Tension ahead of AGL demerger vote; Turnbull, Vesey join forces at Fortescue Future Industries

Tensions are escalating ahead of the June 15 shareholders meeting to vote on the demerger of AGL, with the Graeme Hunt-led energy giant and billionaire major shareholder Mike Cannon-Brookes’ Grok Ventures in a battle royale over the split.

On speculation that Atlassian co-founder Cannon-Brookes had on Tuesday moved on market to convert some of the 11.3 per cent in derivative instruments Grok is holding in AGL into about 5 per cent of AGL’s physical shares, the power company’s boss was banging his feet about how the tech bro’s interests were far from aligned with those of other longer-standing AGL investors.

At the meeting to be held in about four weeks, 75 per cent of AGL shareholders must vote in favour of the spin-off of the company’s fossil fuel business into a new entity called Accel Energy for the conscious uncoupling to proceed.

Hunt, a former AGL chair who last year stepped into run the group, has rejected any suggestion Accel would struggle after the demerger. He described a letter that Cannon-Brookes wrote this week to shareholders as “a lot of rhetoric but little detail from someone who has not provided a plan, and whose interests are not aligned with the interests of thousands of our other longstanding shareholders”.

So whose interests do align with these “longstanding” AGL shareholders, whose stock has been in effective decline since early 2017, and would it include Hunt?

The CEO has 30,475 ordinary shares worth just over $263,000. He was gifted 17,975 of those courtesy of a special deal that he struck when he took over as interim boss and the board decided he wouldn’t participate in short-term or long-term incentive plans.

After three months the gig became permanent, so on a pro-rata basis Hunt got $165,354 worth of shares that at the time bought him 17,975. So he got them for free and he can sell them any time from the end of next month.

When Hunt’s gig became permanent last July it was decided his fixed pay would be $1.55m and that he would participate in AGL’s incentive plans for FY22. If he reached all hurdles his pay would be worth $5.2m.

So far, Hunt has been issued with 297,374 free performance rights under AGL’s FY22 long-term incentive plan as approved at the company’s last annual meeting.

He’s also got another 12,500 ordinary shares, which he is believed to have bought on market in September 2018 at an average price of $19.66 a share (around $245,000 in total at the time). He’s about $138,000 out of pocket on those to date.

But nothing like the skin that Cannon-Brookes has in the game.

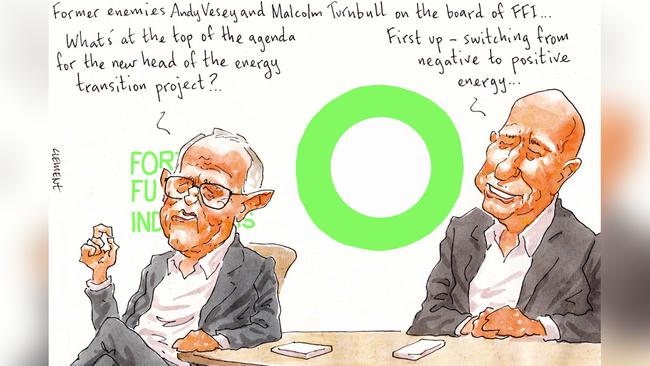

Old foes Turnbull and Vesey join forces

There used to be a time when relations between former AGL boss Andy Vesey and former prime minister Malcolm Turnbull were so frosty that it was genuinely unclear if the pair would even shake hands with each other during their last press event, held in 2018.

The scene was AGL’s Loy Yang A power plant in Victoria’s Latrobe Valley, where the two were drawn after months of skirmishing over Vesey’s announcement that AGL would close its Liddell Power Station by 2022.

The resulting backlash from the Turnbull government, which ruthlessly campaigned for the site to remain open or sold off, turned the Manhattan-born Vesey into a corporate villain of Sol Trujillo proportions. AGL even had to hire security for his protection.

The greatest hostility allegedly originated from Treasurer Josh Frydenberg, then the Energy Minister, who is said to have called numerous AGL board members arguing that Vesey should be sacked. No interference in the market there, of course (comment was sought from the treasurer).

The argument between AGL and the government ended only when Vesey eventually resigned from the company on August 23, 2018, quite literally within hours of Turnbull himself being toppled as prime minister. That was the end of that.

Fast forward a couple of years and not only is Liddell still closing, despite the government’s intrigues against the company, but Vesey is now actually joining forces with Turnbull on Fortescue Future Industries, where the former PM chairs its Australian operations. How’s that for symmetry, or maybe that’s irony?

Per an announcement released on Wednesday, Vesey will be appointed FFI’s head of energy transition projects, placing him in a team that includes former RBA deputy Guy Debelle, outgoing FFI chief Julie Shuttleworth, and other corporate egos in various states of inflation who will all be forced to work together.

Whether the froideur between Vesey and Turnbull continues these days is unclear, although Nick Warner, the former intelligence official and ASIS director-general — and basically Australia’s answer to George Smiley — remains a special adviser to FFI.

No doubt a bit of soft diplomacy from the retired spymaster could provide the antidote between them from here, if that’s necessary.

Turnbull, who is currently in Barcelona for the Global Hydrogen Conference with Fortescue executive chairman Andrew Forrest, was contacted for comment.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout