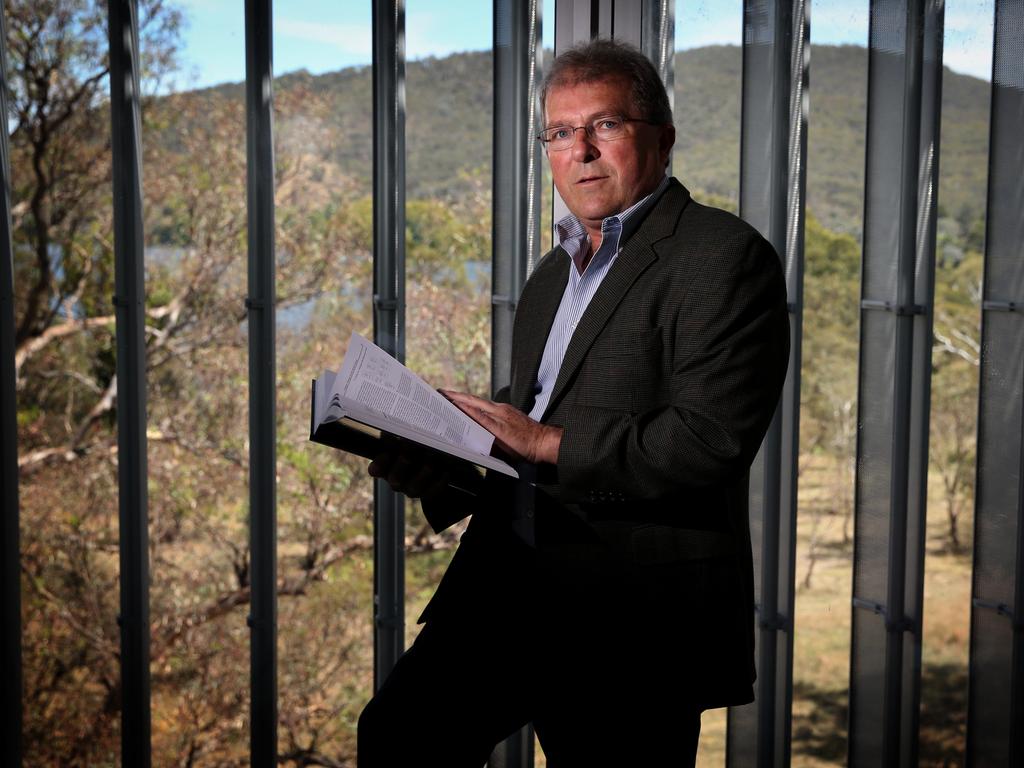

‘Consistency needed on climate metrics’: Reserve Bank of Australia deputy governor Guy Debelle says

Updated global guidance on how companies should disclose their climate-related metrics and actions will help investors, says Reserve Bank deputy governor Guy Debelle.

Updated global guidance on how companies should disclose their climate-related metrics and actions will be released shortly and will help investors direct the vast sums of money being invested with climate impacts in mind, Reserve Bank deputy governor Guy Debelle says.

Dr Debelle, who was speaking at the Impact X Sydney Summit on creating a pathway to net zero on Tuesday, said investors needed “consistency and commonality of disclosures both within Australia but also right across the world’’, in order to be able to make informed decisions.

There was a “plethora of investment products that we are seeing come to market, with green as a fundamental feature’’, which needed a common language and set of rules in order to be comparable from an investment perspective, he said.

Dr Debelle said a high-level guide to climate disclosures that was “somewhat usable’’ had previously been released by the multilateral Task Force on Climate-related Financial Disclosures, but a new guide was about to be released.

“The TCFD has got a much more detailed and usable guide to disclosures, which I am confident is very much going to become the standard in this area,’’ he said.

Dr Debelle said there had been a number of streams of work in this area, raising the possibility of confusion about what would become best practice, but he said he believed the TCFD guide would answer that question.

This was important because there were large amounts of investor funds with an environmental, social and governance (ESG) focus looking for a home, he said.

“There’s a large amount of funds wanting to be deployed in this space,’’ Dr Debelle said.

“I would say this is one case where at least right now the supply of funds potentially exceeds the demand that’s there currently, notwithstanding the large amount of funding needed for the transition over a number of years, but right now, supply probably exceeds demand.

“And they want to know where they should be deploying those funds. And that requires some disclosure.’’ Dr Debelle said that as of last month 80 of the top 200 companies on the ASX were already making climate disclosures under the TCFD guidelines, “and in most cases, it’s because you have no choice’’.

“I’m sure quite a lot of them are willing to do it, but actually you don’t have much choice because investors are demanding it,’’ he said.

“I think in a lot of cases the decision of ‘disclose or not’ has already been answered, both internally by the companies but also very much by their investors.

“And now we’ve moved on to the question of what to disclose and ensuring that consistency there.’’

Centre for Policy Development chief executive Travers McLeod said work his organisation had done earlier this year in collaboration with the Australian Institute of Company Directors and the Australian Chamber of Commerce and Industry on disclosure, which “gave detailed consideration to … what is referred to as greenwashing’’, found there were risks for companies and their officeholders in terms of the statements they made around climate.

“The key finding was that the company directors and companies could be found to have engaged in misleading or deceptive conduct or other breaches of the law by not having had reasonable grounds to support representations made as to net zero plans or commitments about climate change,’’ Mr McLeod said.

“It found that net zero strategies were becoming a necessary, and in some cases a key element of good climate governance, but it’s essential that it’s not that they’re done, but that they’re done well.’’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout