NSW gaming regulator stopped Crown Resorts shortening money laundering bank account probe

NSW gaming regulator insisted on a longer time frame for investigation into Crown Resorts bank accounts.

The NSW casino regulator had to intervene to prevent Crown Resorts cutting the time-frame of a review of its bank accounts for signs of money laundering from seven to three years, a royal commission has heard.

On Wednesday, Deloitte financial advisory partner Lisa Dobbin told Victoria’s royal commission into Crown’s suitability to operate its Melbourne casino that she was appointed to review the company’s accounts for signs of money laundering last February.

The probe would include examining money laundering controls for patron accounts and a forensic review of a “broad set” of company bank accounts, and was set up days after the NSW Bergin Inquiry blocked Crown Sydney from opening in part due to money laundering concerns in company accounts.

Ms Dobbin told counsel assisting Meg O’Sullivan that the Bergin Inquiry and the need to satisfy the NSW Independent Liquor and Gaming Authority was the “trigger” for Crown “engaging us on this piece of work.”

“My understanding is that the review that we perform will be provided to the authority, to ILGA to consider whether it considers that satisfactory in the context of the issues that were raised in the Bergin inquiry,” she said.

But Ms Dobbin also said that Crown attempted to narrow the time frame for the forensic analysis of company accounts to three years from the originally proposed seven, prompting ILGA chair Philip Crawford to intervene.

“My understanding is that Crown sought feedback from ILGA in response to the scope of work that we had agreed, and in discussions between Crown and ILGA, it was expressed that they would prefer a longer period of time,” she said.

“And we were later provided with a letter that ILGA had sent Crown where they describe that they would prefer that the period be longer.”

In the letter ILGA suggested a nine year time frame but Crown’s lawyers Allens and Deloitte pushed for seven years as they “felt that it would be difficult to access records beyond the seven year period,” Ms Dobbin said.

Earlier in the week Ms O’Sullivan said a preliminary analysis of the still to be completed Deloitte review indicated there was money laundering activity in at least 14 Crown bank accounts.

She said Crown’s attempts at reform were a “knee jerk reaction” to the Bergin Inquiry and spoke to anti money laundering consultant Neil Jeans about times where Crown retained him to start investigations but later abandoned them, or limited their scope.

Earlier on Wednesday Crown’s counsel Catherine Button QC said one of these unfinished tasks was picked up by Deloitte, who found early indications that Crown may not be following a new anti money laundering policy of returning patron account cash deposits or third party transfers were unjustified.

“Do you agree that any suggestion that Crown did not get you to complete your work because it didn’t want to find out the answers is wholly unjustified?” she questioned Mr Jeans.

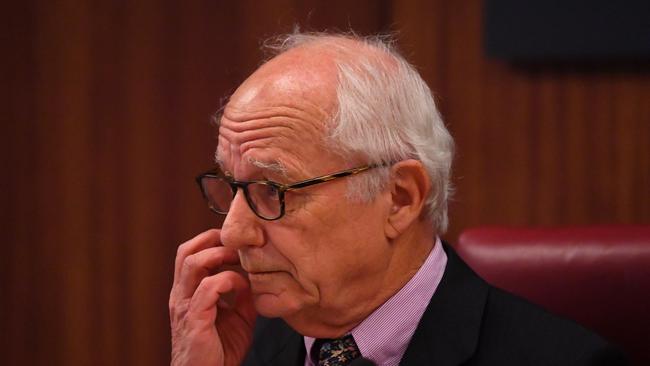

Commissioner Raymond Finkelstein intervened: “That’s a question not for the witness, but a question for me. Thank you.”

Mr Finkelstein returned to the issue of cashless gaming as a method of preventing money laundering in discussion with Mr Jeans, but this time asked about its application to pubs and clubs as well as casinos.

In NSW ILGA has reached a tentative agreement with Crown to gradually implement mandatory carded play linked to identity in all of its casinos.

On Monday Ms O’Sullivan noted Crown used “noticeably softer language” in an ASX release on the issue earlier in the month, referring to making the change only at Crown Sydney, and she called for Crown to clarify its intentions.

The inquiry continues.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout