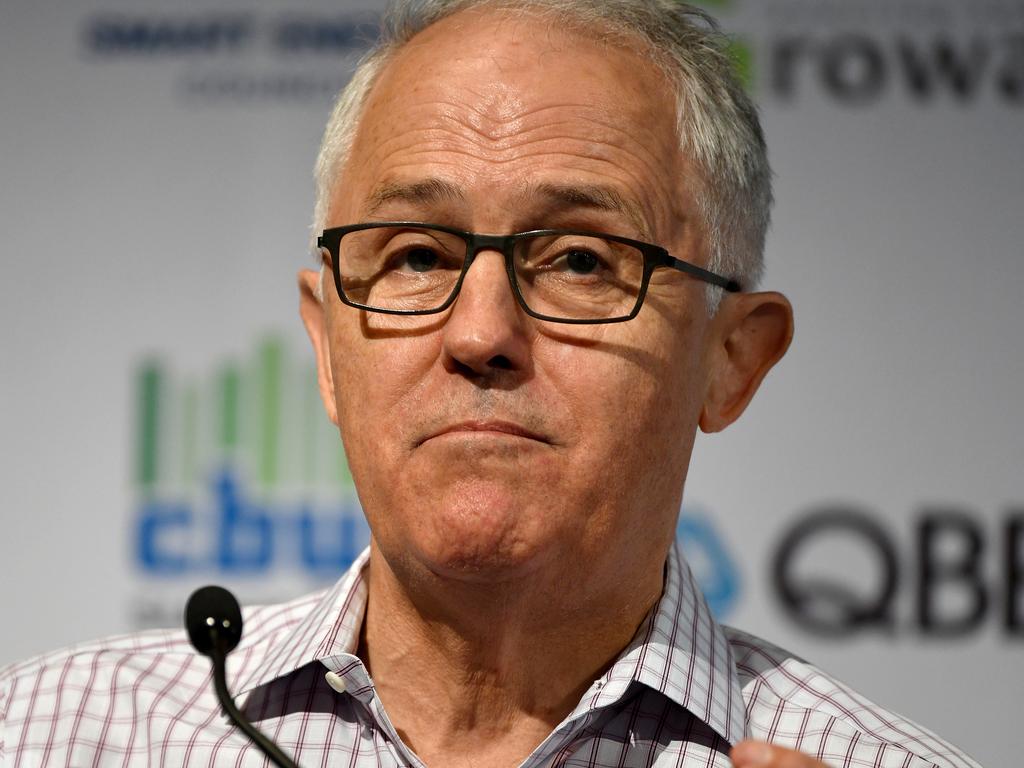

Life’s a beach for Malcolm Turnbull

He really is Mr Harbourside Mansion.

Not every self-managed retiree can set up a superannuation trustee vehicle and name the new company after the Sydney Harbour beach that fronts their Point Piper mansion.

But you can if you’re millionaire former Liberal prime minister Malcolm Turnbull who, ahead of the release of his book A Bigger Picture on Monday, has done just that.

The former investment banker turned pollie and his wife Lucy Turnbull’s mansion sits on Wunulla Road, with the property boasting a gate down to the harbour’s Lady Martins Beach.

So what else would a millionaire call his new super vehicle but Lady Martin Pty Ltd, created a few weeks ago by Turnbull as the latest vehicle in his expansive private corporate portfolio.

He’s something of a creature of habit, having run his Felix Bay Ltd private vehicle since 2000, reflecting the waters that lap the Turnbull’s harbour home.

Of course he’s been into the takeaway from the menu at the invitation-only Royal Prince Edward Yacht Club, just a short walk across the sand. There has been eat-in from the McMahon’s Catalina restaurant around the harbour at Rose Bay too.

It’s a tough life.

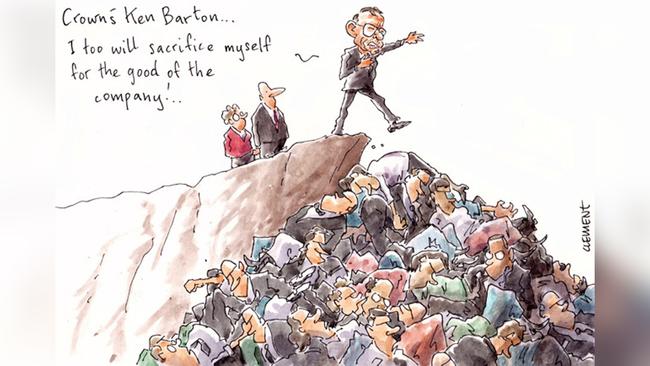

Packer’s payment

We are so relieved.

Global pandemic and economic devastation notwithstanding, gaming billionaire James Packer will still get his $70m-odd in dividends from his 35 per cent stake in casino operator Crown Resorts.

The Helen Coonan-chaired company will finally dump money, previously deferred for a couple of weeks, into Crown shareholders’ bank accounts today.

Phew.

Now the 52-year-old billionaire can keep the engines running on his new $250m Benetti gigayacht IJE, currently resting in the northwestern waters of Tahiti, and the lights on in his luxury homes in Aspen, Colorado, Los Angeles (near where his three children live) and his expansive Ellerstina polo ranch in Argentina.

The income to the billionaire, who continues to build a new casino in Sydney, comes as 11,500 Crown workers have been stood down, with relatively new chief executive Ken Barton banking that the company’s operations can be underpinned by Treasurer Josh Frydenberg and Prime Minister Scott Morrison’s JobKeeper scheme.

That $1500 to each stood-down Crown employee per fortnight under the government’s scheme is the equivalent of about $17m, or about a quarter of Packer’s interim dividend.

We note Packer’s fellow billionaire proprietor Alex Waislitz last week proceeded with the record dividend payment for his listed Thorney Opportunities, but deferred the payment of his own share of that income, which has remained with the group.

Barton, select senior execs and Crown’s non-executive directors, which along with Coonan include Andrew Demetriou, Packer lieutenants Guy Jalland and Mike Johnston, millionaire adman Harold Mitchell, are taking a 20 per cent pay cut to their fixed base until June 30.

At Star Entertainment, CEO Matt Bekier is taking a 40 per cent cut, while Star’s John O’Neill-led NEDs will take a 50 per cent cut.

At Crown, Barton’s base is $3m so in a normal year he’d get about $58,000 a week.

The new coronavirus rate of pay from this week would apply to about 10 weeks’ pay, which would normally yield about $580,000.

A 20 per cent cut in that gross amount is about $115,000, so that after tax Barton will feel the actual take-home pinch to the tune of about $85,000.

We think that’s what you call corporate window dressing.

Betting blues

There’s an old saying that bored Australians would bet on two flies crawling up a wall.

But beware the corporate regulator, as rascally Sportsbet has just found out.

Margin Call concluded it was an April Fool’s stunt when the email from Sportsbet lobbed in our inbox on April 1, just before the traditional noon cut-off times for pranks.

“Fancy yourself as the next Gordan (sic) Gekko?”, the subsequently genuine proposition read.

“Well now you can make money off the ASX without having to plunge your hard-earned into the stockmarket.”

It advised punters could bet on the ASX closing higher or lower.

Or bet on the final digit of the closing price, or just whether the close price was an odd or even number.

“Well, they’ve always said the stockmarket is just gambling, and now, it literally is,” Sportsbet.com.au’s very silly communications manager Rich Hummerston says in the email.

“And during these times, our markets are probably safer than the actual stockmarket.”

Seems James Shipton, the ASIC boss, wasn’t amused with the corporate watchdog advising that the offering “constituted a financial product that Sportsbet was not licensed to offer”.

The product was now withdrawn, ASIC noted, with Sportsbet, in part, blaming issues around working at home.

It’s not the first time the Barni Evan s’ Sportsbet has crossed the line.

Back in 2014, before Evans was at the helm, Sportsbet sought to offer odds on how many viewers would tune into the Michael Jackson, Whitney Houston and Anna Nicole Smith episodes of Autopsy.

Sportsbet.com.au’s latest novelty market is on who will play Joe Exotic in any movie adaptation of the Tiger King. The comedic actor David Spade, despite ruling himself out, remains the favourite.

Working out well

The fear of putting on weight, and the dread of being spotted during online fitness video classes in last season’s lycra, saw fanatics flock yesterday to the PE Nation sale.

So much so that the website, the athleisure brainchild of former General Pants Co design director Pip Edwards and former senior Sass & Bide designer Claire Tregoning, crashed on the midday launch of its annual warehouse sale.

The womenswear fashion website faced intermittent drop-outs throughout the afternoon, given the usual Sydney sale out of a warehouse was opened to the whole of Australia.

The popular annual warehouse sale, which sees prices slashed 60 per cent, has been a major calendar event for PE Nation since Edwards and Tregoning launched the company in 2016.

Their warehouse in Alexandria is owned by the company’s other co-founders, the rag trading brothers Wassim and Ziad Gazal.

Gym gear — from dumbbells to treadmills — has been seeing huge sales lately as gyms stay closed, with Kmart and Target shelves left empty of yoga mats, skipping ropes and foam rollers as stay at home workers continue to find creative ways to keep fit.

They’re also looking to their social media feeds for some of Australia’s fittest figures.

Thor god Chris Hemsworth offered six weeks free on his fitness app Centr, partnering with national gym giant Fitness First to give its members three months free.

The Adelaide-born personal trainer and entrepreneur Kayla Itsines, co-creator of the Bikini Body Guides, continues to engage her 12.4 million followers with at-home exercises.

But big-time gym operators are finding it tough.

Joey Gonzalez, head of the expansionary US chain Barry’s Bootcamp, frequented by the likes of David and Victoria Beckham, Nicole Scherzinger and Kim Kardashian, has taken a 100 per cent pay cut.

Barry’s came to Australia just two years ago, setting up three stores in Sydney, with one heading for Melbourne, but not yet. There were plans for a May opening in South Yarra, but don’t expect those to still be happening any time soon.

Down to earth

No one wants to be unemployed and looking for a new job amid the unfolding global health and economic crisis.

Thankfully, the political gods have smiled on former Liberal prime minister John Howard’s nephew Lyall Howard, who’s managed to find a new gig helping out Tassie senator and Aged Care Minister Richard Colbeck.

But former government relations exec Howard, we expect, has had to take quite a pay cut.

When Howard was an operative at the Christine Holgate-led Australia Post, he was on a package in the order of $400,000. Previously in his career Howard similar gigs at Rio Tinto and BHP.

Howard exited Post mid-last year to join then Nationals leader and trade minister Bridget McKenzie’s office, but then that all went pear-shaped thanks to the Victorian senator’s sports rorts scandal.

Howard, who has been an electoral officer for Colbeck out of Canberra since March, is working on health regulatory matters for the minister.

It’s a job that pays less than $100,000.

But at least it’s a job.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout