NAB dividend to boost Cormack donation fund, Crown hiring spree continues

Scott Morrison has already started next year’s election campaign, so timely was the bumper $6.56bn annual profit unveiled on Tuesday by NAB boss Ross McEwan, which has the potential to provide an important fillip to party coffers for the marathon federal campaign.

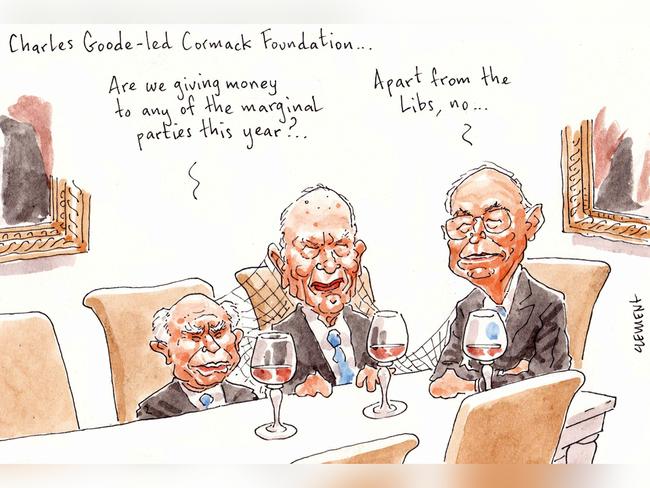

McEwan’s earnings announcement saw the declaration of a 67c per share dividend to NAB shareholders, which along with plenty of mum and dad investors also includes the Charles Goode-led Liberal Party investment vehicle Cormack Foundation.

Cormack’s portfolio of blue-chip shares is dominated by Australia’s big four banks and major miners.

Based on Australian Electoral Commission returns and assuming no shares have been sold over the past financial year, the investment outfit holds what is believed to be a parcel of 807,363 NAB shares that are worth $23.3m.

NAB’s final dividend, plus its almost as generous 60c interim dividend, would therefore mean a total deposit into Cormack’s bank account of $1.03m.

That is more than double the NAB dividends paid out in the previous financial year and would certainly buy plenty of corflutes should Cormack’s board of directors, which include former prime minister John Howard and his then communications minister Richard Alston, see their way clear to sling some cash the federal Libs’ way in the coming months.

The foundation, which was started by the Victorian division of the Liberal party in 1988 with seed funding of $15m after it sold Melbourne radio station 3XY, has been the subject of ownership tussles through the years, but remains the largest single donor to the party, even after controversially in the past given money more widely to other conservative political parties.

The foundation has handed cash to Family First and the Liberal Democratic Party, along with right-wing think tanks the Centre for Independent Studies and the Institute of Public Affairs, with such donations infuriating the Libs.

This time around, and with an election tipped for May, ScoMo might need all he can get.

-

Crown beefs up

Another day, another hire at Crown Resorts, as Steve McCann enters the seventh month of his reform program atop the James Packer-backed troubled gaming empire.

The latest to join Team Crown is Accor Hotels boss Simon McGrath, who will take over as head of Packer’s $2.5bn Barangaroo venue and group head of hospitality.

McGrath’s appointment (probity pending) was announced to the stock exchange on Tuesday morning – tagged “market sensitive” – a courtesy, we note, not afforded to outgoing boss Peter Crinis when he was confirmed by Margin Call as joining the queue of exits at the firm in July.

McGrath starts on February 1, but there’s still no guarantee the doors of Crown Sydney’s gaming facility will even be open as the gaming regulator in NSW continues, post-Bergin royal commission, to negotiate the terms of its operations.

Further down the food chain is another hire of note, with publicist Holly Asser joining as head of public relations at Crown Sydney.

Asser was a right-hand girl for almost five years to the celebrity publicist Roxy Jacenko at her Paddington agency Sweaty Betty, though the pair are no longer on speaking terms.

Jacenko, also a former publicist for and friend of billionaire Packer’s niece Francesca Packer Barham, has no commercial arrangements with Crown but regularly posts her visits to the group’s hotels and venues on her social media accounts.

Asser will be part of the team to be overseen by new chief corporate affairs and brand officer Danielle Keighery, who will take on responsibility for a portfolio that includes corporate affairs, public relations, government relations, brand, sponsorship, media and all corporate communications functions.

But with royal commissions examining Crown’s affairs in each of Sydney, Melbourne and Perth, as well as an unfolding Austrac investigation, it’s government affairs where industry insiders are questioning Keighery’s credentials.

Outgoing executive vice president of group corporate affairs Karl Bitar, who joined Crown in 2011, was a former national secretary of the Labor Party as general secretary of NSW Labor.

But Keighery, who’s chief customer officer at the Bank of Queensland, is a marketing and communications specialist, said to have been recruited to the Crown role by Anna Whitlam.

Keighery’s director of corporate affairs is Tanya Baini, who joined last November from Coca-Cola Amatil where she was head of government relations for four years.

Trouble is, all the exits and ensuing recruiting, along with zero interaction with the Packer camp, means a profound lack of corporate memory at the group.

Does anyone even know where the loos are?

-

Negus on a roll

As AGM season rolls on, and the assault of virtual webcasts continues, spare a thought for veteran director Warwick Negus, who, if he keeps up his latest run, may soon be just about the most prolific director in corporate Australia.

The former head of Goldman Sachs and Colonial First State was most recently appointed to the board of Dexus by its chairman Richard Sheppard in January, passing a shareholder vote on the role just last month.

But it is his longer-held roles that have been more fruitful this week, as just on Tuesday Negus received a total of close to half a million dollars in rights thanks to his chairmanship at Pengana Caitpital Group and a seat on the board of Bank of Queensland.

The seasoned finance exec updated the bourse that he had received $143,658 in non-executive director rights from Pengana as well as a further $315,000 in rights in lieu of a portion of his board fees.

That is not to mention whatever he receives for his roles at WH Soul Pattinson, the now private equity-owned Virgin Australia, investment outfit Terrace Tower Group and Tantallon Capital Advisors.

How does he find the time?

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout