Another good year ahead for floats but rates a worry

Rising interest rates could affect new stockmarket listings this year as well as the performance of technology stocks, accounting firm HLB Mann Judd has warned.

Rising interest rates could affect new stockmarket listings this year as well as the performance of technology stocks, HLB Mann Judd has warned.

But the accounting firm expects lithium companies – star performers among the newcomers to the ASX last year – to continue to do well in 2022, driven by the big increase in sales of electric cars.

After a flood of new IPOs on the ASX since the end of 2020, HLB Mann Judd said initial indications were that 2022 was starting strongly in terms of proposed new listings.

The report says 27 new companies applied for listing on the ASX at the beginning of this year, hoping to raise a total of $250m.

“This is a substantial increase when compared to the 14 which sought to raise $172m at the same time next year,” it says.

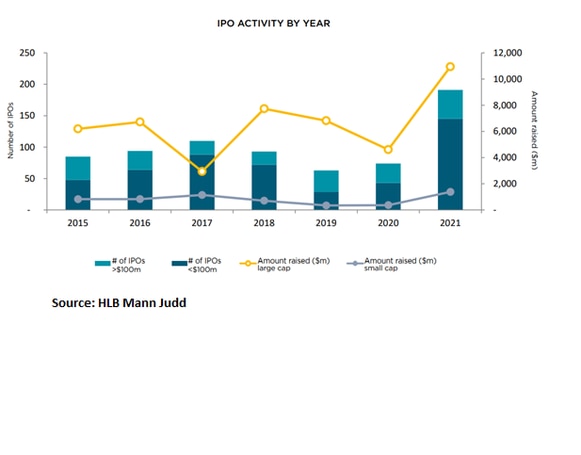

The plans for new ASX listings this year come after 191 floats last year – the highest in the past decade – raising a total of $12.33bn.

“The big uncertainty is interest rates,” the firm’s Perth-based partner in charge of corporate and audit services, Marcus Ohm, said at a briefing releasing the report on Thursday.

“An environment where interest rates are going up means that 2022 is going to be a bit different for markets in general and IPOs,” he said.

“We have already seen it in tech. Rising interest rates are not good for tech companies.”

He said 2021 was a very positive year for tech companies overall, the prices started to fall towards the end of last year on fears of rising interest rates.

He said the market was now watching to see how buy now, pay later stocks would be affected by rising interest rates.

But he said it was a very different story with commodity stocks focused on gold and metals used in the production of batteries for electric vehicles.

“Lithium stocks performed really well last year. Lithium companies were the stocks to be in in 2021,” he said.

The top performers among new companies listing on the ASX last year included cobalt, nickel and copper company Kuniko (up 478 per cent over the year), Global Lithium Resources (375 per cent) and Lithium Energy (365 per cent).

Mr Ohm said lithium companies were driven by the big increase in demand for the mineral thanks to the shift to electric vehicles.

“The price of lithium has gone gangbusters,” he said.

He said there were 10 new lithium companies listed on the ASX last year, with six of them recording price gains of more than 100 per cent.

He expects demand for lithium to continue as car companies around the world stepped up their production of electric vehicles.

“Sales of electric vehicles were up about 40 per cent over the year,” he said.

“All the car manufacturers around the world are putting more funds into research and development of electric vehicles.

“A few years ago, there was an excess of supply in the market, but now we have a situation where there is a shortage of supply.

“Over the long term there is a very positive future for lithium and base metals in general.”

Mr Ohm said the BNPL sector had “not gone so well”, with companies such as Beforepay seeing their shares fall on listing this week.

“None of them have really gone that well post-listing,” he said.

Mr Ohm said the 191 new listings on the ASX last year was significant given that there were an average 2000 to 2300 companies listed on the ASX over recent years.

The total amount raised from new listings of $12.4bn was more than double the $5bn raised from new listings in 2020.

The listings were dominated by eight companies which came to the market with a market capitalisation of more than $1bn, the largest being GQG Partners, which raised $1.2bn, followed by PEXA, which raised $1.18bn.

The best performing large cap company which listed last year was DGL, whose share price rose 213 per cent during the year.

The biggest single group of new companies was in the resources sector, including gold, lithium, minerals and energy stocks, with 107 of the 191 IPOs.

Western Australia was the home state for more than 80 of the new listings.

The largest proposed listing on the ASX this year so far is a US student housing real estate investment trust, which manages a portfolio of student housing real estate assets in the US and is seeking to raise $45m.

Mann Judd’s Sydney-based partner in charge of corporate and advisory, Simon James, said 2021 had seen a big increase in the availability of venture capital funding in Australia.

Last year total venture capital investments in Australia rose to $2.5bn, more than 10 times the $200m invested in 2011.

“The growing venture capital market in Australia shows no sign of slowing down with more than $2.2bn of new capital still to be deployed,” he said.

“A stable economic and political environment, combined with the government’s strong response to Covid-19, have increased investor confidence and set us apart from other countries.”

He said the easier access to venture capital funding was leading US companies to delay stockmarket listings until they were much larger.

While this was not yet evident in Australia, he said he expected that the trend would gain momentum here “because there is so much money (available in the VC) space”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout