Bumper year for market with 20pc gain in sight

The Australian sharemarket is on track for a 20 per cent gain this year, its standout performance of the decade.

The Australian sharemarket is on track for a 20 per cent gain this year, its standout performance of the decade, and fresh interest rate cuts from the Reserve Bank in the first half of 2020 could propel the ASX 200 past the elusive 7000 mark, analysts predict.

With just two trading days left in 2019, the local sharemarket is up 20.8 per cent for the year, its biggest gain since 2009, but profit-taking is expected to see it open slightly lower this morning, down 0.4 per cent at 6782 points.

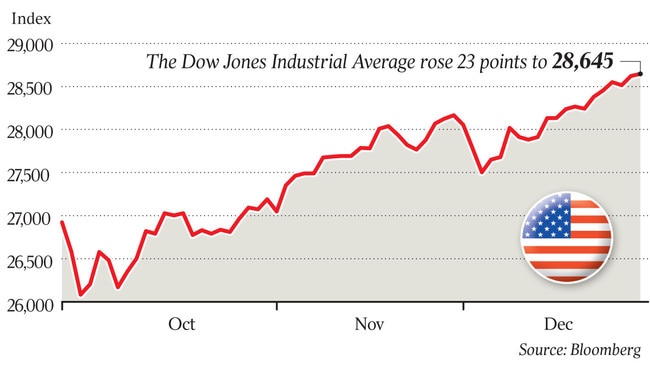

It comes as US sharemarkets eked out fresh record highs on Friday, despite fatigue setting in following the Christmas rally.

“We’re on track at this stage to have the best year since the global financial crisis. And following the strong performance, there is optimism looking into 2020,” said CommSec senior economist Ryan Felsman.

“Growth is expected to pick up around the world. From an Australian perspective the key thing is around what the Reserve Bank does. We think the RBA will cut interest rates at least once if not twice next year. And if things don’t improve there’s every chance they’ll have to start QE (quantitative easing).”

The boost to equities from rate cuts would likely see the sharemarket hit 7000 by mid-year, Mr Felsman said.

AMP chief economist Shane Oliver believes the ASX 200 will be at 7150 this time next year.

“I suspect (next) year will be a lot slower but the market will head higher because the economy is still growing, even though it’s weak, and that will support profit growth of around 4 to 5 per cent. It’ll probably be enough to get the market above 7000,” he said.

Mr Oliver expected the RBA to cut interest rates in February and again in March, bringing the official cash rate down to a record low 0.25 per cent.

He said the central bank might have to resort to QE by mid-year unless fiscal stimulus measures were announced in the May budget, which could further boost equities.

The biggest issue facing the market going into 2020 would be earnings growth, Mr Felsman said. He expects earnings per share growth of 4 per cent for the year.

“This means investors will have to weigh up the need for yield versus the earnings backdrop and whether corporate valuations are suitable in terms of investing going forward,” he said.

Markets around the globe have seen double-digit returns this year, with the US S&P 500 up 29 per cent, the Euro Stoxx index up 26 per cent, Japan rising 19 and China gaining 34 per cent.

“They’ve all had very strong years off the pessimism that was around at the end of 2018,” Mr Oliver said.

“But 2020 is going to be slower, simply because when markets are starting from a higher level they’re more expensive and there’s not as much negativity around.

“It sounds perverse but when everyone’s negative it’s easy for a bit of optimism to come along and push the market up. That’s what happened at the start of this year, when central banks started being less hawkish about interest rates.

“Whereas now things aren’t quite as negative so it will be slower, but the market will still head higher.”

The Dow Jones Industrial Average edged up 0.08 per cent to a new record high of 28,645.26 on Friday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout