Goldman Sachs: Stimulus ‘won’t prevent recession’

A global recession caused by the coronavirus is now likely according to Wall Street’s leading investment banks.

A global recession caused by the coronavirus is now likely according to Wall Street’s leading investment banks, with Australia’s economy also expected to shrink despite the Reserve Bank and federal government fusing monetary and fiscal policies to fire up consumers and businesses.

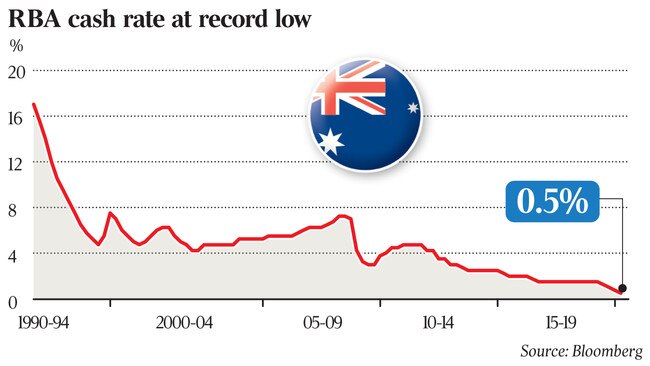

Goldman Sachs has warned that lower interest rates and stimulus payments were unlikely to prevent the nation from recording two consecutive quarters of economic growth.

“Taken together, we estimate monetary and fiscal policy will support Australian GDP growth by around one percentage point in 2020. While helpful, we view the magnitude as relatively modest given the headwinds facing the economy,’’ Goldman Sachs analyst Andrew Boak said in a report to clients.

“As a comparison, we estimate this amount of monetary and fiscal stimulus to be around one-fifth as large as that delivered during the global financial crisis in 2008-09. Looking forward, despite the combination of monetary and fiscal stimulus, we now expect Australia to fall into recession in the first half of 2020.

“While the outlook is highly uncertain, and we wouldn’t be surprised to see additional fiscal stimulus over the coming months, we think the intensification of virus control measures — both domestically and globally — will weigh on activity and see growth contract in the second quarter of 2020.”

UBS economist George Tharenou said a “technical recession” was now likely for Australia, with two negative quarters of GDP in the first half of 2020 ending a world record 29-year run, and having an impact on employment and house prices.

“With the very significant disruption to labour markets, we see employment growth flatlining in coming quarters and the unemployment rate increasing significantly to 6.25 per cent by the end of the year,” Mr Tharenou said. “This stops the boom in home prices, with growth revised down to 5 per cent ahead, [from] 10-12 per cent.”

In UBS’s intermediate scenario, the recession is a little deeper and recovery modestly slower, with GDP of 0.3 per cent in 2020 and 2.1 per cent in 2021. Unemployment spikes towards 7 per cent. In the worst case, the recession continues for a third quarter and unemployment surges towards 8 per cent.

While yet to update its forecasts for China, JPMorgan economists warn that if China recovers no more than 6 per cent year on year in the June quarter, the contractions now incorporated in its US and western European projections would be sufficient to produce two consecutive negative quarters of global economic growth — defining a recession.

“If our current forecast is realised, it seems appropriate to characterise it as a novel-global recession,” JPMorgan global chief economist Bruce Kasman said.

“A fading of the outbreak should promote a normalisation in activity into mid-year … (but) two recent developments lead us to now expect a much sharper first-half contraction.”

He said the breadth of “social distancing” was “increasing at a dramatic pace”, with Italy now in total lockdown, the US and other countries suspending flights from a wide range of nations, and a range of public events cancelled for the coming weeks.

Second, “financial conditions are tightening sharply” as perceptions of credit quality across a range of asset classes deteriorated and “market liquidity dries up”.

That has caused credit spreads and market measures of corporate and sovereign default risk to “widen markedly”, according to Mr Kasman. “We continue to slash first-half global economic growth forecasts,” he said.

The projection of a “China collapse” in February and a March-June recovery remains a key driver of his anticipated minus 1.4 per cent year-on-year global economic growth forecast for the March quarter GDP and a 1.8 per cent rise in the June quarter.

“However, our latest revision now forecasts a meaningful two-quarter GDP contraction in both the US (-2 per cent and -3 per cent) and euro area (-1.8 per cent and -3.3 per cent),” Mr Kasman said.

“Our EM economists have yet to respond fully to these changes, the evolving news on the virus and the material tightening in EM financial conditions. It is thus reasonable to expect further downward revisions.”

Two quarters of negative economic growth is not, by itself, a sufficient condition for recession, according to the US National Bureau of Economic Research, which says it must last more than a few months, but JPMorgan sees a first-half contraction that is both significant and widespread. “We believe that our forecast represents an event best characterised as a recession,” Mr Kasman says.

But while the US has not experienced a post-WWII recession in which its unemployment rate did not rise at least 1.9 percentage points from its cyclical trough, JPMorgan isn’t currently building in a material shock to US and other economy labour markets.

“Our forecast maintains a US unemployment rate below 4 per cent at the end of this year as the contraction in growth, while sharp, is short-lived,” Mr Kasman said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout