OECD upgrades growth but urges faster Covid vaccinations

Immense spending and ultra-low interest rates have fuelled a global rebound, the OECD says, calling on Australia to speed up its vaccination rollout

Global output will grow by almost 6 per cent this year, but economic recovery remains hostage to new variants of Covid-19 and sporadic border closures and shutdowns, the OECD says.

In its latest economic outlook, the Paris-based body warns financial markets may overshoot in the face of one-off inflation spurts and hinder the revival, which will be experienced unevenly, with poorer nations the most vulnerable.

The OECD has upgraded its view for Australia, with GDP forecast to grow by 5.1 per cent this year and 3.4 per cent next year, compared with its March estimates of 4.5 per cent and 3.1 per cent, respectively.

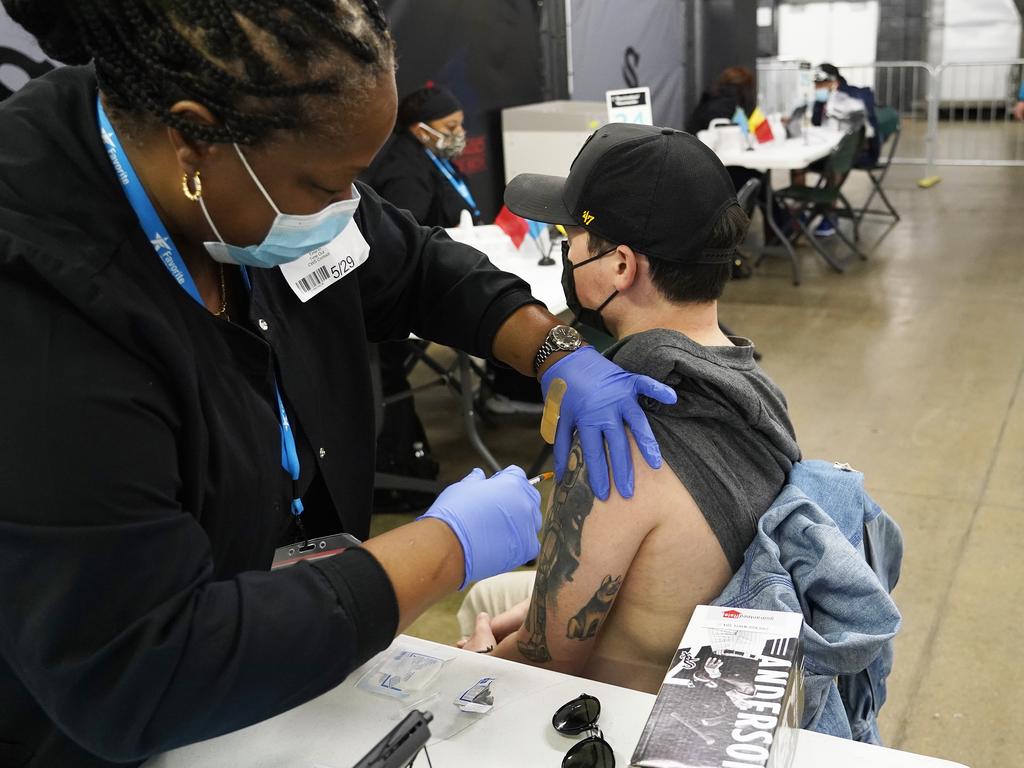

The organisation, to be headed by former finance minister Mathias Cormann from Tuesday, called on Australia to speed up its vaccination rollout, or risk slower growth, and to lift its policy game on decarbonisation by increasing renewable energy, boosting take-up of electric vehicles, and improving co-ordination of climate policies across governments.

“The top policy priority is to ensure that all resources necessary are used to produce and fully deploy vaccinations as quickly as possible throughout the world to save lives, preserve incomes and limit the adverse impact of containment measures on wellbeing,” the OECD said.

“The premature and abrupt withdrawal of support should be avoided whilst economies are still fragile and growth remains hindered by containment measures and the pace of vaccinations.”

OECD chief economist Laurence Boone said “the world economy is currently navigating towards the recovery, with lots of frictions.”

“The risk that sufficient post-pandemic growth is not achieved or widely shared is elevated. This will very much depend on the adoption of flexible and sustainable policy frameworks, and on the quality of international co-operation,” Dr Boone said.

But the OECD found the direct impact on domestic demand could be smaller in Australia, China and New Zealand, where Covid-19 cases are at very low levels because of strict control of international borders.

“However, these countries remain exposed to fluctuations in world demand and financial market sentiment and will benefit if borders can be reopened earlier for international travel,” it said.

On Tuesday, the Reserve Bank board will meet to discuss monetary policy, and the following day the ABS will issue March quarter national accounts. Private sector economists expect GDP to rise by an average 1.1 per cent in the quarter, following two successive periods of 3 per cent growth.

Dr Boone said “it is very disturbing that not enough vaccines are reaching emerging and low-income economies”.

“This is exposing these economies to a fundamental threat because they have less policy capacity to support activity than advanced economies,” she said.

“A renewed virus-driven weakening of growth would be harder to cushion, resulting in further increases in acute poverty and potentially sovereign funding issues if financial markets were to become concerned.

“More broadly, as long as the vast majority of the global population is not vaccinated, all of us remain vulnerable to the emergence of new variants. Confidence could be seriously eroded by further lockdowns, and a stop-and-go of economic activities”.

Noting the strength of the recovery in Australia, and the huge amount of fiscal and monetary support expended, the OECD said: “Restrictions continue to constrain some parts of the economy and insolvencies will rise from their current low levels”.

It signalled a downside risk if the “unwinding of government support is more disruptive than anticipated”. “The vaccine rollout represents a risk in both directions. On the downside, without widespread vaccination, the economy is vulnerable to a sizeable outbreak and accompanying restrictions, and delays to skilled immigration could crimp growth. A resolution of trade tensions would boost exports.”

As of Sunday, 4.2 million Covid-19 vaccinations had been administered in Australia, or 16.5 doses per 100 people. This compared with the UK (94), US (87) and Israel (122).

The OECD called on Australian governments to “act early to provide more support if downside risks show signs of materialising”.

With Victoria in a seven-day lockdown, amid fears it will be extended after acting premier James Merlino warned the outbreak is likely to “get worse before it gets better”, the OECD said: “Additional targeted support may also be needed where international border closures and remaining physical distancing restrictions have the largest impact”.

Further, it said facilitating the “geographical mobility of workers across states would help the necessary reallocation of resources” to lift productivity, growth and employment.

It urged more states and territories to replace taxes and fees on property transactions with a recurrent land tax to promote mobility and more efficient property use. In its recent budget, Victoria slugged citizens with higher stamp duties and payroll taxes.

Responding to the report on Monday, Josh Frydenberg said Australia had outperformed all major advanced nations last year, with GDP falling by 2.5 per cent compared to an OECD average of 4.8 per cent.

“Australia’s economic recovery has beaten our most optimistic forecasts, but we cannot be complacent,” the Treasurer said.

The OECD said Australian policymakers should also “limit the rebound of greenhouse gas emissions accompanying the recovery”.

“Further increasing renewable energy, boosting take-up of electric vehicles, and improving co-ordination of climate policies across governments – including better interconnection of electricity grids – would help progress towards the Paris Accord decarbonisation objectives,” the OECD observed.

According to the federal Energy Department, last year carbon emissions in Australia fell by 5 per cent.

“As countries transition towards better prospects it would be dangerous to believe that governments are already doing enough to propel growth to a higher and better path, especially keeping in mind the objective of decarbonisation,” Dr Boone said.

“It is essential that sufficient public investment is made available for the digital and green transitions and that the funds are swiftly and efficiently spent. This would help to also encourage private investment in these areas.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout