Moula split on ice; David Koadlow chases missing millions; new jobs for Coalition staffers

The sorry saga engulfing small business lender Moula is nearing a final, pitiful denouement for a company that just last year was fielding buyout offers from Afterpay and being hounded by private equity firms.

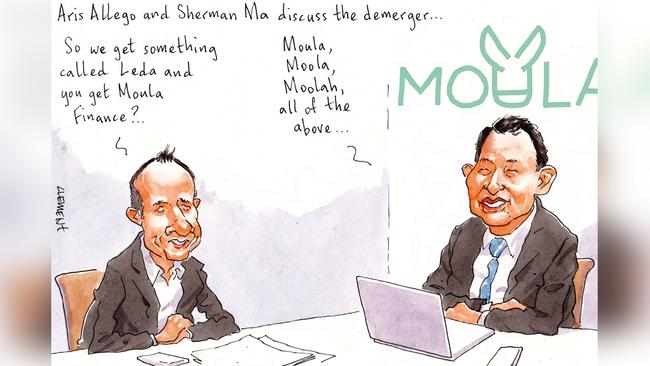

Margin Call has reported on the decline of Moula for months and, most recently, a shareholder revolt against an extortionate-sounding plan to demerge the business.

This course of action had been decided after months of boardroom infighting between Moula’s founders and Sherman Ma, an influential shareholder whose Liberal Financial Group provides the warehouse funding to the company.

It was Ma who allegedly threatened to cut off its financing last year unless the business was broken into two entities: a successful and proven lending operation (Moula) and what one observer described as a “crappy” payments platform (Leda).

What’s more, Ma insisted that he be given control of Moula, the healthy business, while the founders be given the untested Leda entity. As far as deals go, anyone could see it was dogshit.

But in a note issued to shareholders on Friday, Moula’s co-founder and CEO Aris Allegos confirmed the demerger plan was being cancelled on account of a “material deterioration in market conditions” and shifting investor sentiment “with respect to early stage growth”.

To put it simply, the capital raising required to launch Leda was forecast to be a flop. That’s the official reason, anyway; the other explanation is that there were shareholders on the verge of listing this matter in the Federal Court.

However, halting the demerger hasn’t stopped Ma from taking the initial steps towards a makeshift takeover. Allegos’ note said the board would be reconstituted regardless, with Gavin Slater, a Ma crony and employee, to be named CEO of the company. Ma, too, will join the board, of course. And the founders? They’ll be allowed a representative.

Does this not sound completely parasitic?

Reminder: Moula was a company valued at $220m last year. Ma’s threats to choke off its funding – defendable through a demerger that would basically give him half of the business – effectively placed it at risk of administration, as the founders have told investors.

Exactly how the company survives henceforth remains unclear. Even with Ma’s appetite reasonably sated with board seats, the company is still bound by negative undertakings and needs to raise capital to “pursue further growth opportunities”. For now, it is prohibited from signing new funding arrangements.

“This current situation is not sustainable,” Allegos said, explaining that Ma (unnamed in the note) is providing just enough funding to cover Moula’s operational expenditure.

Allegos’ plan is to buy out the company’s convertible note holders and thereby erase the negative undertakings preventing new deals. But this requires a high benchmark of investor approval, and some have already indicated they will not budge.

No crystal ball required to see the deadlock up ahead here.

-

Missing millions

A big idea born on Little Bourke St has wound up in the Victorian Federal Court, where Melbourne businessman David Koadlow is scrambling to claw back a raft of missing millions.

Koadlow is suing Mitchell Atkins of Magnolia Capital after meeting him at Melbourne’s Osteria Ilaria last year where, having been wooed by promises of “significant returns”, he signed away $9.5m to create a jointly owned investment fund and management company. Not much has been written about Koadlow in recent times. He’s a macher of Melbourne’s Jewish community and his wife Leonie is a trustee of The Victor Smorgon Charitable Fund, set up by the big cheese himself and wife, Loti.

Documents filed with the court state that not long after that meeting, Atkins allegedly convinced Koadlow to invest his money in one of Magnolia’s microcap funds, but only while the joint-venture was being established. The plan, eventually, was to transfer the money out of the microcap fund and into the joint fund once it was operational. Sadly, on Koadlow’s reading, that never eventuated.

Already on the hook for millions, Atkins persuaded Koadlow to invest $880,000 into the upcoming IPO of Perth-based gold explorer Star Minerals, with shares purchased through his private investment vehicle, Kadoo Pty Ltd.

According to Koadlow, all of these investments were supposed to be considered capital contributions to the joint-fund they were creating; on other occasions he was led to believe that he was buying shares on behalf of the joint fund itself, although he became suspicious when, after months, it still didn’t exist.

Citing the lack of any bank and investment accounts, Koadlow confronted Atkins in November last year but was fobbed off with an excuse about being “under pressure” and that lawyers were tarrying with the management agreement.

Critically, Koadlow’s case is that Atkins refuses to return the money despite his early promises that the funds could be redeemed at any point.

As it stands, Koadlow alleges the joint fund was never “properly opened”, that it holds no assets, and that the money invested – still yet to be returned – has lost a cumulative value of $1m.

Atkins was unable to be contacted for comment, and Koadlow’s lawyer, Nathan Kuperholz, declined to give remarks.

-

Minders on the move

It seems that more than a handful of Coalition staffers aren’t willing to spend a few chilly years in the wilderness of opposition. Margin Call has clocked more than a couple making haste for the private sector and other pastures of a greenish hue.

Simon Birmingham’s former spinner Benn Ayre is off to work for NSW Premier Dominic Perrottet (nine months out from a very uncertain election contest) while Talitha Try, formerly a strategist for Scott Morrison and once a staffer to Bronwyn Bishop, has been snapped up by C|T Group as a senior manager.

Her recruitment is well-timed given the departure of several of the firm’s directors in recent weeks, as revealed by Margin Call on Friday, which just happened to be pollster Michael Turner’s last day on the clock; he and a few others have started their own corporate advisory, Freshwater Partners, which intends to throw open its doors next week.

Heading up Peter Dutton’s communications is, of course, his long-time staffer Nicole Chant, while Dean Shachar, formerly a ScoMo press adviser and fresh from campaign HQ, is moving up to the office of Deputy Opposition Leader Sussan Ley as her chief of staff.

Some changes for David Littleproud, too, with Ben Hindmarsh, formerly of lobby shop SAS Group and previously a Nationals federal director, appointed CoS in that office.