NAB wants new workers to support rebound, forecasts bumper 2022 economy as its profit soars

National Australia’s chief Ross McEwan urges the speedy return of temporary and student visas, saying labour shortages are an impediment to the boom the bank expects.

National Australia Bank chief executive Ross McEwan has warned the biggest impediment to the economy’s strong rebound over the next year is crippling labour shortages, underscoring a need for the nation to facilitate the speedy return of temporary and student visas.

After he delivered a better-than-expected surge in NAB’s annual profit, Mr McEwan stressed labour shortages for both unskilled and skilled workers posed a real risk to Australia’s growth prospects.

While he is optimistic on a sustained Australian economic rebound, as businesses emerge from months of hibernation, Mr McEwan cautioned that labour issues needed to be addressed.

“That’s our biggest issue that will inhibit growth the most, but also the effect of pushing up wages over time, which isn’t a bad thing,” Mr McEwan said in an interview.

“There’s been hundreds of thousands of people who have left Australia because they were on temporary visas or student visas that we need to get back into this Australian economy as quickly as we can, and safely of course.”

Mr McEwan said labour shortages were hitting industries spanning cafés, tourism, agriculture, manufacturing and digital and data. He understands Treasury is working through a list of priority sectors to enable a return or entry for workers in short supply.

“The government needs to set the priorities and then get the borders open in a controlled and measured way,” Mr McEwan added.

NAB – the nation’s largest business bank – expects a recovery in business confidence, healthy household balance sheets and ongoing government policy support will support the 2022 economic rebound.

The bank expects a September quarter hit to the economy to cause a 3.8 per cent contraction in growth, which it tips will come in at 1.6 per cent for calendar 2021. NAB then expects 2022 growth of 4 per cent.

Mr McEwan said measures by the banking regulator to cool the housing market by increasing loan serviceability buffers should spur a 3 per cent or 4 per cent reduction in activity.

He believes the regulator may raise the buffer further if the higher rate and increased house supply don’t dampen prices and activity.

“It’s (raising the buffer) a very simple way of slowing a market down because it doesn’t impact what people will pay, what it does is influences what they can afford to borrow … it also means you can move that buffer any time,” Mr McEwan said.

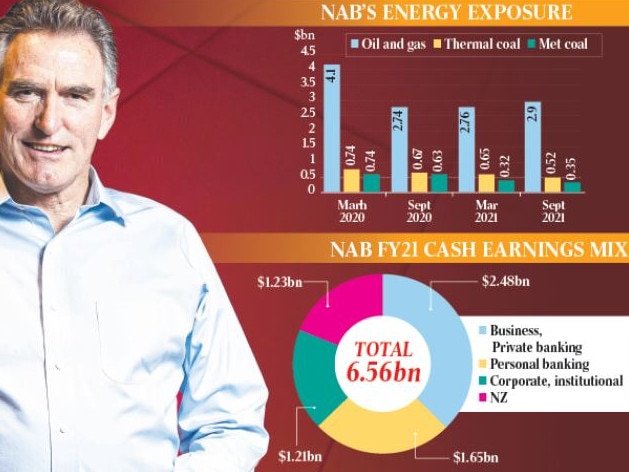

The bank’s annual cash profit soared 76.8 per cent to $6.56bn, buoyed by lending growth and an improved full-year performance in its personal banking and New Zealand divisions.

The NAB profit rounded out the earnings results for three of the big four with a September 30 balance date, while Commonwealth Bank ruled off its year on June 30. EY’s analysis of the four big banks’ results showed a 55 per cent jump in cash earnings for 2021 to a combined profit of $26.8bn, compared to the prior year which was impacted by billions of dollars being set aside for potential pandemic-related loan losses.

But investors were lukewarm on NAB’s results sending the stock see-sawing on Tuesday. After initially rallying to a two-year high, the bank’s shares slumped as low as $28.22 before retracing ground to finish 0.8 per cent lower at $28.89.

Fund manager Martin Currie Australia’s Matthew Davison was positive on NAB’s result but noted investors remained nervous about a review of the bank’s know your customer practices by regulator Austrac.

“NAB showed the bank is transitioning back to the basics of banking smoothly, with the major unknown negative seeming to be an Austrac review mostly around processes and their program to ensure that AML/CTF (anti-money laundering and counter terrorism financing) is fully compliant,” he said.

“They‘ve (NAB) got loan momentum and a reasonable outlook on (net interest) margin, whereas obviously some of their peers had more troublesome (margin) exit rates.

“The NAB result leaves Westpac as a clear laggard on a number of industry metrics such as keeping control of NIMs (net interest margins) and project costs.”

NAB is the subject of an Austrac enforcement investigation but unlike two of its peers has not been the subject of legal action.

Jarden’s banking analysts labelled NAB’s earnings a “decent result”, saying the bank was executing its plans well but delivered a worse than expected fall in net interest margin in the second half.

NAB declared a final dividend of 67c a share, taking the annual payment to $1.27. This year’s final dividend compared to 2020’s 30 cents per share payment, when dividends remained capped by regulators due to the pandemic.

While NAB’s annual revenue fell 2.2 per cent, gross loans and advances rose 5.9 per cent underpinned by home and small business lending growing faster than industry averages. The bank is also simplifying processes to improve loan turnaround times and customer engagement.

Despite some areas of softness in the bank’s results, Mr McEwan said NAB’s strategy was tracking ahead of what he had anticipated.

“Our assets on the balance sheet grew by $30bn in the second half of 2021, the strongest growth since 2007. Importantly this growth is not sacrificing returns,” he added.

The results included a write-back in the credit impairment charge of $217m as Covid-19 related loan losses printed lower than expectations.

Mr McEwan highlighted that NAB wanted to wait for several further quarters before making any large releases of funds set aside for pandemic loan losses.

The bank’s net interest margin – what it earns on loans minus funding and other costs – fell 6 basis points to 1.71 per cent.

NAB’s business bank had flat annual earnings, although income improved in the latter six months versus the first half. Annual personal banking earnings rose 14.4 per cent and NZ saw an 18.7 per cent rise.

The corporate and institutional bank saw annual earnings decline 14.8 per cent, as lower market-risk income dented the division’s result.

NAB’s expenses fell 13.2 per cent over the year, but when notable items were excluded from 2020, costs rose 1.8 per cent. The bank said the growth in costs was in line with its guidance and stuck to a target to have lower costs over three-to-five years compared to its $7.7bn 2020 cost base.

NAB’s common equity tier one ratio sat at 13 per cent as at September 30, boosted by the sale of wealth unit MLC. The bank said it expected that ratio would decline by 75 basis points as it completed the acquisition of Citigroup’s retail banking operations, expected by mid calendar 2022, ruled off its share buyback and deducted proceeds from the sale of BNZ life.

NAB is still purchasing $2bn in shares from its outlined $2.5bn buyback, after raising capital from investors in 2020 when the pandemic was gripping markets.

Mr McEwan said he expected NAB would reduce its capital stores further over the next four years to boost returns.

NAB’s return on equity printed at 10.7 per cent.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout