End of escrow creates stock overhang

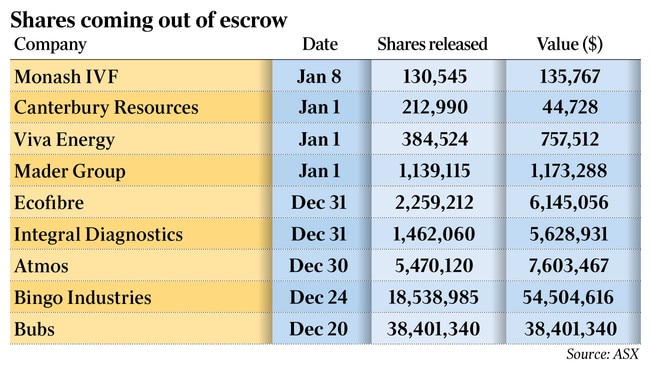

Nearly $120m worth of shares are set to come out of escrow arrangements in the New Year period.

Nearly $120m worth of shares are set to come out of escrow arrangements in the New Year period, creating a potential overhang across several companies as they push record highs.

The biggest tranche includes some $54m worth of shares in Bingo Industries which came out of voluntary escrow on Christmas Eve.

These shares are held by major Bingo shareholder Ian Malouf, who was given a 12 per cent stake in Bingo as payment for the acquisition of his Dial A Dump Industries and will see his stake progressively unlocked. “Shares held directly by Mr Malouf are subject to escrow over four equal tranches to be released nine, 12, 18 and 24 months post-completion (of Dial a Dump merger),” Bingo said in a statement.

The release of 18.5 million shares on December 24 represented tranche one, the waste company added.

Bingo shares are up more than 58 per cent this year to close at $2.94 on Friday and are just short of the record high of $3.20 each reached in mid-2018.

Escrow periods prevent owners of companies from selling their shares until a certain date.

The lifting of escrow periods usually comes after financial results are released.

The move prevents a flood of shares hitting the market shortly after listing or a merger and is also designed as a way to align investor interests with the owners of companies.

The ASX has put in place escrow arrangements of between 12 and 24 months for new stockmarket listings, depending on the type of listing and the vendor.

The lifting of escrow arrangements does not automatically signal a share sale, but fund managers note that broader trading in a company leading into and coming out of the removal of escrow arrangements can often be more volatile.

Others to see escrow periods lifted include $38.4m worth of shares in dairy interest Bubs that were issued in relation to the company’s $39m acquisition of Nulac Foods in 2017. The escrow restrictions on the Nulac shares were lifted on December 20.

Meanwhile, healthcare group Integral Diagnostics has more than $5.6m worth of shares scheduled to come out of escrow restrictions across two tranches by Wednesday.

Intergral said in a statement: “The release of these shares does not change the issued capital of the company.”

There are $6.14m worth of shares scheduled to come off escrow in hemp play Ecofibre on Wednesday. These shares were subject to mandatory ASX imposed escrow restrictions for up to 12 months.

Ecofibre, which has former Count Financial founder Barry Lambert as a major investor, last traded on Friday at $2.72, compared to its stockmarket debut of $1.

Among the bigger escrow restrictions set to be lifted this calendar year is some $700m — or half the issued capital — in newly listed Tyro Payments.

The voluntary escrow arrangements are in place until the release of Tyro’s financial results for the year ending June 30.

The Australian sharemarket has gained 22.7 per cent this calendar year and at Friday’s close of 6821.7 points it is just 40 points short of a record high.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout