Jayne has Bain in her blood

We always knew Bain & Co was never far from Jayne Hrdlicka’s heart.

Her love affair with Bain goes all the way back to the late 1980s, scoring a summer associate job when she was in her native US. She ducked in to the publishing world which took her between the US and Sydney, before returning to Bain & Co in 1997 where she acted as a senior partner up until 2010.

And since then she’s brought a bit of Bain wherever she’s headed.

Not only is she working with Bain on the Virgin bid process, but she’s got them in at Tennis Australia too where she has been president for nearly three years.

TA’s latest recruit is James Penn, who has been at Bain & Co for the last two years. Despite being promoted to a senior associate consultant in January, he’s now on a six-month “externship” as a strategy analyst, reporting to TA’s chief strategy officer Tim Jolley.

Jolley has only just joined the TA team. Where from? You guessed it, Bain & Co.

They want to seek out new revenue opportunities for TA beyond their marquee event, the Australian Open.

One of Hrdlicka’s first acts when she became chief executive of the infant formula giant A2 Milk was to bring in Eleanor Khor, a former Bain & Co consultant for four years, as her head of strategy. They forked out $19m in consultancy fees to Bain & Co during her 18-month reign.

Her latest gig assisting the Bain/Cyrus consortium arises because of her local aviation experience as former Jetstar CEO. She was also group executive of strategy at Qantas back in 2012.

Kogan director exits

Michael Hirschowitz has resigned as a director of online retailer Kogan.com after only joining the board in March last year.

He cited “increasing commitments in his other business interests” for his surprise departure.

The exit of Hirschowitz, the chief financial officer at fast food chain Guzman y Gomez, comes just a week after the Kogan.com’s remuneration committee, of which Hirschowitz is a member, put up a lucrative bonus scheme for Kogan.com founder Ruslan Kogan and CFO David Shafer that could see then awarded $50m worth of options in the company.

Hirschowitz said his “other commitments have continued to grow and are now at the point where dedicating the necessary time to my Kogan.com role has become increasingly challenging. It is neither in the company’s nor my best interests for me to continue in the role if I am unable to fully participate.”

The juicy options package for Kogan and Shafer needs to be supported by shareholders.

Their exercise price has been chosen as a three-month weighted average ending April 30, when sharemarkets around the world were crashing. During the period, Kogan.com shares fell to a low of $3.79, from as high as $7.94 before the coronavirus pandemic gripped investors.

On the current Kogan share price, Kogan’s options are worth roughly $31m and Shafer’s options $21m.

Working overtime

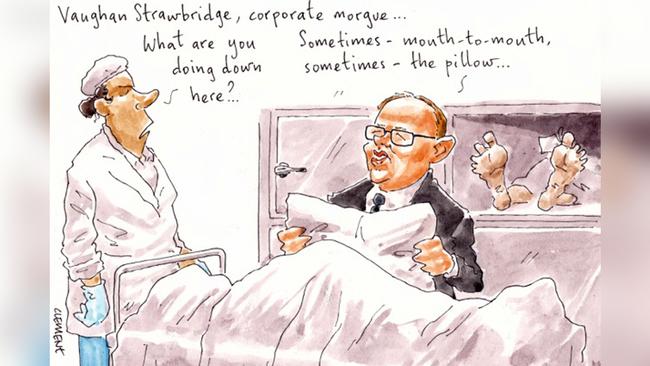

Deloitte’s Vaughan Strawbridge has been the busiest of all company undertakers during lockdown. There’s the rather important Virgin matter, plus the longstanding DIRECT FX Trading liquidation and his recently completed success of the Harris Scarfe receivership and sale.

He’s also the administrator of the Colette fashion empire.

The New Zealand-born accountant had a win in the Federal Court on Wednesday, getting an extension for his second Colette creditors’ meeting until late August.

Margin Call gleans two purchasing parties had been engaged in the data room.

Strawbridge’s restructuring team believes if all stores are open by June, there is a “real possibility” there will be a sale, and or a recapitalisation proposal by early August.

The court heard since they’d accessed the JobKeeper package which was set to cover around 75 per cent of the gross wage bill for 324 plus employees.

Access to the JobKeeper subsidy would not have been possible had Colette been liquidated.

Judge Brigitte Markovic recently absolved the administrators of personal liability for unpaid rents. The landlords have become unsecured creditors although some 11 of the 17 landlords (representing 50 of the 93 stores) have called on bank guarantees giving them some priority. The administrators have successfully negotiated reduced rental obligations.

We hope the Cremorne-based Strawbridge can clear the way for a big 40th birthday this October.

Take your seats

There’s plenty at stake for NAB director Simon McKeon and Melbourne billionaire Peter Gunn in the unfolding administration of their Arthurs Seat Eagle tourism operation on Victoria’s Mornington Peninsula.

The prominent businessmen McKeon is a former Macquarie banker while Gunn controls a transport, logistics and property empire estimated to be worth about $1.5bn. They have sunk millions over the past five years into the failed gondola operation, which was placed into voluntary administration in late March.

Arthurs Seat Eagle signed a 50-year lease on the site with the Victorian government in 2015 and went on to spend about $20m developing the state-of-the-art gondola in place of what was the iconic Arthurs Seat chair lift.

Documents prepared by the administrator Robert Ditrich, from PricewaterhouseCoopers, reveal that in the months leading up to the administration, Arthurs Seat Eagle was only surviving financially thanks to a series of shareholder loans.

Gunn’s PGA (Services) is owed $10.6m, entities associated with McKeon (who has long held an expansive home at nearby McCrae) are owed just under $8.4m, while Arthurs Seat Eagle boss Hans Brugman is owed $1.7m.

As a collective, unsecured creditors of the company are owed almost $26m.

McKeon and Gunn have proposed a deed of company arrangement to drag the tourist attraction back into operation (when COVID-19 restrictions ease), which PwC had initially recommended that creditors accept. However, at the second meeting of creditors held on May 6, Ditrich told creditors that his firm had formed the view that a campaign calling for expressions of interest in the business and the company’s assets should be conducted.

That means that McKeon and Gunn might not have things all their own way.

Already PwC has fielded inquiries from several interested parties.

We shall know more come the next meeting on June 5.

Cost of privilege

No uprising yet — or at least splashed acrossed the pages of the Herald Sun — from the sport-starved Melbourne Cricket Club members who have paid their $715 annual membership. It appears a tad rich given the last event was the Women’s World Cup final over 10 weeks ago. The seagulls haven’t had a feed since Katy Perry and 86,174 attendees vacated the arena.

This is the hallowed institution where even memorabilia doesn’t come cheap. A 1901 Melbourne Cricket Club membership medallion sold last week at Leski auction for $3800. And an 1894 MCC membership ticket went for $3000.

There are more than 205,000 people on the MCC waiting list.

Those nominated on the waiting list around 1991 have full membership while those who signed up in 2002 have provisional membership.

The entrance fee payable by each member who joins the club is $1100.

Pricey and slow, but not too dissimilar to the home of cricket in England where the membership regime is getting a potentially overhaul.

Lord’s cricket lovers keen to bypass the 26-year waiting list will likely soon be able to pay up to £80,000 ($150,000) to join the current membership.

There are 18,000 full members and 5000 associates of the exclusive club that pay up to £600 a year. Of course Lord’s only seats around 30,000.

Rather that wait for the privilege, the members are set to vote next month on offering life membership able to be bought on a sliding scale from £7000 to £80,000 based on age.

Members of the public not on the waiting list will be charged even more.

The initiative by the debt free MCC, the Marylebone Cricket Club who own Lord’s, is to fund the £50m rebuilding of the Compton and Edrich stands at the Nursery End of the ground to increase capacity by 2500 seats.

Lord’s was due to host two Test matches and other domestic matches including the final of the inaugural edition of the Hundred, the new domestic 100-ball, T20-style tournament.

But any international cricket will be likely at two or three “bio-secure” grounds such as Southampton or Old Trafford.

Sri Lankan cricket legend Kumar Sangakkara, the MCC president, is seeking to have his term extended by a year.