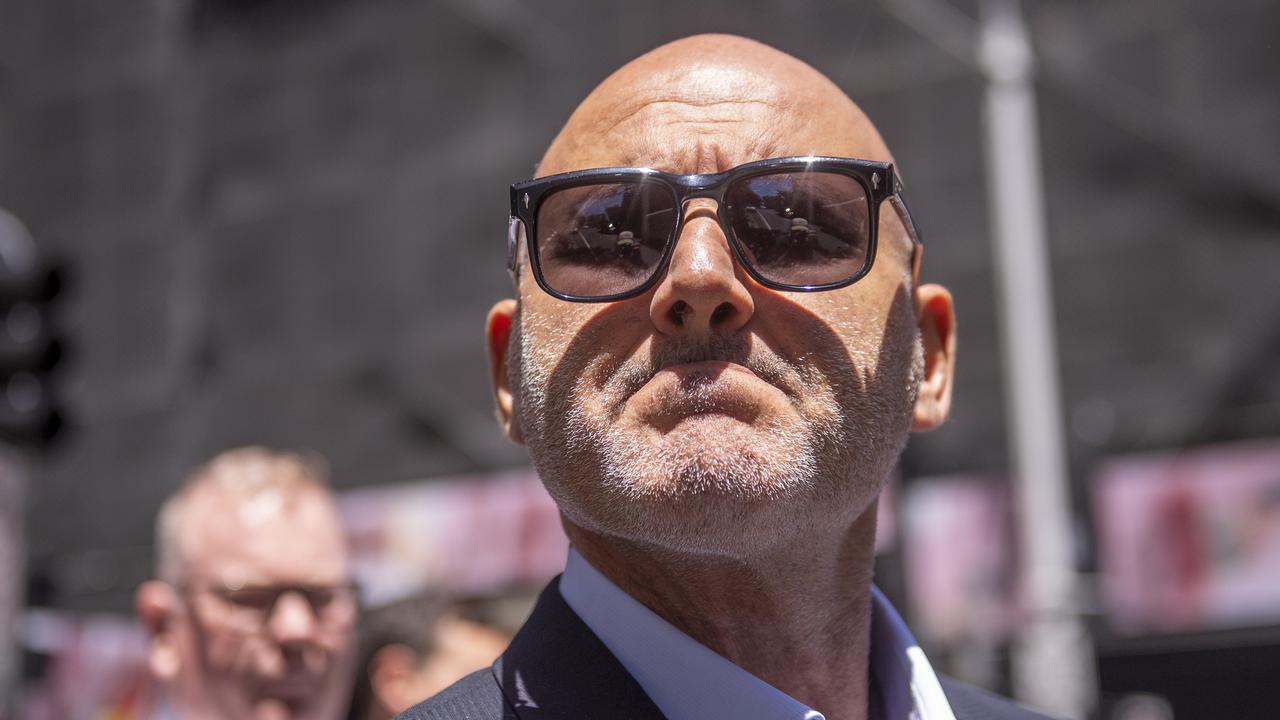

Stars queue for Eddie McGuire’s Collingwood Football Club gig

Now that Eddie McGuire’s given his effective year’s notice as president of his beloved Collingwood Football Club, the leading AFL outfit will this week release what is expected to be its disappointing bottom line for the 2020 financial year.

Thanks to the impact of the coronavirus on operations, Pies boss Mark Anderson may not even be able to unveil a surplus when on Thursday he likely reveals the club’s off-field performance in the year to October 31, which would compare with an almost $4m profit in 2019.

For context, at the end of last month AFL premiers Richmond, chaired by Peggy O’Neal and led by CEO Brendon Gale, revealed they had made just $217,000-odd in net profit for the year as revenue fell 20 per cent to $74m. The Tigers received almost $1m in JobKeeper payments from Scott Morrison’s government.

That will leave just one more season for McGuire, who’s been chair for 22 years since his 34th birthday in 1998, to restore his club’s financial fortunes before he vacates the top posting.

There remains the potential, however, for McGuire after he steps down as president to remain on the Collingwood board for at least one more season until his current three-year term expires at the 2022 AGM. With McGuire, you never know.

So who might replace the 22-year chair?

The terms of several Collingwood directors will expire at the club’s annual meeting scheduled for February 2 next year. If they don’t seek re-election and the slots are to be filled, that would open the door for some new faces to join and have the benefit of a year on the board before it is time to choose a new chair.

McGuire’s exit could mean his billionaire vice-president Alex Waislitz goes too. The businessman, who’s a big Pies fan, joined the Pies’ board the same year as McGuire and has been there with him ever since.

Of the internal candidates, that leaves corporate undertaker and co-vice-president Mark Korda as the likely favourite to replace McGuire.

Korda, who via his KordaMentha advisory shop is busy with the voluntary administration of Daniel Grollo’s Grocon construction empire, has been on the Collingwood board since 2007 and is a turnaround specialist. Helpful for a club that finished just eighth on the ladder this year.

Former Australia Post boss Christine Holgate is on the board too, although her bumpy corporate ride of recent times, which sees her with plenty of free time, might not make her an ideal candidate.

Other options could include Pies supporter, investment banker John Wylie, who has just stepped down as chairman of Sport Australia after eight years.

Another potential could be one-time America’s Cup-winning skipper John Bertrand, who is a lifelong Magpie also has time on his hands, having just stepped down as president of Swimming Australia.

All big names.

Chips down at James Packer’s Crown

Another day, another dollar in revenue lost at James Packer’s $2.2bn Crown Sydney, which was meant to open at the start of this week, but remains locked shut.

As the festive season cranks up and summer holidays begin, Margin Call understands that talks between Crown executives led by CEO Ken Barton and NSW’s Independent Liquor and Gaming Authority towards awarding the $6.6bn group the liquor licence it needs to open the facility’s non-gaming operations remain unresolved.

The Philip Crawford-chaired ILGA board will on Wednesday meet for the last time this year, but with no item relating to Crown Resorts on the board’s meeting agenda.

On November 18, Crown said its gaming operations would not open as planned in December after ILGA pushed out the gambling den’s approvals until after the final recommendations of Patricia Bergin’s suitability inquiry are released in February.

Crown at the time also said it was working with ILGA to get its non-gaming operations — bars, restaurants, function rooms and hotel — open.

On Crown Sydney’s website, hotel bookings have now been pushed out to the start of February, missing potential custom over the entire festive season and peak holiday period.

“ILGA is currently considering Crown’s applications for liquor licences that would allow the non-gaming parts of the casino to open,” an ILGA spokesperson told Margin Call yesterday.

“We can confirm there are no agenda items relating to Crown for ILGA’s (Wednesday) board meeting.”

After today, the ILGA board is not scheduled to meet again until January 21, which would be the next opportunity for the board to consider approval of Crown’s liquor licence to at least allow the non-gaming operations to open.

This leaves open the possibility that Crown’s luxury Barangaroo facility — a project that was personally championed by former Crown chair Packer — could remain idle and generating zero turnover for many weeks to come.

Perpetual moves on

As the wait continues to learn of the fate of Crown at the ILGA’s inquiry, it seems major institutional investors such as Perpetual might not be sticking around.

Perpetual, the resort group’s largest institutional investor, this week gave notice to the market that it had reduced its substantial stake in the group from 9.33 per cent to 8.19 per cent through the sale of about 8 million shares.

Head of equities at the fund manager, Paul Skamvougeras, had previously been an advocate for Crown and even spent time on James Packer’s own payroll.

After his initial stint with Perpetual, and before his return in 2010, the Sydney-based Skamvougeras was employed by Packer’s CPH and Ellerston Capital as a portfolio manager.

But after the recent airing of the company’s multitude of governance failures before the casino inquiry, there has been a noticeable change of tune from the Rob Adams-led fund manager.

Following Crown’s AGM on October 22, where Perpetual’s key vote against the remuneration report contributed to a first strike, Skamvougeras broke his silence on the scandal, calling from the board, including chair Helen Coonan, to consider resigning.

Now, notices lodged to the ASX show the meeting was also a trigger for Perpetual to start trimming its holdings.

Lengthy spreadsheets from the fund show it had been in acquisition mode in early April, scooping more shares after the COVID-19-induced market rout pushed the stock to lows of $5.84 a pop.

While its holdings ebbed for the next six months, the records show Perpetual hasn’t purchased shares in Crown since late October, with a course of heavy selling taking over since then.

While Crown’s rebound back to the $10 mark is no doubt a contributing factor to the selling, there’s no denying an empty casino still isn’t an enticing investment.

Big start for Ben Small

He’s only 32, but Australia’s newest senator Ben Small brings to Canberra an impressive portfolio of financial investments to underpin his new career as a federal politician.

Small has just been sworn in as the west’s newest rep in the upper house, replacing just retired finance minister Mathias Cormann, who’s now pitching hard (with his government’s backing) for a gig on the world stage as head of the OECD.

Small, who’s been billed a local bar operator from Bunbury, has just made his first financial disclosure as a senator, revealing he’s already amassed some wealth.

As a logistics manager at Woodside, Small drank the Kool-Aid and became a shareholder. His share portfolio also includes National Australia Bank, Webjet and De Grey Mining, whose directors include Joe Gutnick lieutenant Ed Eshuys and former McIntosh boss Bruce Parncutt, who now chairs Melbourne boutique advisory shop Lion Capital.

All up Small, whose bar in the west is called Small’s (what else?), also owns five investment properties in WA, comprising two homes in Millbridge that are owned in his own name and three townhouses in Australind that are controlled via his corporate vehicle Ascension Property Investment Pty Ltd. All are mortgaged to the Ross McEwan-led NAB.

His bar, in Eaton near Bunbury and run with old school pal Michael Prosser, son of former small business minister Geoff Prosser, is no minor operation either.

The venue, which is entirely cashless, can seat 250 punters — able to accommodate Small’s new Senate colleagues more than three times over.

All of which leaves Margin Call wondering whether all that sees Small rivalling the likes of his fellow WA Liberal Christian Porter as one of parliament’s most eligible bachelors?