Hancock’s Gina Rinehart’s golden touch for Aussie Olympians

Could it be the Rinehart touch? Much the magnate mines for seems to be turning up gold this Olympics.

On day five, Australia’s medal tally was sitting at six gold, all turned up in swimming and rowing, two of four Olympic sports generously donated to by squillionaire Gina Rinehart herself.

All that’s left is to secure metal neckwear in the artistic swimming and volleyball for a quadrella for Australia’s richest woman.

It’s hard to miss her influence, too, with her ads for Roy Hill and Atlas, and featuring none other than singer-turned-Olympic-hopeful Cody Simpson and Olympic great Dawn Fraser, running prominently during prime time on both Games broadcaster the Seven Network and Sky News.

While she joined the so-called PODS (Parents of Dolphin Swimmers) on the Sunshine Coast and was perched alongside the parents of recent bronze medallist Mack Horton, Cheryl and Andrew during the broadcast on Tuesday night, things were a little more low key for Rowing Australia chairman Rob Scott.

A little matter of running the nation’s largest conglomerate during a pandemic kept his celebrations more restrained, said to have tuned into the gold medal races on Wednesday from his home in Perth and at Wesfarmers HQ.

While it has been a while since his silver medal in the Coxless pairs at Atlanta in 1996, Scott is very much still involved with the sport, chairing the board of the national sporting body alongside the likes of former Anchorage Capital MD Merrick Howes and Andrew Michelmore, and helping to dole out the $3.5m in sponsorship dollars pledged by donors such as Rinehart.

But how’s this, the 51-year-old chief exec, who also married an Olympian in water polo star Liz Weekes, says there’s plenty that translates from the water to the board room, and not just the early morning wake-ups.

As the pandemic put many competitions on ice last year, Scott took to the organisation’s YouTube series “Get Cooked”, as hosted by former Olympian Sarah Cook, to describe how elite sport had set him up for success in business.

“Although we might not sweat as much and our pulse rate might not get as high, the world of business is super competitive and I love working with teams to do something special,” he said.

As it turns out, his ability to mix business with his sporting pursuits has been a long-running feature, his partner in the silver medal-winning race, Dave Weightman, first starting out as a colleague during his early days at Ernst & Young.

These days, Weightman is based out of Brisbane and a director in transport finance at Macquarie.

They still do make for quite the pair.

-

Gretel’s power play

While all eyes are firmly fixed on the precarious position of billionaire James Packer’s Crown Resorts, elsewhere in Packer Land there’s been a small shift in power dynamics.

While her younger brother faces the potential loss of his casino empire’s lucrative gaming licences in its various domestic facilities, fellow billionaire Gretel Packer is getting on with managing her money with the assistance of key personnel.

The late Kerry Packer’s firstborn now runs her own family office out of offices in Sydney’s Edgecliff, the same building, we note, that was once the electoral office of former member for Wentworth and prime minister, Malcolm Turnbull.

Increasingly influential in the heiress’s affairs is Sydney lawyer Glen Selikowitz, who joined as Packer’s in-house lawyer in early 2018, having previously been at law firm Baker & McKenzie.

Selikowitz, 53, is now managing director of Packer and her children’s family office Ritam, which was previously driven out of Hudson House on Macquarie St, and in recent weeks has assumed several key directorships of the arts patron and philanthropist’s private vehicles.

South African-born Selikowitz is now on the board of Packer’s BEPM Investments Pty Ltd, named after her son Benjamin Eaton Packer Murray, the family’s Infinite Investments Co Pty Ltd, as well as WKAPM Investments Pty Ltd, named for Packer’s youngest child William Kerry Amadeus Packer Murray.

The new appointments follow several others for Selikowitz to Packer directorship towards the end of last year, elevated from many company secretary roles held for several years.

Notably, the lawyer is also chair of the Cantarella family office, based around the wealth from Cantarella Bros, trading as the Vittoria Food and Beverage empire that’s led by Les Schirato.

Increasing influence, indeed.

-

Jacques’ parting gift

A bumper profit in the first half from Rio Tinto thanks to the year’s strong iron ore price has delivered a late, but oh-so-sweet, parting gift for former chief Jean-Sebastien Jacques.

The international mining giant on Wednesday unveiled a mammoth $US5.61 ($7.62)-a-share interim dividend as the company jumped to a $US12.2bn underlying profit for the period, up more than 150 per cent from the first half of 2020.

Rio’s most recent annual report reveals former CEO Jacques, who will turn 50 later this year, owned 148,073 ordinary Rio shares, which will yield the mining and metals exec an interim dividend payment of $1.13m – that’s if he’s held onto his shares, that is.

New Rio boss and former CFO Jakob Stausholm, however, won’t be getting quite so much. The annual report reveals the Danish-born 52-year-old has 30,280 shares that will mean a dividend payment of almost $231,000, which Margin Call reckons is nothing to sneeze at.

How sweet it is.

-

Questions kept short

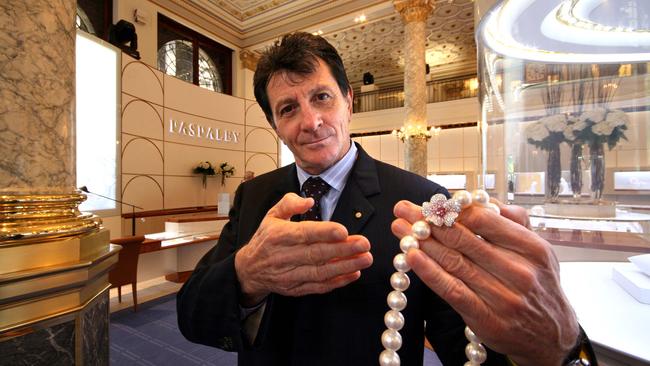

It was off to Darwin this week for West Australian Liberal MP Rick Wilson and his standing committee on agriculture and water resources, set to tackle big issues of sustainability in the nation’s aquaculture sector and opportunities and barriers for its expansion. When it came to Darwin royalty the Paspaleys, however, his questions were remarkably non-existent.

The luxury pearl jewellery group fronted the Darwin contingent, also including member for Flynn Ken O’Dowd and local member Luke Gosling, represented by chief operating officer Sam Buchanan, grandson of founder Nicholas Paspaley, executive director James Paspaley and Tony Thiel, general manager for production.

Despite coming all this way, it seems there was precious little the trio really wanted to know, with a short history lesson seemingly enough to keep the committee happy.

Buchanan detailed the strong family history of the group, its incorporation and, in his own words, “the two-minute tour of the Australian cultured pearl business”.

No mention there though of the group’s $11.7m loss in its recently lodged accounts, or the slip in customer receipts to $62m, from $71m, in the year to June 2020.

Still, in response the chair had only a simple thank you, with no follow-ups on any of the committee’s stated terms of reference.

Here’s hoping he has prepped a few more questions when the topic shifts south to Tassie, the issue of salmon farming in the isle set to ignite more spirited debate.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout