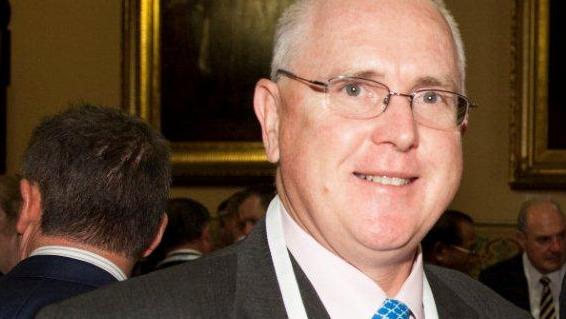

Blue chips look cheap: Baillieu’s Richard Morrow

Melbourne stockbroker Richard Morrow says there is less panic in the market this time than in the last few sharemarket routs.

Veteran Melbourne stockbroker Richard “Dickie” Morrow has seen it all before, the 1987 crash, the dotcom boom and bust and the global financial crisis.

This time around from his Melbourne office at E.L.& C. Baillieu he casually waves off the slump as no different really. In fact he believes there is less panic in the market this time than in the last few sharemarket routs.

In fact, we could all be kicking ourselves next year for not “backing up the truck” and loading up on blue-chip stocks going cheap.

“This seems more calm than 1987 and 2008. I think it has been exacerbated by margin calls, but I see it as all very calm and we will come out the other side,” Mr Morrow told The Weekend Australian.

“Why would you sell now? It’s too late to sell, and I think we will come out the other side of this in a world with very low interest rates and lots of liquidity thanks to the stimulus packages put together by all the governments around the world.’’

He said his clients were diving in now scooping up cheap stocks or just picking away at some bargains.

“They are nibbling really. In 18 months’ time we will be probably asking ourselves why we didn't back up the truck and buy as many as blue-chip equities as we could.’’

Jason Teh, chief investment officer at Vertium Asset Management, said there were some stronger stocks in an otherwise horror day for the market, with those “better performing stocks” just not falling by as much as other companies on the ASX.

“Right now from a valuations point of view, valuations are on par, for not all stocks, some stocks, but they are on par with GFC multiples,’’ he told The Weekend Australian.

“Healthcare is holding up, consumer staples are holding up — when I say holding up, I mean still falling but by not as much. And iron ore is still pretty resilient.

“Look at Telstra — it is down 6 per cent today. I don’t have a position in Telstra, and I would have thought it was defensive but it’s not.’’

Mr Teh believed the government would continue act to protect the economy from a recession, throwing more money at households if required.

“One thing is for sure: you have seen governments come out with fiscal stimulus programs, and the market is not obviously not buying it.

“Is the government doing enough? And that’s fine because we know the government will throw everything at it.”

Bruce Smith, portfolio manager at Alphinity Investment Management, said rather than clients pulling out of the market they were looking for opportunities to pick up bargains in the market and deploy more funds into equities.

“There are a lot of other players out there, like hedge funds, high frequency traders and the like who generate a lot of turnover and do weird things from time to time.

There are a lot of weird things going on in individual companies’ share prices, some justified, some not.

“We have a bunch of cash which we are waiting to deploy. While the market is feeding negatively on itself, it’s probably too early but it will reach a point where that is done. S&P futures are only down 1 per cent currently so, maybe, it’s coming to an end.

“I’d be surprised if the ASX200 is down around 25 per cent at month end — there should be some bounce at some point. When it happens it could be big. But this sort of thing feeds on itself as we’ve seen this week.”

Cyan Investment Management portfolio director Dean Fergie said his fund had been cashed up leading into the market slump with his house view that valuations had been stretched for a while.

“We are looking at it through a lens of incredibly lower for longer interest rates, a lot of government stimulus and that once all this panic subsides, or at least stabilises, there will be a lot of businesses trading on low double-digit or single-digit PEs, but with near-term earnings risk, not long-term earnings risks.

“In many cases paying dividends of 8, 10, 12 per cent fully franked, which is 10 times what you are getting in the bank.

“Now, we wouldn't be looking at anything in travel, anything that is highly leveraged, anything in consumer lending. But we could be looking at retail, more defensive banking stocks … Telecommunications is another good one. We have also been buying shares in Jumbo, which is online lotteries, and that shouldn't be impacted at all by the coronavirus, or salary packaging, like McMillan Shakespeare.”