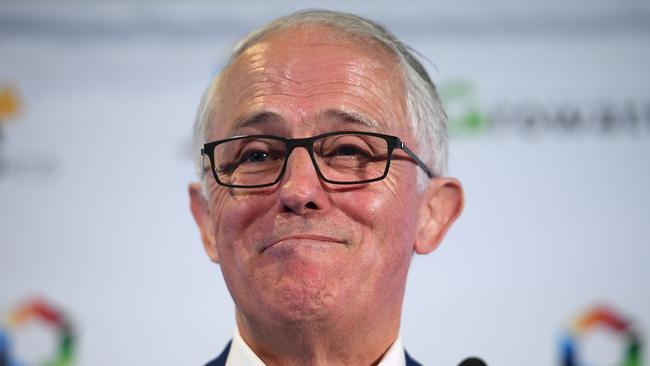

Malcolm Turnbull on board for new role

He’s been a journo, advised media moguls, made millions as a venture capitalist and led the nation as our 29th prime minister.

Now millionaire retired politician Malcolm Turnbull is preparing to add listed company director and likely even chairman to his resume.

Margin Call has learned that the former member for Wentworth has joined the board of private equity-backed accountancy and financial advisory company Findex Group, which is being prepared for an eventual $1bn-plus float.

Turnbull, at last count worth almost $200m, was appointed to the board of Melbourne-headquartered Findex at the end of January, along with a clutch of other representatives of its major shareholder, American private equity giant Kohlberg Kravis Roberts.

Turnbull joined KKR as a global senior adviser in May last year. His new role on the Findex board opens up the potential for former investment banker Turnbull to get in on the ground floor of a Findex float to potentially make millions via early share issues.

MORE MARGIN CALL: Stay classy, government | Seven acts on debt concerns | Wedding bells again for Fahour | Calombaris’s twisted empire owes $22.3m | Double delivery at AusPost | Christine Holgate’s evolving door

Last year, Latitude Financial boss Ahmed Fahour was set to reap as much as $51m from the float of the KKR-backed financial services group thanks to a generous allocation of stock and bonuses.

The former PM’s ability to build on his already considerable wealth has been stymied during his political career due to his investment portfolio being managed at arm’s length via a series of blind trusts.

Findex was founded by Melbourne businessman Spiro Paule. The group employs about 3000 staff in Australia and New Zealand, providing accountancy and advisory services to 250,000 individuals and 80,000 businesses.

It is said to boast the largest non-bank network of financial advisers, with funds under management of about $17bn.

In the most recent full financial year, its turnover was a steady $432m for an operating net profit of about $41m.

While Findex told Margin Call there were no plans for a float, it is understood preparations are afoot so investors can hit the button when the equity market returns to a stable footing.

As well as decades of high-level business experience, Turnbull brings significant political insight to the Findex board, having personally signed off on Kenneth Hayne’s royal commission into financial services.

The financial planning industry was one of the hardest hit by recommendations from the commission, with the listed AMP still reeling from the fallout.

KKR, which in Australia is led by Scott Bookmyer, has held its 40 per cent share in Findex since 2014. In 2017 it is believed to have informally sought investor interest in its stake, but the process went nowhere.

The past year has seen Findex execute on a number of acquisitions towards beefing up its operations and is in the process of rebranding its range of operations across Australia and New Zealand under the Findex brand.

KKR has also appointed Myer chairman Garry Hounsell to the board of the company. He joined in the same week as Turnbull.

Hounsell is also a director of Treasury Wine Estates, which several years ago was the subject of a failed KKR takeover bid. It’s believed that’s when Hounsell was introduced to the private equiteers. Also joining the board are KKR’s managing director of credit Brian Dillard and Hong Kong-based exec Diane Raposio.

A spokeswoman for Findex, Zoe Paule, declined to comment on the new board appointments or plans for the group’s preparations towards listing on the sharemarket.

A2 comeback

It was only a line in A2 Milk’s interim results, but it spoke volumes on the transformation the milk and infant formula juggernaut has undergone since December.

Almost buried was news that A2’s long-serving chief marketing officer, Susan Massasso, who had tendered her resignation in November while Jayne Hrdlicka was still boss, was to “continue employment with the company in the recently expanded role” — Chief of Growth and Brand Officer no less.

So why the about-face?

A clue came in December from chairman David Hearn — the day Hrdlicka was unexpectedly replaced in the top job — when he told The Australian: “I am not ruling out her return. Let’s wait and see. She is an extreme workhorse. She is burnt out and she needs a little bit of time to get her own personal space together.”

A workhorse Massasso is indeed, Margin Call hears, but we also reckon she was pretty keen to work with her old boss again, the company’s founding chief executive Geoff Babidge, who took over from Hrdlicka on an interim basis in December.

We also bet Massasso’s return is being welcomed with open arms by the company’s well-regarded operational boss, Asia-Pacific chief executive Peter Nathan.

This newspaper reported last year that two long-time A2 Milk backers — New Zealand fund managers Harbour Asset Management and Fisher Funds Management — had expressed concern about losing access to Nathan during Hrdlicka’s reign. Now the Babidge, Nathan and Massasso triumvirate rules again at A2 HQ, while Hearn watches on from his London home.

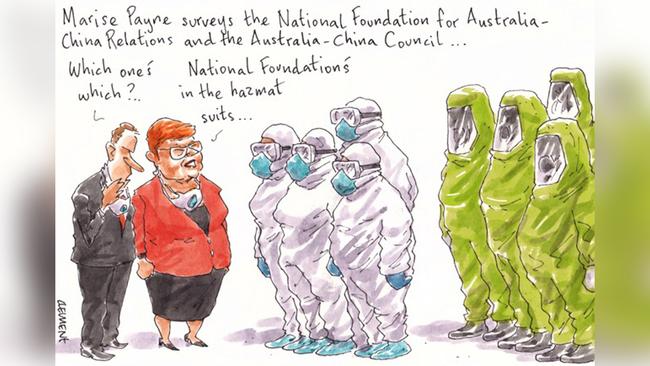

Building bridges

Inauspiciously amid the pandemic preparations, the Morrison government’s new advisory board to “build co-operation with China” was revealed yesterday. It’s the National Foundation for Australia-China Relations, not to be confused with the Australia-China Council, which had been around since its 1978 establishment when chaired by Professor Geoffrey Blainey. Australia’s Mr China, Warwick Smith, who has been the chairman of the council since 2011, chairs the new replacement outfit.

Foreign Minister Marise Payne announced that Virgin Australia’s group chief adviser Peter Cai was on board, plus entrepreneur Jason Yeap, former China ambassador Frances Adamson and our very own double Walkey award-winner sinophile columnist Rowan Callick. Douglas Gautier, the artistic director of the Adelaide Festival Centre after living in Asia for 25 years, is another member. Smith, who hit the national landscape in the 1990s as the member for Bass in the Howard government era, has enjoyed corporate roles over the years with Chinese developer Aqualand and at ANZ China.

It is hoped the foundation will see governments, business, education institutes and cultural sectors strengthen bilateral engagement.

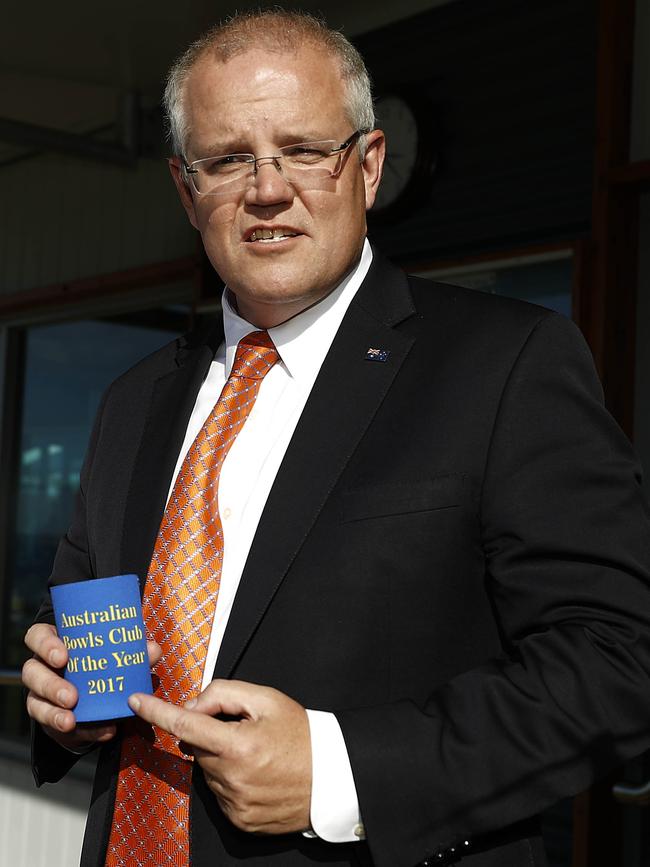

Mugs no more

If you wanted to celebrate this year’s projected budget surplus, now unlikely due to the economic havoc being wrecked by the coronavirus, we’re sorry, you’ve missed your chance.

The Andrew Hirst-directed Liberal Party’s sale of celebratory, limited edition “Back in Black” mugs is no more.

Margin Call told you how marketing enthusiasts at party headquarters were flogging the official merchandise mugs for $35 each to commemorate that “the 2019 budget delivers the first surplus in more than a decade”.

That’s despite Treasurer Josh Frydenberg now preparing the electorate for the prospect that their May 12 economic statement might not be in surplus after all.

By yesterday morning, the website was telling the faithful the mugs were “sold out”.

No longer available, just like the government’s declared surplus.

For $20, punters can get themselves a pack of two Liberal Party 2019 election stubby holders featuring ScoMo’s “How good is Australia”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout