Malcolm’s boy rankles judge; while big names not vaxxed against Ellume fallout

As far as eviscerations go, Supreme Court judge Kate Williams went medieval on Alex Turnbull in a judgment delivered on Friday that let loose on the former prime minister’s boy.

Turnbull’s evidence against fund manager Russel Pillemer was described in some of the most unflattering terms deployed in a court judgment: “self-serving”; “self-interested”; “inherently implausible”; “wholly unconvincing”.

Claiming that he had been deceived, he accused the Pengana Capital chief executive of duping him into trading back shares in Pengana, once owned by his father, for $6m, at a time when a reverse merger was under way and stood to increase the shares’ value significantly.

Those who watched the trial would have been impressed by Turnbull’s ability to project comic levels of arrogance while giving evidence from Singapore, often reclining in his swivel chair or audibly yawning during cross-examination.

At other times he would glower at the screen, smouldering like a freshly-shot cannon as he brushed off questions from barrister Robert Newlinds, SC, and pissed off the judge.

Practically every plank of his claim against Pillemer was rejected on the basis of inferior credibility, and in this case one’s word really was one’s bond.

We’re not going to pretend that Pillemer was a grossly injured party in all of this. But his crimes, if any, appear to be matters of recollection, and were mostly forgiven by Williams.

Most telling was her deliberation on a luncheon at the Osteria restaurant in Singapore, on February 23, 2017, where Turnbull moved to formally end his association with Pengana.

In the contest of memories revolving around that conversation, Turnbull said Pillemer coquettishly asked whether he was sure about this decision.

“Is there something you are not telling me?” Turnbull then allegedly asked, growing suspicious. “No,” Pillemer replied. But when it was Pillemer’s turn in the box, he offered an entirely different version of events, saying he was disappointed the Turnbull family were casting off from Pengana, which Pillemer had formed with Malcolm Turnbull in 2003.

He said he even tried to keep the Turnbulls invested and was “happy to reverse” their decision in the event that the merger was completed.

Turnbull, of course, denied Pillemer’s account, claimed he knew nothing of the merger, and denied calling him a month later to congratulate him on the deal, which Williams concluded had all happened as the fund manager had outlined.

“I accept Mr Pillemer’s evidence and reject (Alex) Turnbull’s evidence about that conversation,” Williams found, adding that Turnbull’s evidence included “several lies”. “The resulting damage to (Alex) Turnbull’s credibility, and the demonstrated unreliability of his recollection … are further reasons why I reject (his) evidence of the 23 February 2017 conversation and prefer the evidence of Mr Pillemer.”

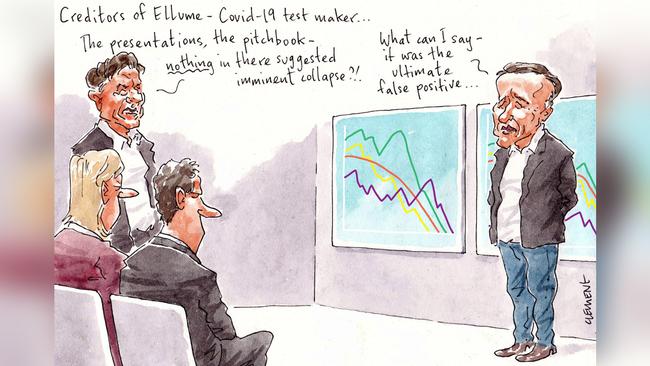

Ellume fallout

It was an pandemic success story, until it wasn’t, with a clutch of rich listers said to be sweating on the failure of Covid-19 test maker Ellume.

Set to absorb a liver-shot to his reputation, and the loss of some capital, is former Australian ambassador to the US Joe Hockey. The former treasurer was instrumental in Ellume securing a $US250m-plus deal with the US Government, as well as advising the Brisbane-based group via his Bondi Partners advisory shop.

Ellume’s contract with the Department of Defence was announced by President Joe Biden a week after he took office. An insider told us that the deal was pretty much all the company had going for it, with delays causing blockages with cash flow.

Margin Call has learned that two of the manufacturer’s non-executive directors resigned from the company’s board in the days leading up to the appointment of administrators.

First out the door was US-based director Caroline Popper, a healthcare consultant who joined Ellume in June.

Close behind was corporate governance expert Joanne Moss, a former lawyer at Norton Rose Fulbright. She joined Ellume in November 2019 and was chair of the board’s audit and risk committee. She resigned on August 31, the day FTI Consulting was appointed as a the voluntary administrator.

Ellume’s accounts for 2021 financial year revealed a net loss of $87.8m, with liabilities exceeding total assets by $94m.

The directors, including founder and CEO Sean Parsons, warned there was a “material uncertainty that may cast significant doubt on the group’s ability to continue as a going concern”.

The numbers, Ellume said, were impacted by the recall of Covid tests that were returning false positives, which had had a “significant impact on the operations and liquidity”.

However, the directors said they believed the group would be successful and prepared its financial report “on a going concern basis”.

Auditor Simon Neill of PwC signed off on the 2021 accounts, with Ellume soon after asking investors for more money. In August 2021 it issued $69m in convertible notes to “high net worth individuals”, who are now likely to be creditors.

Then in November there was a pre-IPO raising of up to $100m, led by Ord Minnett and Morgans. Those equity holders will be at the back of the line in the administration process.

Of note will be the contents of the pitchbook used to sell the equity to investors and any representations made.

One prominent investor is Brisbane entrepreneur Paul Darrouzet, who chairs the company, while billionaire pub baron Bruce Mathieson is also believed to be on the register.

FTI is expected to hold its first meeting of Ellume creditors in mid-September.

Takeover trauma

Speaking of biotechs, Pfizer’s attempted takeover of ResApp will go to a shareholder vote on Wednesday where failure is likely to leave the micro-cap scrambling for cash to keep its operations running.

Estimates released to the ASX read like a pleading from the company’s board. With much cupping of hands, they revealed that ResApp has about $530,000 in available cash at the bank. Prior to taking a bridging loan a fortnight ago, officials were actually projecting a negative cash balance of $322,985 by end-September.

On the plus side, revenues are up – from $69,731 to $2,512,411 – but yearly losses have widened from $6.7m in FY21 to just under $7.1m.

Short of melting down the family silver, the ResApp team, led by Tony Keating, has staved off calamity with a $680,000 bridging loan from Pfizer. That’s to tide things over until the vote on Wednesday.

The company has been attempting to work up a smartphone app that assesses the sound of a person’s cough to see if they have Covid-19. The algorithm’s success could transform coronavirus testing the world over, hence Pfizer’s repeated mating efforts.

The initial bid was held out in April with an offer of 11.5c per share, which has increased over the succeeding months to 14.6c and then to 20.8c, or about 5.4 per cent higher than where the share price closed on Friday.

The vote to sell has the support of the board, of course, along with proxy advisory group Institutional Shareholder Services. Approval requires 75 per cent of the votes on the day and the voting of half the shareholders, some of whom are deeply displeased with the idea.

Among them is former parliamentary speaker Peter Slipper who has been shrill in his advocacy to vote against the offer on Twitter. As recently as Friday he tweeted that accepting the Pfizer deal would be to “sell it (the company) for a pittance”.

Short of a deal with Pfizer, there’s a reasonable likelihood that shareholders will be tapped for an emergency capital raise, given that ResApp churns through a couple of million dollars every quarter, and, apparently, has almost nothing in the bank.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout