Buying at Covid bottom has been richly rewarded as ASX hits record

A record high for the Australian share market has reinforced the prospect of strong returns for investors who bought during the Covid-19 panic in 2020.

A record high for the Australian sharemarket has reinforced the prospect of strong returns for investors who were smart or lucky enough to buy in the depths of the Covid-19 panic last year.

The ASX 200 hit a record of 7203.3 points on Monday, 63 per cent above a seven-year low of 4402.5 it reached in March last year due to extreme monetary and fiscal policy stimulus and vaccine developments in the past year.

Investors who bought the market at the start of the 2020-21 financial year may make a total return before fees – assuming dividends were reinvested – of about 25 per cent.

But if they held throughout the crisis, they would only be up a few per cent on pre-pandemic levels by now.

Active investors could have done better as long as they didn’t keep too much cash aside once the market bottomed, and were not overweight the large cap “dogs” such as A2 Milk, Appen, AGL and Nuix.

They also needed to navigate a strong shift to growth stocks and “Covid winners” in 2020 and an equally big shift out of growth to value stocks later in the financial year. Few companies that outperformed last year have also outperformed in 2021.

Within the ASX 200, the biggest drivers of performance for those who got the timing right will be the banks, which have risen about 90 per cent on average from the March 2020 low.

The materials sector is another major driver, with a 76 per cent rise on average in the period.

One area where most active fund managers appear to have broadly got their positioning right throughout the Covid-19 debacle is the local IT sector.

Anyone who held Afterpay through its 80 per cent fall in February-March 2020 would have had sleepless nights, but active managers monitored by JPMorgan potentially made up for that by increasing their holding of the local IT sector to a three-year high in May last year.

Afterpay shares rose 18-fold from the low in March 2020 to its high in February 2021.

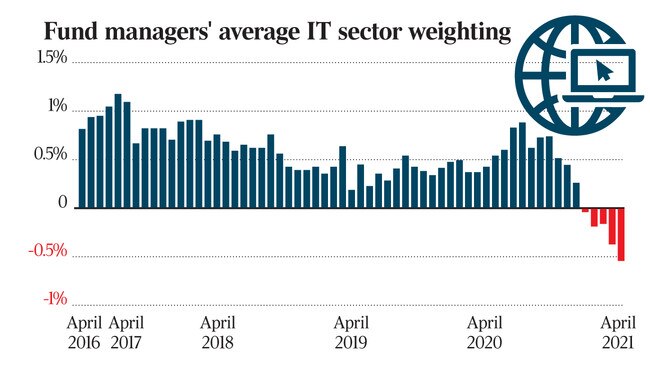

After reaching a three-year high in May last year as investors scooped up bargains in IT stocks and other “Covid winners”, the average IT sector holding of Australian funds turned underweight in December and continued falling to a multi-year low of minus 0.5 per cent in April 2021.

That level was the biggest underweight for the sector in JPMorgan’s data set going back to March 2016, according to the Bank’s head of Australian research, Jason Steed.

As well as this underweight position relative to the benchmark, short interest has been climbing.

In stark contrast to the overall market, where short interest has fallen by about 70 basis points since mid-2020, the average IT sector short interest of local hedge funds rose 110 basis points.

Overall, active funds look to have captured much of the 195 per cent rise in the IT sector from March to February, as well as much of its subsequent 27 per cent fall to mid-May.

The Australian IT sector has led developed market counterparts by 5000 basis points since the market turned up in March last year, but its fortunes have reversed this calendar year with an 11.3 per cent fall, while the MSCI developed markets technology index has risen 5.1 per cent.

“The timing of these moves has been fortuitous, with tech the worst performing Australian sector in the year to date,” Mr Steed said. “Much of that slide has been concentrated in the past month, with the likes of Afterpay and Appen down 19 per cent and 15 per cent respectively.”

He said one factor working against the sector had been its expensive valuation. The PE ratio of the sector climbed to more than 85 times earlier this year.

While the one-year forward PE multiple of the US tech sector has also been on the rise, at 26 times it sits at a “more palatable level”, Mr Steed said.

The question is how long will funds stay underweight a sector that’s arguably driving most of the “disruption” of “old-economy” business models.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout