revenue and will expand 4D’s product reach beyond its four approved products. 4D’s AI and cloud-based tech enables clinicians to detect fine particles in the lungs, especially for the millions of US veterans suffering the effects of toxic open-air ‘‘burn pits’’ in combat zones such as Iraq.

4D shares were poised to end the year about 150 per cent higher, but the subsequent post-raising pullback offers latecomers the chance to join the party.

Aumake (AUK)

With China-Australia trade relations recovering from a dismal low, some investors are pondering how to ride the theme beyond going long on Treasury Wine Estates (a key beneficiary of a soon-to-be abolished wine tariff).

The low-key, Parramatta-based Aumake sells products such as health supplements and wool and skincare items into China, through both online and via physical stores. Having closed its 15 Australian stores during the pandemic, Aumake is seeking to re-establish its local presence.

To tap inbound Chinese tourism, the company recently signed a non-binding term sheet with the Petersons Wines to promote tourism experiences in NSW’s Hunter Valley. Aumake posted perkily higher September quarter receipts of $6.4m with cash outflows of $630,000. The company’s sub $10m market cap reflects plenty of upside – and oodles of risk.

Dicker Data (DDR)

Most tech companies pride themselves on cutting-edge innovation and start-ups wear persistent losses as a badge of pride.

But for Dicker Data it’s a case of sticking with the simple business of selling other parties’ hardware and software and making money from it.

Over 45 years, founder David Dicker has seen all the momentous advances – such as the advent of the PC and the internet – as well as the IT fads. Over that time, the business has rarely failed to increase year-to-year revenue and profitability. In a third quarter update, Dicker referred to an accelerated PC “refresh cycle,” the result of the hybrid working era. He also notes that Microsoft will withdraw support for Windows 10 in 2025, which will see a further spike in PC upgrades. Artificial intelligence and the need for boosted cybersecurity are also compelling growth drivers.

Meteoric Resources (MEI)

Meteoric is focused on its recently-acquired Caldeira ionic clay rare earths project in Brazil.

Clay rare earths are valued as battery materials, but the prospect for most greenfield projects has dimmed because of pull-back in prices and higher development costs. Barrenjoey Capital describes Meteoric’s prospects as “materially better than its peers” due to the “uniquely high-quality nature” of Caldeira as the world’s highest grade large-scale clay deposit. Caldeira has a resource of 409 million tonnes at 2626 parts per million of total rare earth oxides, but with no reserves. A feasibility study is yet to be carried out. Barrenjoey values the stock at 50c a share, more than twice its current price with plenty of upside if Caldeira is jump-started.

Patriot Battery Metals (PMT)

Unlike in Western Australia, the Canadian lithium sector is short of swashbuckling types such as Gina Rinehart and Chris Ellison, so M&A activity has not taken off in the same way as here.

Given Canada’s proximity to the US electric vehicle sector, this situation is unlikely to last for long and Patriot is well positioned with its Corvette discovery in Quebec’s James Bay region. Corvette is the biggest hard rock lithium find in North America and the eighth biggest in the world (109 million tonnes at 1.42 per cent lithium oxide, in the inferred category).

If the project gets to production, the output will qualify for credits under the omnibus US Inflation Reduction Act. Patriot shares gained about 50 per cent in calendar 2023, but with the sector off the boil generally they have also declined by around 40 per cent in the last six months.

Propel Funeral Partners (PFP)

If all else fails, the folk at the country’s second-biggest funeral operator are the last people to let you down. Propel’s investment appeal has been enhanced because it’s now the only ASX-listed deathcare exponent. The biggest operator by some margin, Invocare, recently was taken over by private equity mob TPG.

Propel’s performance has been superior to that of Invocare since the company listed in late 2017: a circa 80 per cent share gain compared with Invocare’s 30 per cent decline (ahead of the delisting). As with its rivals, Propel has been troubled by labour costs, but these pressures are abating.

Propel reported revenue of $168.5m for the full year to June 30, up 16 per cent with operating profit spurting 18 per cent to $20.9m. The clincher is that Propel has also fielded takeover advances so may also face a demise – in a listed sense only of course.

* Health warning (courtesy of Chatbot)

Predicting specific stock market sectors that will perform well in the future can be challenging due to the dynamic nature of financial markets, which are influenced by a multitude of factors.

Additionally, unforeseen events, economic shifts, and global developments can impact sector performances.

Tim Boreham is a columnist with Stockhead.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout