Coronavirus crisis spurs a rush to raise capital

The coronavirus crisis is spurring a bumper period of equity raisings on the Australian Securities Exchange.

The coronavirus crisis is spurring a bumper period of equity raisings on the Australian Securities Exchange as under-pressure companies shore up their balance sheets in a spree that could top the discounted equity calls that distressed companies made in the depths of the global financial crisis.

Since the COVID-19 crisis swamped Australia, domestic companies have scooped up more than $15bn in funds.

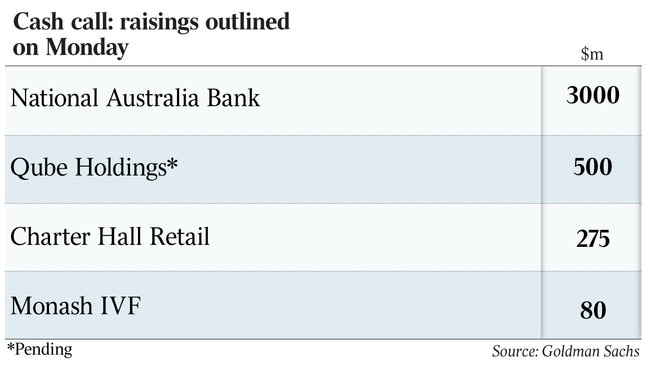

The latest run saw a cash call of almost $4bn on Monday, led by banking major National Australia Bank, with its monster $3bn placement, while shopping centre owner Charter Hall Retail REIT tapped investors for $275m.

Monash IVF also raised $80m and logistics company Qube went into a halt as it prepares to approach investors for about $500m, adding to the tidal wave of capital calls driven by the virus shutting down some sectors and prompting companies in more favoured areas to increase cash holdings to grab any bargains.

Monday’s action took the total amount of follow-on equity raisings this year to $15.1bn, with the surge coming this month, according to investment bank Goldman Sachs. Investors were tapped for only $1.2bn before the coronavirus struck the Australian market in mid-March.

Hearing implant maker and stockmarket darling Cochlear kicked off the spree with an $880m raising late last month. Institutions have since snapped up discounted stock, bailing out companies in struggling sectors, including travel operators Webjet and Flight Centre, but they have also backed blue-chip companies they believe will come through the crisis and grow once the threat of the coronavirus is contained.

High-quality companies including data centre operator NextDC also tapped the market, as did insurer QBE. Favoured property sectors have also been active, with the Charter Hall-run retail fund quickly placing stock via JPMorgan and UBS, following the path of rival supermarket owner SCA Property Group, which raised $250m, and a Centuria Capital-run industrial property fund raising $130m.

Other under-pressure areas — including an airport and a childcare centre operator — have gone cap in hand to investors as their businesses have been battered by the virus.

More raisings are tipped, particularly in financial services as banks deal with a wave of bad debts.

“There will be more equity raisings driven by companies refining their business models as they assess the impact of COVID-19 on their businesses,” JPMorgan co-head of investment banking Simon Ranson said. “Some companies are thinking about how they’re going to be positioned coming out of this situation and making sure they’re in a position of strength.”

Some investors have expressed disquiet about the structure and handling of equity raisings taking place. Mark Delaney, chief investment officer of the $170bn AustralianSuper, criticised equity fund raisings that provided preferential treatment for select investors.

“Investors should be treated equally at all times,” he told an online conference hosted by the Queensland Investment Corporation on Monday. He said boards should also “represent the interests of all investors”.

Mr Delaney’s comments came amid increasing criticism by shareholders that companies have announced equity raisings that are made available to a select few investors rather than providing all shareholders with an equal opportunity to participate in the fundraisings.

Australia’s largest super fund, AustralianSuper has participated on several recent equity raises by companies including Reece Plumbing and QBE.

The fund confirmed on Monday that it would also be participating in NAB’s equity raising.

Mr Delaney’s stand was supported by the chief investment officer of the $21bn Telstra Super, Graeme Miller.

“We believe that existing shareholders should be first in the queue,” he said. “At the very least, they should get their pro rata entitlements before new capital.

“That is a principle which is very difficult to argue against.”

While superior companies are looking to steal a march on their rivals by raising to give themselves an edge if opportunities are thrown up by the dislocation caused by the virus, some companies are going to market to stave off balance sheet pressures.

Credit Suisse analysts have warned that toll-road operator Atlas Arteria may be forced into an equity raising with the company in danger of breaching debt covenants on a €350m ($589m) facility.

Traffic on its biggest roads in the US and Europe fell 70 per cent in the last week of March and tapping its shareholders for cash may be required based on COVID-19 restrictions being mostly lifted in September.

Atlas Arteria, previously known as Macquarie Atlas Roads, may breach the covenant in December with net debt to EBITDA at 7.2 times compared with a 6.5 times threshold, according to the broker.

Additional reporting: Perry Williams