Raelene Castle hangs out consulting shingle

Raelene Castle has quickly hung up a new shingle following her resignation as the boss at Rugby Australia three weeks ago.

She’s been straight on to LinkedIn to reveal she’s entered the consulting world.

The former code-hopping rugby executive is now a consultant at Castle Consulting, although there’s no formal signs of the company’s registration with ASIC just yet.

Castle stepped away from Rugby Australia having been chief executive since early 2018, taking over from Bill Pulver.

The Pyrmont-based Castle still retains a board seat at Sanzar (South African, New Zealand and Australian Rugby), and its travel company Sanzar Travel, although the board aren’t exactly sharp with their paperwork.

Cameron Clyne, who left the RU chairmanship in late February, is still listed on the board.

His interim replacement Paul McLean will presumably pass the paperwork on to Hamish McLennan.

Stoush brews over Centrelink closure

It’s game on.

The billionaire Melbourne Tarascio family has returned Social Services Minister Stuart Robert ’s fire over the immediate closure of the Centrelink office in Abbotsford.

The billionaire property group led by patriarch Sam Tarascio, 75, has rejected claims from Services Australia that the family’s Salta Properties “required” Centrelink to leave the Victoria Street, Abbotsford, premises, which is set to close on Thursday.

“Services Australia, on behalf of Centrelink, had previously informed Salta Properties that it wanted to extend the lease and Salta had agreed to an extension,” a Salta spokesman said.

“Services Australia had sent a Deed of Extension to Salta, which had sent back its comments. Salta never heard back.”

In a statement on Wednesday Services Australia general manager Hank Jongen said: “The outcome of comprehensive lease negotiations with the Yarra Service Centre landlord has resulted in Services Australia being required to vacate the building before the lease expiry date of 22 May 2020.”

The plot thickens

But then on Thursday arvo, Services Australia claimed Salta Properties told it on May 12 there was to be no lease extension and that it now has a notice to vacate — by Friday.

It added that Salta had offered — via a text on Thursday — to allow an extension to the lease for three months.

“We await a written legal offer,” Services Australia said.

So ball back in the billionaire’s court.

The conflicting accounts of how Stuart Robert ’s department came to be closing the centre, which offers both Centrelink and Medicare services, comes as Australia’s unemployment rate skyrockets amid the coronavirus-driven economic crisis.

The inner-city building is owned by Taras Nominees Pty Ltd.

Company records show that Taras Nominees is controlled by Salta Properties Pty Ltd, which is owned by Sam Tarascio, who is executive director of the group.

According to The Australian’s list of our nation’s wealthiest people, The List, Tarascio is estimated to be worth $1.43bn. The billionaire is assisted in the operation of his empire by his 44-year-old son, Sam Tarascio Jnr.

Salta Properties is one of Australia’s largest privately-owned companies.

It owns and manages commercial property all over Melbourne, including the Victoria Gardens Shopping Centre that is nearby to the Abbotsford Centrelink office.

“Salta Properties was shocked to learn (Wednesday) on Twitter of Centrelink’s decision to vacate the premises,” the company spokesman said.

“This morning it reached out again to Centrelink to confirm the premises remain available and it is welcome to stay.”

The Abbotsford centre has seen some of the longest queues as the COVID-19 crisis struck the local economy as businesses all over the southern capital were shut down and employees laid off.

Services will now be consolidated at the South Melbourne service centre, which is 6km away.

So, whose version of events to believe?

The Tarascios are loaded, running their property empire from a high-rise office at the Paris-end of Melbourne’s Collins Street, having relentlessly built their wealth over the past 50 years.

Tarascio Snr lives in the top floor of an East Melbourne apartment building, for which he paid $10m 14 years ago, while his son lives on Toorak’s Orrong Road.

But Robert has form.

Remember back at the end of March when his department’s MyGov website had a meltdown amid a surge in activity thanks to the coronavirus outbreak?

Robert tried to tell Australia there’d been a distributed denial of service attack, but a few hours later was forced to walk that explanation back, admitting the service had just been overwhelmed by the large volumes of Australians trying to login.

Eventually the truth will out.

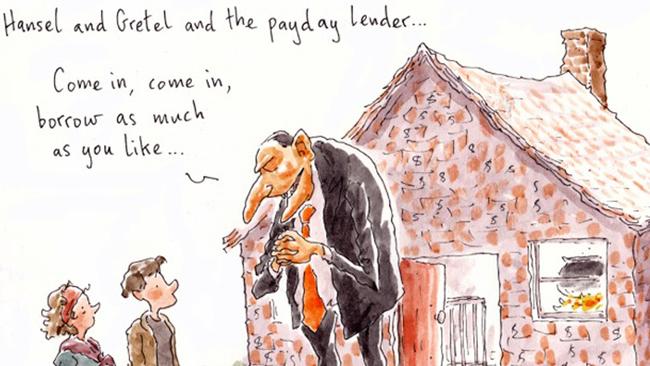

Predatory lender

The first win by the corporate watchdog to prohibit predatory financial products is being appealed by the payday lender Cigno.

The Gold Coast company, directed by 29-year-old former Super Rugby halfback Mark Swanepoel, has filed a challenge to the recent ruling in the Federal Court by judge Angus Stewart.

Under the lending model, Cigno and its associates under separate contracts charged fees that sometimes totalled up to 990 per cent of the original loan amount.

Not even the persuasive oratory of Bret Walker SC, could secure the payday lender success in thwarting the application by the Australian Securities & Investments Commission.

Last-resort lenders have issued some 4.7 million loans amounting to $3bn in a recent three-year period across Australia, with the banning interventions possible since last September under the watch of ASIC commissioner Sean Hughes. Nicely prescient given the increased demand during the pandemic.

Walker, instructed by Piper Aldermen, was up against ASIC’s Stephen Lloyd SC.

ASIC used its product intervention power to ban the Cigno lending model saying the loan package caused “significant consumer detriment”.

Stewart ruled ASIC could prohibit Cigno’s financial products for indirectly causing harm to consumers.

ASIC said while Cigno charged within credit licensing limitations, its family-related associate, Gold-Silver Standard Finance, charged significant upfront, ongoing and default fees for managing the loan.

ASIC alleged one customer obtained $120 from Cigno, with the total to be repaid being $263 in four fortnightly repayments. However, the fee structure meant, after defaulting, that $1189 was due, equivalent to 990 per cent more than the amount borrowed.

Justice Stewart agreed with Walker that ASIC’s product intervention power interfered with freedom of contract, but said “that is what it was intended to do”.

Credit providers who breach the law face fines up to $1.26m per offence. The South African-born Swanepoel had stints with the Brumbies and Western Force between 2009-2013.

Cain’s done it again

Coles is continuing to bolster its executive ranks. Its chief executive, Steven Cain,has stepped up recruitment at the supermarket giant, hiring longtime money man George Saoud, who was poached from grocery wholesaler Metcash, where he had been chief financial officer for the past two years. He joined Metcash after departing furniture retailer Fantastic Holdings.

Cain and Saoud were both at Metcash at the same time.

The new gig at Coles is a different tack for Saoud, however, as he will head up the emerging markets sector.

It’s another direct report for Cain, who for the past month has had veteran Walmart recruit Ben Hassing reporting in remotely from San Francisco as its newly appointed head of

e-commerce.

Hassing has now made the trip to Melbourne and is isolating for two weeks before heading into the Tooronga headquarters.