Boom in artificial intelligence stocks ignites market returns

Investment returns improved sharply in 2023 thanks to a boom in artificial intelligence stocks, rapidly cooling inflation and resilient economic growth in the US and Australia.

Investment returns improved sharply in 2023 thanks to a boom in artificial intelligence stocks, rapidly cooling inflation and resilient economic growth in the US and Australia.

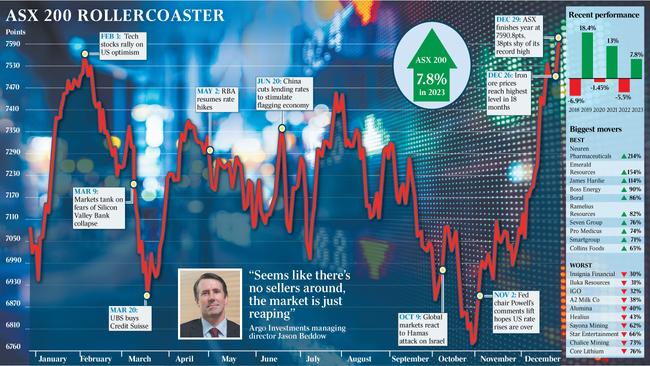

The Australian sharemarket had its best year since the pandemic era returns of 2021, booking gains of 7.8 per cent, while the AI euphoria drove the tech-heavy Nasdaq 100 to its best year since 1999.

While 2022 was one of the worst years for super funds returns since the Global Financial Crisis, the median balanced growth fund will have well and truly made up for that in 2023.

In the final two months of the year, dovish signalling on US interest rates by the Federal Reserve sparked a particularly strong run up in stocks, bonds and the Australian dollar.

Looking ahead, the market may be prematurely celebrating the expected interest rate cuts without taking account of recession and geopolitical risks from the Middle East conflict and important elections, including the upcoming US presidential vote in November.

“It has become consensus that a recession will be avoided, while equity multiples appear rich, credit spreads are tight, and volatility is unusually low,” JPMorgan chief global markets strategist Marko Kolanovic said.

“Thus, even in an optimistic scenario, we believe upside is limited for risky assets, favouring cash and bonds over equities from a risk-reward standpoint.”

Mr Kolanovic expects both inflation data and economic demand to soften in 2024, allowing the Fed to begin easing rates at a pace of 25 basis points per meeting from around mid-year, or quicker if the economy slides into recession. But he’s “very cautious” on risky assets and the economic outlook.

He says the “interest rate shock over the past 18 months should “negatively impact economic activity”, as well as geopolitical headwinds, and “expensive risky-asset valuations”.

However, JPMorgan is mostly positive on the outlook for Australian stocks in 2024.

Banks are expected to face heightened competition for mortgages, hitting their net interest margins.

But near-record terms of trade, high immigration and ongoing strength in employment make Australia stand out against a range of other economies in terms of growth projections for 2024. JPMorgan has an overweight recommendation on bulk miners BHP, Rio Tinto and Fortescue Metals, as steel demand looks set to be supported by China’s focus on stimulating housing.

The bank is also positive on the healthcare, property trust and tech sectors, but recently switched from overweight to underweight on consumer discretionary stocks.

The MSCI All Country World index of stocks rose 20 per cent, almost offsetting last year’s drop of the same magnitude (19.8 per cent) and the best return since 2019.

The US benchmark S&P 500 index was on track to book 25 per cent gains ahead of the last day of trading in the US, while the Nasdaq 100 index soared 54 per cent.

Led by market darling Nvidia, the biggest US tech stocks rallied between 50 and 239 per cent.

Japanese shares outperformed due to their high tech weighting, with the Nikkei 225 up 28 per cent.

Australian stocks were relatively subdued in comparison, the S&P/ASX 200 rising just 7.8 per cent.

China was one of the worst performing stockmarkets globally. The end of Covid-19 restrictions failed to ignite consumer confidence in the face of depressed property values and residential construction activity, amid ongoing debt headaches for China’s biggest property developers.

The CSI 300 fell 11 per cent for the year and is down 41 per cent from its February 2021 high.

Government bonds had a rollercoaster year as the global benchmark – the US 10-year Treasury yield – soared to a 16-year high of 5.02 per cent before falling back to 3.84 per cent.

The volatile cryptocurrency bitcoin rose 157 per cent to $US42,539 after shaking off concern about the collapse of Bahamas-based cryptocurrency exchange FTX in late 2022. Spot gold rose 14 per cent to $US2074.71 per ounce, hitting a record high of $US2135,39 in early December.

The Aussie dollar ended the year flat at US68.45c.

Both stocks and bonds had battled hawkish central banks for most of the year.

A crisis among US regional banks required an urgent policy response and China’s economic reopening disappointed observers.

By early February, Australia’s S&P/ASX 200 stock index had soared 7.5 per cent in a somewhat euphoric reaction to China’s sudden decision to scrap its “zero-Covid” policy.

January’s 6.2 per cent rise in the S&P/ASX 200 marked its best January on record.

But the S&P/ASX 200 erased its early year gain by mid-March as four regional US banks collapsed amid a run on their deposits and a crash in their shares as they failed to raise equity capital.

Unrealised losses on their bond portfolios caused by the Fed’s quantitative tightening and its fastest interest rate increase since the 1970s had left some US banks severely undercapitalised. At that point the US 10-year Treasury bond yield hit its low for the year at 3.24 per cent and economists’ estimates of the chance of a US recession within 12 months were elevated.

Amid fear of a broader financial crisis, the Fed came to the rescue with a Bank Term Funding Program of emergency loans which was backstopped by the US Treasury Department’s Exchange Stabilization Fund.

It was offered on collateral valued at par rather than market value.

Still, regulators refused to guarantee bank deposits over the $US250,000 limit as they did during the GFC. Some US regional bank share prices fell 30-50 per cent after the BTFP was announced.

The US regional banking crisis quickly spread to Europe, where Swiss regulators forced UBS to buy its weaker rival, Credit Suisse, for almost $US3.25bn – well below its market value at the time – amid fears that a failure to protect depositors could trigger a new global banking crisis.

Just as the US regional banking crisis stabilised, the market began to conclude that China’s economic reopening was a major disappointment and its property developers struggled with debt payments.

However, iron ore prices soared 23 per cent to $US134 a tonne as China began to support its property sector and US recession worries subsided. Lithium and nickel prices collapsed.

US interest rate hikes continued until July, by which time the Fed had increased its policy rate by 525 basis points since March 2022.

The Reserve Bank stopped lifting rates in June after a 400bps increase since May 2022, but was forced to hike again in November as inflation remained high.

From around mid-year the Australian stockmarket began to benefit from a recovery among banks.

Mortgage competition lessened and loan-loss provisioning wasn’t as bad as expected, as house prices recovered amid booming immigration.

The consumer discretionary sector also benefited from resilient economic growth, making it the second-best performer behind tech.

In August there was additional concern about the outlook for the US bond market amid a massive blowout in the US Treasury’s debt funding needs. Fed officials worsened a sell-off in stocks and bonds in September when they increased their interest rate assumptions for 2024 and 2025.

But as the US 10-year bond yield soared toward 5 per cent and the Israel-Hamas war began in mid-October, Fed officials suddenly began to say that surging bond yields could substitute for additional increases in the Fed funds rate.

In his post-meeting press conference in early November, Fed chair Jerome Powell softened his language to say that the Federal Open Market Committee is “proceeding carefully”.

Then at their December meeting, FOMC officials lowered their interest rate assumptions for 2024 and 2025. Their statement downplayed the need for further rate hikes.

Mr Powell said the timing of interest rate cuts was a “topic of discussion” at that meeting.

That caused the all-important US 10-year Treasury bond yield fall from a 16-year high of 5.02 per cent to a five-month low of 3.85 per cent in the space of two months, improving the valuations of stocks and bonds. A resilient labour market and further disinflation also proved favourable.

After an overall weak year for mergers and acquisitions, the Australian stocks got a late-year boost from takeover interest in Perpetual, Santos, Link Administration, Adbri, Pact Group and Pacific Smiles.

For the super sector, the combination of solid gains in stocks and modest gains in bonds means the median balanced growth fund is looking at an annual return of close to 9 per cent, which is an “excellent result under challenging circumstances” according to Chant West.

“2024 is likely to see positive returns helped by falling rates but they are likely to be more constrained given likely volatility associated with the high risk of a recession,” AMP’s head of investment strategy and chief economist, Shane Oliver, said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout