Senators split on probe into Christine Holgate’s AusPost exit

You would think after all these months of discussing Christine Holgate’s exit from AusPost there might be some consensus.

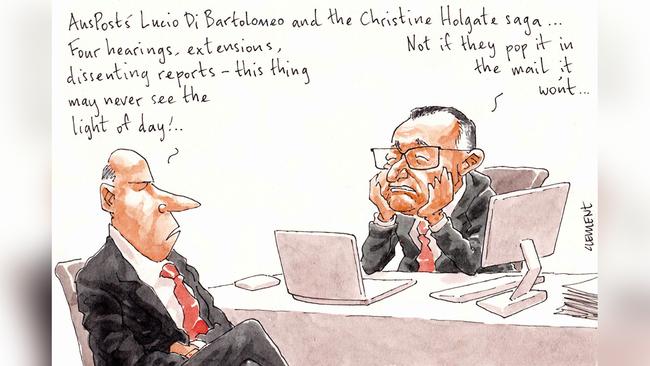

But alas, after seven months, three public hearings and two extensions, the major parties still cannot see eye-to-eye, with Liberal and National senators submitting their own dissenting report alongside the final recommendations released on Wednesday.

It’s any wonder they needed the extra time.

Signed off by senators David Fawcett and Bridget McKenzie, the dissenters poked holes in each and every recommendation set out by the Sarah Hanson-Young-led committee, including pushing back on the suggestion that chairman Lucio Di Bartolomeo should resign from his role.

The dissenters highlighted that Di Bartolomeo had not been appointed chair until November 2019, and that it had in fact been former chair John Stanhope (an appointee of Labor MP Stephen Conroy no less) that was in charge during the Cartier affair.

“Evidence to the committee highlighted that the current chair sought to work in a constructive manner with Ms Holgate during what was a fast-moving sequence of events being played out in the spotlight of the media,” the opposing report reads.

That’s in stark contrast to the committee’s own findings, which raised concerns of the chairman’s respect for senate authority and alleged four instances in which he provided false or misleading evidence.

To use the words of the dissenters themselves, “…this inquiry has become a highly politicised exercise”. Go figure.

Never ones to back down from a political battle however, the Libs and Nats included in their own recommendations a little flavour in the form of quotes from Opposition leader Anthony Albanese that, “Christine Holgate has done the wrong thing,” and that “her position is untenable”.

Adding to their argument, the fact that it was Victorian senator Kimberley Kitching (whose taste in Melbourne restaurants is akin to Holgate’s) who started it all with her questions at October estimates.

No mention of PM Scott Morrison’s“she can go” moment there. All in all the official report makes for another hefty government tome at 255 pages, the findings of which were welcomed by Holgate and prompted well wishes for Holgate’s future from her former chair.

With mediation between the two still ongoing it won’t be the last they hear of this.

–

Crown conundrum

A new layer of intrigue has been added to Ray Finkelstein’sVictorian royal commission into Crown Resorts, with Thursday’s hearing retreating to a closed session accessible to vetted media but all subject to a non-publication order.

The witness at the root of such measures? No, not the billionaire James Packer nor any of his inner circle, rather the wholly unassuming Alex Carmichael – the chief operating officer of regulatory consultant Promontory Financial.

He just so happens to be a descendant of Australian regulatory royalty Jeffrey Carmichael, inaugural chairman of APRA and former long-time employee of the RBA, who, in no coincidence we daresay, is the Singapore-based chairman of Promontory Australasia.

The firm, based in Washington under former US regulator and banker Eugene Ludwig, has previously been tapped for the investigation into Westpac’s risk management failures which ultimately led to the scalping of Brian Hartzer and Lindsay Maxsted as well as the internal review of Commonwealth Bank following its 2017 Austrac investigation.

Up until its buyout by IBM in 2016, the Carmichaels, as well as a third Elizabeth Carmichael, had board seats on the locally-registered Promontory Australasia arm, now replaced by IBM’s managing director Katrina Troughton.

The firm’s appearance before Finkelstein comes after its review of Crown’s money laundering program, with the group’s links to the casino operator dating back to an appointment by then-CFO Ken Barton in 2014.

Alluding to the questions to come in Thursday’s hearing, counsel assisting Meg O’Sullivan told the Melbourne court this week that there would be “detailed discussion about particular money laundering channels and present vulnerabilities Crown has”, adding that there was a “real risk” such facts could be exploited by potential criminals seeking to launder funds at their venues.

Here’s hoping the blue cooler bag toting crims aren’t listening.

–

Still waters run deep

It’s any wonder the nation’s $226 billion Future Fund is hiring hordes of new staff, if only to keep up with the ESG demands of senators the likes of Greens’ Larissa Waters.

Addressing senate estimates alongside Finance Minister Simon Birmingham on Wednesday, chief investment officer Raphael Arndt, who recently clocked 12 months in the top job, detailed a plan to hire at least 150 new staff for the organisation, the majority of which would be required in investment management.

But despite Arndt’s cited motivation of keeping up with the changing financial markets and shifts in global policy, can Margin Call proffer that a few hires would be headed to its environmental, social and governance department.

The issue was front and centre for Waters, as it has been in previous hearings, this time with a new target other than the $3.2 million invested in Adani Ports, linked to the Carmichael Coal mine development and its reported links to Myanmar’s military.

None other than the $735 billion Chinese behemoth that is Jack Ma’sAlibaba, the same group spruiked regularly by the likes of Magellan’s Hamish Douglass, and not for the reasons you might think.

Arndt disclosed that the fund’s $14 billion invested in State Street’s emerging market equity index, the same that accounts for its relatively minor slice in Adani, gave it biggest exposure to the likes of Alibaba, Tencent and Samsung.

That too raised Waters’ ire however, with the senator quick to reference media reports linking the Hong Kong-listed company to sales of childlike sex dolls reported in July last year.

Despite acknowledging he had not seen such reports, it was still no grounds for Arndt to reconsider his mandates, the CIO standing firm that, “We have considered our exposure and have no plans to change”.

Not, it seems, the answer Waters was looking for, who settled with a swipe at Peter Costello’s board instead.

“… who’s advising the board, because they are making some terrible decisions”, Waters noted.

Maybe add a few more staff to deal with those mean comments too.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout