World needs climate policies before targets: Warwick McKibbin

The former Reserve Bank board member says people will be disappointed if they expect real policy to come out of COP26 in Glasgow.

“What you will see is targets and that is a real problem,” McKibbin says.

“That is why Kyoto failed. It is why all the previous agreements basically failed because people have taken on commitments without any knowledge of the cost on any policy or how to do it.”

The whole thing is upside-down, says McKibbin. Policy should be the priority and there should be a common price of carbon, however the world finally decides to go about it.

With so much still in dispute between nations, McKibbin sees little chance of a global carbon trading market or indeed a global carbon offset market. He favours instead one agreed and recognised carbon price around the world that could anchor different systems. Most effective would be a system that tracks carbon emissions from businesses.

By the end of 12 days of COP26, McKibbin will almost certainly be right. Targets, mostly for net zero 2050 and interim 2030, are as far as nations attending the “last chance to save the world” seem prepared to commit. National policies are few and there is little aspiration for consistent policies between countries.

Boris Johnson can claim a victory overnight with more than 100 countries including Brazil, Russia, Indonesia, Canada and the Democratic Republic of the Congo committing to end and reverse deforestation by 2030. Now they have to deliver on that.

McKibbin says 2030 must be the focus for real action on policy, because eight years is a tight time frame. “You are really going to have to say how you are going to do it. This is one of the problems with ‘the Australian way’. It doesn’t tell you how you are going to do it. It just tells you this technology is going to do it for you.”

Some countries are committing to 35-50 per cent emission reductions by 2030. “You can’t do that just be twiddling in the electricity sector,” McKibbin says.

“To get there you are going to need electrification of motor vehicles, and massive infrastructure from public investment that the private sector won’t provide for recharging stations. At the moment Audi has a different recharging station technology to Tesla, so you can’t pull an Audi into a Tesla charging station. It’s like Sony/Beta. You have got to get the policies right. You can make it expensive and you can make it really expensive.”

Done right, McKibbin says the trajectory to net zero by 2050 could come quicker than people think, particularly if financial incentives for new technology are put in place. “Tesla has just gone over a trillion dollars in value. People said the company was going to be broke even five years ago. The idea is to get technology to come and to get people to change their behaviour towards a low carbon world.”

Policy and technology enabled Australia to reach its Paris target of a 26-28 per cent emissions reduction faster than predicted, beating McKibbin’s modelling. “All the assumptions turned out to be way too pessimistic. The price of solar fell, the penetration of solar went up. And most of it was triggered by the carbon tax under Labor, even though it was abolished. That stuff doesn’t go away.”

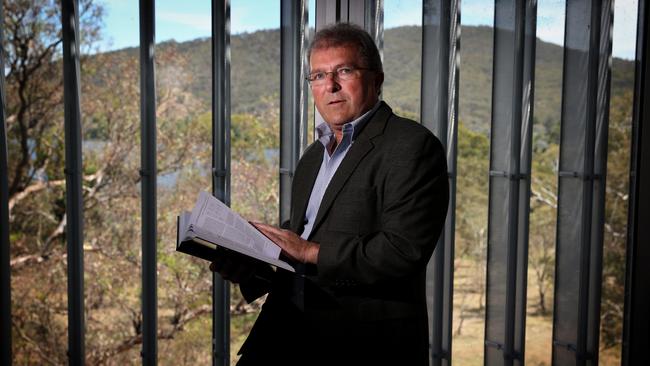

Warwick McKibbin’s views are hewn from years of market trial and error. Based at ANU’s Crawford School as professor of public policy, he is also co-director of the Climate and Energy Economics project at Washington’s Brookings Institution.

In many markets, ESG pressure is pushing business to take a lead. Companies have their own net zero targets and a patchwork of carbon offset markets is emerging. Unfortunately, says McKibbin, a truly global carbon offset market has all the same problems as a carbon trading market, which has struggled with compliance and credibility on measurement.

“For these offsets to be truly valuable, you need an institutional structure that enables the value of a forest in Russia to be deemed to be valuable in the American market. It’s the same problem we have with the common currency. Americans won’t use renminbi because they don’t trust it. So you’ll never have a global currency. I don’t think you’ll ever had a global carbon market.”

McKibbin believes any global offset market would operate at a discount reflecting the uncertainty. This will not be solved at Glasgow. And he does not believe carbon capture and storage at scale will ever work. Instead, fossil fuels need to be traded out of the system. “It would be much better to have a proper carbon emitting market,” he says. “Then you bring the offsets into that market and because there is a compliance process in the market itself, the offsets then have to be subject to the same degree of compliance.”

For Australia, McKibbin and Crawford School colleague Frank Jotzo looked at the low hanging fruit for new policy. A good start, they suggest, is to extend the closest thing to a carbon constraint in the system: the government’s safeguard mechanism.

Under the current mechanism, big carbon emitters aim to keep emissions below a baseline limit. McKibbin says emissions credits could be issued to companies remaining below their baselines in a market that linked up with the Emissions Reduction Fund scheme. “We have got to make the safeguard mechanism real, so that it is not voluntary and you put a penalty in there if you don’t achieve it,” he says. “At the moment if you don’t achieve it you can request an exemption, so it’s not really binding.”

The pair also recommend a climate asset and liability mechanism (CALM). This works a bit like the bond market in that the central bank fixes the short-term interest rate but allows the market to drive the long-term bond rate.

Long-term carbon certificates in fixed supply would be issued with a climate bank intervening with short-term carbon certificates that would only satisfy current year emissions. Big emitters could use CALM permits to meet their obligations and CALM credits could be issued to households and businesses in a way that could compensate for higher energy prices.

“I remember describing CALM 20 years ago,” McKibbin says. Its beauty, he says, is that it locks the government into a policy of decarbonising the economy.

“You provide financing so that the revenue from all of this pricing of carbon goes back into the balance sheets of companies that are transforming themselves and to houses who are managing variations in energy price,” he says.

“You don’t want to destroy the coal companies. You want them to make it in their interests to substitute producing coal to becoming hedge fund managers of portfolios of these certificates, so the shareholders themselves will be protected.”

A much greater challenge is any global alignment on emissions reduction.

“Rather than negotiate targets without any real policies, there should be a uniform price of carbon, not necessarily fixed in the market, just an agreed price.”

This price can be used in some markets for a carbon tax, or in others a cap and trade.

McKibbin published the idea in a Harvard paper. The IMF is now suggesting a common floor price for carbon. “That in itself is an effective policy and especially if it is a price that is expected credibly to rise over time,” he says. “The short-term carbon price needs to be low and the long-term carbon price needs to be high. Then you can achieve a lot of new investment which will avoid you hitting that high price when you finally get there. That’s the whole trick.”

Whether the IMF can convince European leaders to adopt a price on carbon is all about the art of the possible.

“Environmentalists don’t like prices,” McKibbin says. “They think all you are doing with a price mechanism is giving capitalists a lot of money. And that what you need to do is just make people stop doing stuff. That’s always the problem I run into when we talk about this. There are no trade-offs in the environmental space.”

For more than two decades as prime ministers were mowed down by climate change politics, Warwick McKibbin has been carefully modelling climate risk and solutions for the government and international agencies such as the IMF.