ASX 200 makes late comeback

A late recovery kept a lid on losses on the local stockmarket on Wednesday.

A late recovery kept a lid on losses on the local stockmarket on Wednesday. Local weakness came despite an earlier lift on Wall Street, where investors focused on the easing of coronavirus isolation restrictions and businesses returning to trade.

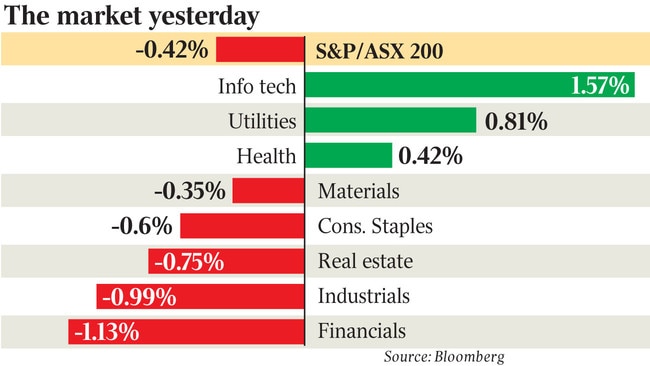

The benchmark S&P/ASX 200 fell as much as 1.1 per cent early i the session, but clawed back to finish the day down 23 points, or 0.42 per cent, at 5384.6. The All Ordinaries fell 13 points to 5464.8.

Retail sales data for March was a key focus, printing slightly higher than expected with a record surge in food retailing due to stockpiling ahead of the shutdown and higher food prices.

The positive read is the first partial data input for first-quarter GDP, but RBC chief economist Su-Lin Ong noted it would do little to alter a likely negative read for consumption. She said the data revealed a “far greater degree of uncertainty around any set of forecasts”.

“While markets appear even more forward-looking than usual, and focused on the easing in social distancing measures and path to recovery, there are a lot of very weak data in the coming weeks/months to get through,” she said.

“Some of these numbers, especially the labour market data have implications for the growth path and recovery ahead.”

The retail figures had little impact on the dollar with the currency edging 0.18 per cent higher by the local close to US64.41c.

Electronics retailer JB Hi-Fi echoed the data from the ABS, reporting a sales surge in March as workers equipped themselves to work from home. Still, it skipped on providing any guidance and its shares added 3.4 per cent to $35.10.

Elsewhere in the retail space, Premier Investments fell 1.5 per cent to $15.14, Myer lost 2.6 per cent and Kathmandu jumped 10.2 per cent to 86.5c after announcing it was reopening some of its stores.

Shopping centre owner Vicinity warned that the retail environment would be tough for the next 12 months. Its shares gave up 1.4 per cent to $1.37.

Fellow mall owner Scentre dropped 2.3 per cent to $2.13 while Mirvac fell 1.4 per cent to $2.18 and Stockland lost 1.1 per cent to $2.67.

Aerial mapping company Nearmap was the biggest ASX 200 gainer, rising 9.5 per cent to $1.66 after announcing it was slashing costs by 30 per cent in a plan to break even by the end of the financial year.

In healthcare, Mesoblast surged 12.5 per cent to $3.69 after the Melbourne biotech announced it was beginning a 300-patient clinical trial to test its drug Remestemcel-L in critically ill COVID-19 patients.

The major banks all lost ground, led by NAB,which closed 2.4 per cent lower at $16.59. Commonwealth Bank fell 0.8 per cent to $60.35, Westpac dropped 1.5 per cent to $15.96 and ANZ fell 1.5 per cent to $16.20.

Macquarie shares edged 0.8 per cent lower to $99.45 ahead of its full-year results to be handed down on Friday.

Among the heavyweight miners, BHP fell 0.9 per cent to $30.41, Rio Tinto lost 0.9 per cent to $81.99, but Fortescue gained 2.1 per cent to $11.26.

Elsewhere, goat milk formula maker Bubs rose 0.7 per cent to 95c on a new supply deal, while Medibank gained 3.8 per cent to $2.76 as it maintained its outlook for the full year.

additional reporting: AAP