Virus-plagued NAB seeks $3.5bn, slashes dividend

National Australia Bank has launched a $3.5bn capital raising and taken the axe to its interim dividend.

National Australia Bank has launched a monster $3.5bn capital raising and taken the axe to its interim dividend to prepare for a violent COVID-19 jolt, as the bank’s most optimistic scenario for the virus points to a huge spike in unemployment and a deep recession.

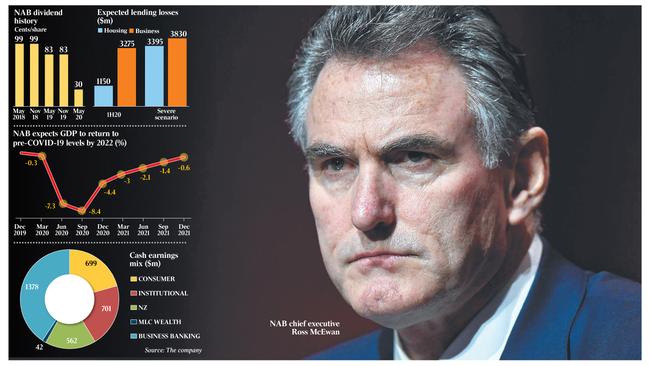

NAB predicted the economy would tank, contracting 8.4 per cent by September compared with December 2019 and not returning to pre-COVID-19 levels until early 2022.

Unemployment was expected to peak in the June quarter at 11.7 per cent before falling to 7.3 per cent by the end of 2021.

While government support packages were expected to cushion the blow to output and employment, NAB said they were unlikely to fully offset the downturn “in the near term”.

“A bank such as ours needs to be ready for anything thrown at it and I think that’s what we’ve tried to do,” new chief executive Ross McEwan said, in his continuing baptism of fire.

“Given our scenario planning, we don’t know whether (the recovery) will be a ‘V’ or a ‘U’; everyone’s hoping it’s a ‘V’, so plan for the worst and hope for the best.”

With NAB in a trading halt, shares in Westpac slumped 67c, or 4.4 per cent, on expectations that it would be the next major bank to go cap in hand to shareholders despite raising $2.7bn last November.

Earlier this month, chief executive Peter King flagged a potential $900m penalty arising from an Austrac investigation into contraventions of anti-money laundering legislation.

Mr McEwan said on Monday there had been no further developments in relation to NAB’s dealings with the financial intelligence agency.

He also rejected suggestions that NAB would perform worse than its peers through the crisis because it was exposed to riskier loans as the nation’s biggest business bank.

NAB, he said, had “one of the two great franchises” in the sector along with Commonwealth Bank’s retail business, and its size and strength would help the economy recover.

But the bank’s heartland of small and medium-sized businesses was still doing it very tough.

“I would estimate about 20-25 per cent of it is in hibernation, and this is quite different from the financial crisis because it hit so quickly,” Mr McEwan told The Australian.

“I’ve had customers tell me that one week they were fine and the next week they were closed and laying off colleagues.”

NAB was due to unveil its half-year result next week but brought it forward to accommodate the capital raising and the outcome of Mr McEwan’s strategic review, which will focus on simplification, digital and a vast improvement in execution.

As expected, the bank took a big hit from the virus, with net profit more than halving from $2.7bn to $1.3bn.

An additional $807m in provisions for the potential impact of COVID-19 saw loan impairments surge to $1.2bn.

UBS analyst Jon Mott said the overlay appeared “slightly light” and had assumed a V-shaped recovery in the economy, although the capital strengthening was prudent.

“But we question paying a dividend to shareholders while simultaneously raising $3.5bn in fresh equity below tangible asset value,” Mr Mott said.

After cutting its dividend in both halves in 2019, NAB took drastic action in the March half-year, slashing the interim payout from 83c a share to 30c.

The last time the dividend was at this level was in 1993, when directors declared a 26c payment.

The move will preserve $1.6bn in capital and add 37 basis points to the bank’s common equity tier one capital ratio.

NAB said it expected to continue paying a dividend, although the situation ultimately depended on regulators, the business environment and the bank’s performance. The CET1 ratio was expected to improve from 10.39 per cent in March to 11.2 per cent after the $3.5bn capital raising, which includes a $3bn institutional placement and $500m from retail shareholders.

The $14.15 price for the fully underwritten institutional component was an 8.5 per cent discount to the stock’s last traded price of $15.46.

Mr McEwan defended the move to simultaneously raise capital and pay a dividend, saying the bank believed it had struck the right balance to encourage retail shareholders to remain on the register and contribute to the raising.

“With 48 per cent of our shareholder register being retail, our view was we should continue to make a dividend payment and at the same time raise capital,” he said.

“What we want to do is make sure that this bank is in great condition both for today and for the future so that we come out of this crisis in a very strong position, able to take opportunities on the other side of it.”

NAB directors and executives will share in the bank’s pain, with board members including chairman Phil Chronican taking a 20 per cent cut in fees.

Mr McEwan will take a similar cut in his fixed pay, and he and his executive leadership team will not be paid a short-term bonus in 2020. On the strategy review, the NAB chief said progress had been made but the bank needed to go further to become simpler, easier and faster to deal with.

Products and processes had to be streamlined, more IT applications had to be migrated to lower-cost cloud platforms, the number of core systems had to be cut, and separation of MLC Wealth’s operations had to be accelerated.

Mr McEwan said NAB had 467 projects “on the go” when he arrived, and this would be slashed to 150 by the end of September.

“There are no wholesale changes but we have seen this bank needs to execute much better than it has done in the past,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout