Charlie Aitken’s return, Andrew Forrest in the running for David Jones

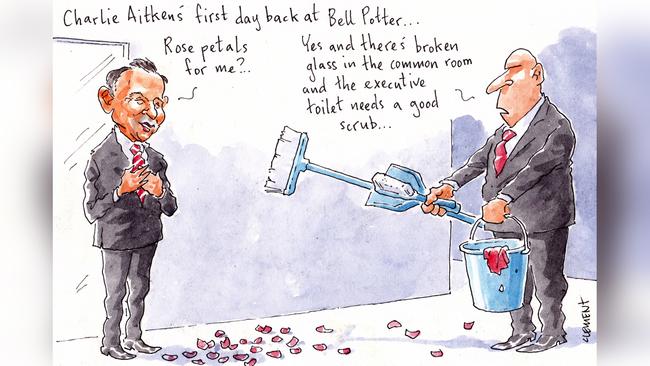

The life of stockpicker Charlie Aitken is appearing to morph into a series of slinking, repentant homecomings after some elaborate and well-documented straying in his personal life and career.

The first of these ignominious returns from the cold has seen Aitken reconcile with ex-wife Ellie after an extravagant affair that ended not only his marriage but that of his business partner, Chris Nasser, leaving a trail of destruction magnified ad nauseam by the Daily Mail.

The Aitkens are said to be residing together once more, presumably away from the apartment above the bus depot in Bondi Junction where Charlie was flopping during his months in the doghouse.

But Margin Call can report on a second reunion also in the offing for Aitken, and one that also has a touch of grovelling to it. The former fund manager is starting a new job on Monday with none other than Bell Potter, the firm where he plied his trade as a stockbroker only to then cast off and launch his own fund, Aitken Investment Management, in 2015.

That caper ended last month after years of underperformance and lacklustre returns for investors, resulting in Aitken selling his share in the company to a consortium of in-house stockpickers who moved quickly to rebrand the entity.

Margin Call has confirmed that he will be working again as a broker but who’s to say if he’ll revive his jauntily-written daily note – Ringing the Bell – that developed a following during the middle years of his career. We would note that most of its content was compiled by a clutch of shambling analysts working for Aitken, who edited the missive and received most of the credit.

We’re loathe to point out the obvious ignominy of Aitken’s return to an industry that he basically trashed from his perch in funds management.

In a 2019 piece for Livewire, he boasted of cutting out the “unnecessary noise” from his investment decisions, namely the fuzz and static delivered by his former colleagues.

“This is to the displeasure of the stockbroking community,” he said, “and to the benefit of my investors.”

In an even earlier interview, he said: “Every idea from a broker ends with an action – and every idea I ever sent ended with something you had to do today. The difference in fund management is you don’t have to do something today.”

Not quite a sneer, but a remark that could come back to haunt him. We struggle to see how Aitken can remain useful at Bell Potter if he’s unable to convince his clients to do anything.

–

Shopping around

Andrew Forrest has emerged as a contender to purchase ailing department store David Jones, with the mining magnate aiming to bring the company back into Australian ownership and revive the business that’s been put on the market by its South African parent company.

Margin Call has confirmed that Forrest’s Tattarang investment arm is in discussions to buy the company, owned by Woolworths Holdings, with sources telling Margin Call he has been in personal contact with its former chief executive Mark McInnes in relation to the sale.

In 2020 Woolworths sold DJs’ flagship store on Sydney’s Elizabeth St to Australia’s largest landlord, Charter Hall, in a sale worth $510m thought to have been motivated by broader concerns to bolster the department store’s balance sheets.

Margin Call revealed on Wednesday that Woolworths Holdings – no relation to the Fresh Food People – had appointed Goldman Sachs to negotiate the sale of its ownership of DJs, which it bought for $2.1bn in 2014, with at least two buyers said to be weighing a deal.

McInnes is understood to be working with Goldman Sachs to arrange prospective buyers, although sources are split on what role, if any, he would have with Forrest if a sale was to proceed.

At least two other private equity firms are known to be in discussions to buy the company, one of which is said to be Anchorage Capital, with Flagstaff Partners said to be advising one of the prospective bidders.

Tattarang is one of the country’s largest private investment groups and maintains interests in a slew of listed and non-listed companies, including bootmaker and saddler RM Williams, which was purchased in 2020 from private equity firm L Catterton.

It is understood that Forrest’s intention to purchase DJs would be to similarly return it to Australian ownership. Tattarang declined to comment when contacted.

One source said McInnes had been tapped by Forrest to run DJs as its CEO, returning him to the role more than a decade after he resigned over a sexual harassment scandal. However, the claim was disputed by another source aligned with the magnate.

McInnes was contacted for comment.

It remains unclear and unlikely as to whether McInnes could even accept such a role under his existing restraints with Premier Investments, the company from which he resigned as CEO in 2021. It retains an option to limit his retail-related activities for a further two years.

A return to DJs would herald a remarkable twist in the businessman’s career that halted over sexual harassment allegations brought against him in the Federal Court.

David Jones later confirmed that the case, in which the complainant sought $37m, was settled for $850,000. The allegations ended McInnes’ meteoric career until he was hired back into the rag trade as chief executive of Premier Retail, owned by billionaire Solomon Lew.

It was while working with Premier, from 2011, that McInnes was able to rehabilitate his career in a partnership with Lew, mere months after his departure from DJs, and at a time when he was regarded as unemployable within the corporate sector.

–

Wilson selling up

Is the defeated member for Goldstein on the move?

Margin Call has learned that ousted Liberal Tim Wilson, who served two terms in federal parliament, has thrown his Sandringham apartment onto the market.

Wilson, elected in 2016, and his schoolteacher husband Ryan Bolger, bought the unit that year, not long after Wilson emerged victorious against Georgina Downer in a preselection battle.

Alas, two terms on, Goldstein was relinquished in a high-profile battle to Teal independent Zoe Daniel, a former ABC journalist, during which contest Wilson’s home was repeatedly vandalised.

He and Bolger purchased the unit for $755,000 and are asking for $1.65m, with Wilson maintaining a silence on what his future will hold.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout