Malcolm Turnbull warms to climate advisory gig

Matt Kean looks to already be getting a little more than he bargained for in his appointment this week of Malcolm Turnbull to the NSW government’s new board that will advise on long-term climate policy.

The state Energy and Environment Minister’s naming of the former prime minister as chair of the Net Zero Emissions and Clean Economy board was only announced on Monday, but already Turnbull is up and about with much to say when it comes to energy policy.

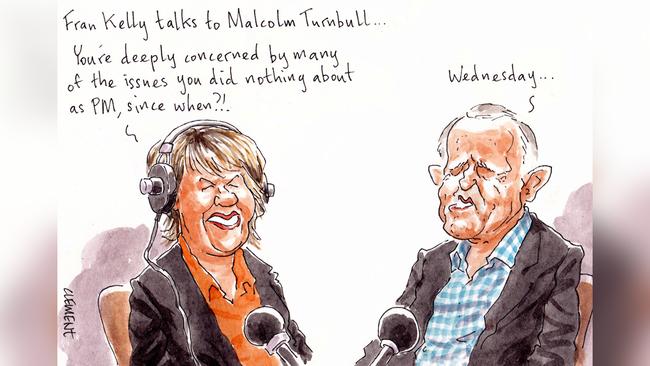

Things started early on Wednesday for the millionaire former leader, joining broadcaster Fran Kelly on RN Breakfast to discuss coalmining in the Upper Hunter, where the ex-pollie has an expansive farm.

Stressing that he was talking in his private capacity, Turnbull said he was particularly concerned with air quality in the region and that mining companies were devastating the landscape.

The former PM said he was concerned miners would not have enough money to cover huge remediation bills once their projects were shut down and backed calls for a moratorium on new coalmines in NSW.

By lunchtime the former investment banker was stepping across the threshold of the distinguished private The Australian Club to dine with Australian Energy Council chief Sarah McNamara, formerly a senior policy adviser to his predecessor, Tony Abbott.

The pair were joined by McNamara’s media man Hamish Fitzsimmons, who arrived at the AEC mid-last year from his senior government relations role at NAB.

The trio are believed to have dined off the back of Turnbull’s membership to the elite gentlemen-only club, where these days women are welcome as guests.

The AEC represents Australia’s major electricity and natural gas businesses in the wholesale and retail markets for energy, with members including Alinta, Origin and Energy Australia.

Curious, too, how Turnbull is going to square up his new government gig with the new role he has also just taken up with Andrew Forrest as chairman of the billionaire’s Australian Fortescue Future Industries, a Fortescue subsidiary that scours the globe for clean-energy investment opportunities.

No shock to see that federal Energy Minister Angus Taylor didn’t get a lunch invite though, after expressing his surprise that the former PM would take on such a NSW government role in the first place.

While the minister also noted that action was needed in the upper Hunter, he drew the line at working with his former leader, saying: “I won’t be working with Malcolm Turnbull. What I’ll be doing is working with the NSW government.”

Latitude for riches

Latitude’s third run at the local boards may have been downsized, but that hasn’t put much of a dent in chief Ahmed Fahour’s takings.

The finance group’s prospectus lodged this week details its $200m offer, valuing the group at $2.6bn — down from their first attempt in 2018 which targeted a $4bn valuation.

Fahour, of course, wasn’t around for the first tilt — he was busy running Aussie Post — but his role in the second attempt had him slated to rake in roughly $22.5m in stock.

This time around the chief has yet more reasons to make the float a success, 16.5 million options to be exact.

As part of the deal, Fahour and Latitude’s private equity owners KKR, Varde Partners and Deutsche Bank have entered into a call option agreement, with three tranches of 5.5 million shares each that are exercisable in March 2023 at $3.12, $3.25 and $3.50.

The listing will herald in Fahour’s first time as a listed company chief executive and he’ll be hoping the stock over the next two years at least climbs from its $2.60-a-share issue price to well beyond his options’ exercise prices to substantially enhance the boss’s personal wealth.

Fahour will net the difference between the respective exercise prices and the prevailing share price in March 2023. He has pre-paid for the options for an undisclosed amount, according to the prospectus, so we can’t yet calculate the benefit. But on the flip side, if they don’t make it past $3.12, Fahour will make not a cent.

Such is life in the listed market.

In addition to all that potential, the newly married Fahour already holds 2.7 million shares, or 0.3 per cent of the open float, which on the deal’s completion will be worth about $7m at the float price, just behind chairman Michael Tilley with a $9.6m stake.

Also on the Latitude board, QBE director Mark Joiner has 500,000 shares, and former IAG exec Alison Ledger has roughly 100,000.

Rounding out the board are KKR’s local partner and head Scott Bookmyer, Varde’s James Corcoran and Deutsche’s Beaux Pontak.

They will soon have another board member in the mix as appointed by new investor, Japan’s Shinsei Bank, whose purchase of a 10 per cent stake in the company will have to first face Treasurer Josh Frydenberg’s FIRB.

Still, if Latitude stock fails to fire and Fahour’s stock is a stinker, he’ll still be sitting pretty with a $1.8m fixed annual salary, with a $4.85m total annual target that includes long and short-term incentives (still shy of his $5.6m Post pay packet).

Joint lead managers Credit Suisse, Jefferies and Merrill Lynch will also get a slice of the action — set to reap 2.75 per cent of the institutional offer and 0.75 per cent of the broker firm and employee offer, on top of a potential pool of $8m to be handed out at the PE consortium’s discretion.

There are plenty of windfalls here, with all no doubt hoping it is a case of third time lucky.

Byron’s Covid blues

It has taken more than a year, but COVID-19 has come to Byron Bay, landing at the doorstep of some of Sydney’s richest and most influential business owners and operators.

Music entrepreneur and festival director Peter Noble, 71, had what was to be the 32nd Byron Bay Bluesfest cancelled by NSW Health Minister Brad Hazzard on Wednesday just hours ahead of its scheduled kick-off.

It was the second year running that the internationally renowned event, what would have been the largest festival in the country for more than a year, has been canned due to the pandemic in what is a devastating blow to the northern NSW beach town.

The festival is said to generate significant direct and indirect economic activity for Byron Bay and surrounding NSW north coast regions — in 2019, when it was last held, that was to the tune of $234.4m.

Ouch.

The virus will also be affecting the operations of the Byron Bay Beach Hotel, after a patron there contracted COVID at a hen’s party.

The establishment is owned by listed financial services group Moelis Australia, which is led by investment banker Andrew Pridham, who also chairs AFL team the Sydney Swans.

Moelis early last year paid $100m for the beachfront watering hole, which we expect might be a little quieter this Easter than Pridham might have expected.

Also recently just sold and now on the NSW government’s list of hot venues is The Farm at Byron Bay. The hospitality venue is now owned by The Sydney Collective, which is a joint venture between Fraser Short — of the Sydney pub family — and almost 80-year-old hospitality billionaire Arthur Laundy (who last month stripped down to his bathers for an in-pool photo shoot in The List — Australia’s Richest 250).

They bought it last year from Orton fashion empire heir Tom Lane and wife Emma.

Short and Laundy, who is the father of former federal parliamentarian Craig Laundy, also own the Watsons Bay Hotel among an ever-growing broader portfolio of pubs and eateries across NSW and Queensland.

Only last week the pub group picked up the Illawong Hotel at Evans Head just south of Byron — its less than bougee exteriors likely to keep any hens parties — and, by extension, hopefully any COVID-19 cases — well away.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout