Seven West Media acts on debt concerns

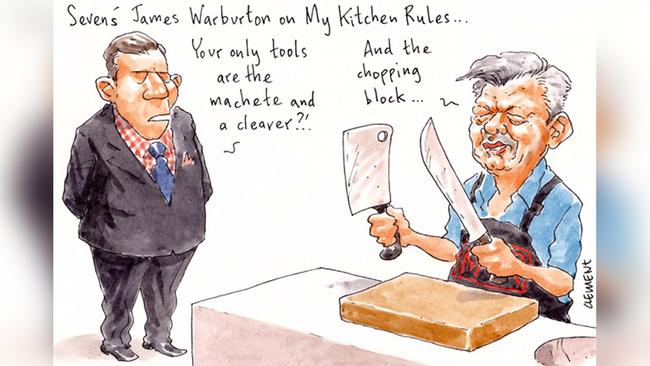

James Warburton is talking up the potential of transformative mergers and acquisitions to drive billionaire Kerry Stokes’sSeven West Media forward.

But more pressing for the newish boss looks to be the now $264m listed group’s need to cut its $570m in net debt to keep its heavily exposed lenders from its door.

Seven’s debt is now more than twice its market value and, to make sure there’s plenty of headroom between financial reality and Seven’s prevailing financial covenants, the Stokes-chaired board has warned that economic “uncertainties” require dramatic action.

“To counter these uncertainties, the directors have approved several actions to accelerate the group’s transformation and debt reduction agenda to ensure adequate headroom with respect to the group’s financial covenants,” the fine print of last week’s interim results reads.

Margin Call notes that listed companies’ interim results are only “reviewed”, as opposed to “audited”, and do not include an “audit opinion”.

Investment bank Morgan Stanley is pleased to be helping out with flogging off the jewels, driving Warburton’s asset sales program to hopefully return money to the coffers.

Since last week Seven has been out in the market briefing fundies on its asset sales program, specifically its Seven New Ventures arm comprising its stakes in online marketplace for services Airtasker, financial services group SocietyOne, online health directory HealthEngine, online social network for seniors Startsat60 and Huddle Insurance.

Seven reps have told fundies they are keen to sell the ventures’ assets as a portfolio, but would consider selling interests separately.

The carrying value of the combined assets is $103m at the end of the first half, up 27 per cent from the start of the financial year, so if that’s realised it should go some way to bringing down the net debt number.

Meanwhile, SocietyOne is believed to be in the market for capital, while HealthEngine is also conducting a capital raising.

All this as Seven shares trade at 17c each.

For Warburton, its shaping up as an interesting second half.

Wilson backs WAM

Federal Liberal politician Tim Wilson has poured more of his superannuation into the investment funds of Wilson Asset Management.

He’s invested in WAM Global and WAM Micro Cap, two of WAM’s six LICs.

These investments were added late last year to the prior stake in WAM Leaders that was bought in late 2017 by Wilson and his teacher husband, Ryan Bolger.

“I was just happy with them,” he told Margin Call yesterday.

There was the initial stake in 2017 in WAM Capital, which was established in 1997, and is responsible for investing about $3bn in Australian and international companies on behalf of 80,000 retail investors.

Of course, WAM is headed by Geoff Wilson, Tim’s cousin.

As head of the House of Representatives economics committee, they banded together this time last year in a mightily effective campaign against the franking credits policy of the Bill Shorten-led ALP.

WAM, which secured Macquarie’s Shaun Weick as an equity analyst for small caps last year, has recently bounced back in its half-year results after ruling off last year on its toughest year in equity markets since 2008. Holding about 17 per cent in cash, WAM’s recent best stock performers included technology services company Codan Limited, which announced the highest half-year profit in the company’s history last week.

Meanwhile the member for Goldstein dumped his stake in BetaShares Bear Hedge Fund this month after it disappointed in its claims to “to help investors profit from, or protect against, a declining Australian sharemarket”. He retains holdings in BetaShares’ Global Sustainability Leaders fund, which invests in companies leading action on climate change, and also in BetaShares’ Australian Sustainability Leaders ETF.

Wilson holds property, too.

The Melbourne bayside politician co-owns four properties: two in Melbourne, along with a $425,000 Cape Schanck weekender on the Mornington Peninsula and an investment abode in Canberra.

A tricky conflict

Seven’s legendary commercial chief and confidant to billionaire proprietor Kerry Stokes, Bruce McWilliam, is dealing with a tricky situation due to the unfolding inquiry into James Packer’s Crown Resorts.

McWilliam is a long-time associate and adviser to the billionaire Packer family, first to the late media mogul Kerry Packer, for whom McWilliam worked in the 1980s, and then as media deals have come and gone in Australia.

McWilliam these days is a trusted lieutenant to Stokes, who of course has emerged as something of a father figure to the troubled James Packer.

Stokes was instrumental in the demise of Packer’s engagement to US pop diva Mariah Carey and spends much time with the gaming billionaire when they are both at their respective homes in Colorado.

Which brings us to Patricia Bergin’sunfolding inquiry in NSW by the Independent Liquor and Gaming Authority into Crown’s licence to operate a casino at Barangaroo and the sale by Packer of a 10 per cent stake in Crown to Lawrence Ho’sMelco.

McWilliam’s wife Nicky McWilliam is an accomplished lawyer and, since 2016, has been on the board of the ILGA.

Margin Call hears the solution to this potential conflict of interest based on her husband’s long-term friendship with the Packers has been for McWilliam to permanently recuse herself from ILGA matters concerning Crown.

Back in flak

The impending declaration of COVID-19 as a pandemic has Scott Morrison and Josh Frydenberg warming up the populace for the prospect that their budget might not be in surplus come delivery of the national accounts on May 12.

The “unknown global shock” of the coronavirus means the Morrison government’s promise to bring the 2019-20 budget back into the black, as declared in April last year, is increasingly unlikely to eventuate.

“I announce that the budget is back in black and Australia is back on track. For the first time in 12 years, our nation is again paying its own way,” the Treasurer heralded with some hubris in his pre-election budget.

Despite unfolding global events, the optimists at Liberal Party headquarters are still of the faith, with official “Back in Black” coffee mugs being offered for sale on its website — a steal at a mere $35 apiece. “Limited edition”, the marketing blurb goes.

“The 2019 budget delivers the first surplus in more than a decade. Mark this event with the official Back in Black mug.”

Maybe they’ll become a collector’s item.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout