Aussie stocks warm to Trump’s State of the Union pep talk

Local blue-chip stocks edged higher during Donald Trump’s State of the Union address yesterday.

Local blue-chip stocks edged higher during Donald Trump’s State of the Union address yesterday, reflecting expectations the US sharemarket will today claw back some of the losses from earlier in the week that threaten to spoil the President’s economic message to congress.

The President’s speech included a renewed call for $US1.5 trillion ($US1.85 trillion) in infrastructure spending — roughly equivalent to Australia’s entire GDP. This seemed to bolster US government bond yields, which have soared in recent days on expectations the Federal Reserve will lift rates in 2018 on the back of stronger growth. While the US 10-year Treasury yield, a key global measure of future interest rates, held above its three-year high of 2.7 per cent during Mr Trump’s speech, Australia’s equivalent government yield dropped to 2.8 per cent as investors absorbed another weak inflation report and a sharp, unexpected slowdown in business lending.

The chance of an official interest rate increase dropped back below 50 per cent around noon yesterday after the Australian Bureau of Statistics revealed the inflation rate had once again failed to climb into the Reserve Bank’s target band of between 2 and 3 per cent. “Inflationary pressures remain subdued so the Reserve Bank will remain on the sidelines for some time yet,” said CommSec economist Craig James. Shane Oliver, chief economist at AMP Capital, said: “While there are areas of strength in the Australian economy, the low inflation and wages backdrop, risks around home prices and high household debt and the high Australian dollar all indicate that it’s still too early for the RBA to start raising interest rates.”

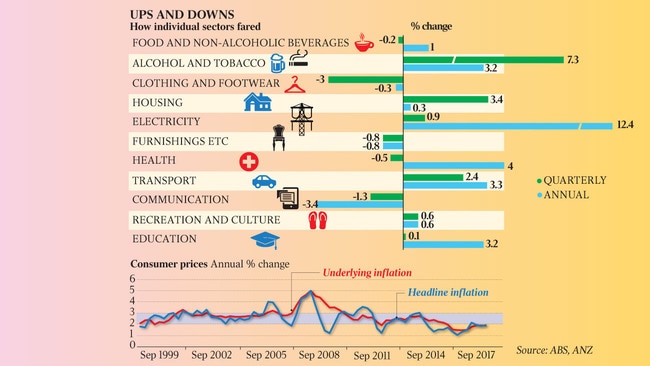

Despite double-digit annual price rises for petrol and electricity and a 5.4 per cent increase in childcare costs, the categories with the largest increases of 2017, the consumer price index rose only 1.9 per cent over the year, including a lower than expected rise of 0.6 per cent in the final three months.

The ACTU seized on the figures, releasing analysis showing key essentials in household budgets had increased well above the overall inflation rate. According to the study, the price of electricity increased 553 per cent faster than the CPI, while gas and childcare rose 311 per cent and 184 per cent faster respectively. It also found health costs had risen 111 per cent faster than the CPI.

Private sector wages rose 1.9 per cent over the year to September, suggesting real wages last year might not have increased for many workers.

ACTU secretary Sally McManus said: “Working people are already struggling to keep their head above water. These figures show the water just keeps getting higher and higher.”

Royal Bank of Canada’s Su-Lin Ong said: “As has been the case for some time, these ongoing pressures continue to squeeze disposable income, posing an ongoing restraint to household consumption.”

Household consumption has been a weak point in the national accounts for some time.

Imported, trade-exposed goods helped keep inflation down. Audiovisual and computing equipment fell 7.5 per cent over the year; clothes and small electrical appliances each fell about 5 per cent. Rents rose 0.3 per cent. Perth and Darwin, the most mining-exposed cities, experienced inflation about half the national level, while the highest price increases were concentrated in Hobart and Brisbane.

Economists expect the still-weak inflation to convince the Reserve Bank to leave the cash rate at 1.5 per cent, a record low, at least until the second half of the year. The US Federal Reserve, however, is expected to raise rates again at least twice this year.

Separately, the Reserve Bank said outstanding business loans rose 3.2 per cent last year compared with 5.6 per cent a year earlier, leaving annual total credit growth at the lowest level in almost four years. CBA economist John Peters said: “The recent slowing in total credit generally also encompasses affordability issues, particularly in Melbourne and Sydney, the nation’s two major housing markets, where housing prices have kept rising solidly in the past few years.”

Additional reporting: Ewin Hannan

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout