The ghost of George Herscu has returned to haunt the LJ Hooker estate agency.

It was Herscu who presided over the last collapse of the estate agency, then within the Hooker Corporation conglomerate, which was liquidated in 1989 with debts of $1.7bn.

While the then network of 450 LJ Hooker offices had operated independently of Hooker Corporation, Herscu had burdened it with enormous debt after taking it over in 1986.

Margin Call recalls the understandably disgruntled agents sought to buy the network, led by the late Mosman agent Ron Wilson, who was being advised by Simon Mordant, then of Barclays de Zoete Wedd.

But it was secured by Suncorp, which ran it as a mortgage lead generator, before selling in 2009 to a syndicate headed by Janusz Hooker, the then 40-year-old grandson of its 1928 founder, Leslie Hooker.

Fast forward three decades, now with 650 offices, and the debt is only $80m, which Hooker Jr thought he could restructure with fresh funds through a voluntary KPMG administration process with the help of Gilbert + Tobin’s Rob Trowbridge and Skye Capital’s Kelly Morton.

Hooker Jr didn’t envisage the appointment of receivers by an Asian pension fund lender.

It was just a few years ago when Hooker Jr had plans of a $400m stockmarket float, but then retreated into what he thought was the high-technology, low-commission future of real estate, the LJX Lab. The foray into incubating and commercialising products in the prop-tech sector stalled.

LJ Hooker’s 2019 accounts have not been lodged with ASIC, but the 2018 accounts for Empireal Holdings Limited, the ultimate holding company now in receivership, shows the loan fell due in December this year. The accounts suggest the debt is held by ICG Australia Senior Loan Fund and the Singapore-based Madison Pacific Trust Limited, as trustee for KOI Structured Credit Pte Limited.

Macquarie Group would be highly relieved it departed in late 2017 as its senior lender.

Bottles under hammer

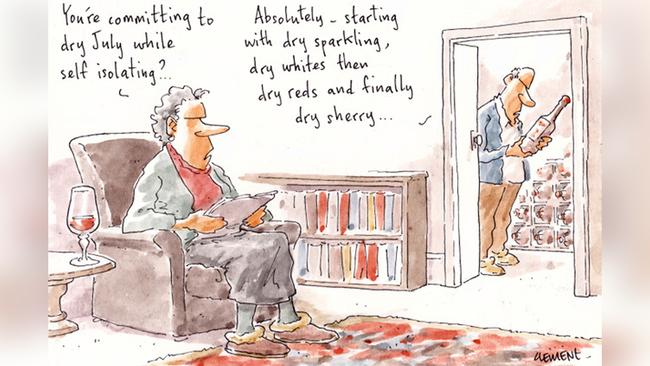

Possibly no dry July for some as online buyers from across the world bid to secure something special from the initial Domaine de le Romanee Conti collection of wine connoisseur James Halliday.

They were procured from France’s Burgundy wine region.

About 35 per cent of the 250 bottles will be shipped to overseas buyers.

The priciest was the 1973 Domaine de la Romanee-Conti at $11,715, including buyers’ commission. Other vintages, from 1999 to 2015, fetched between $7500 and $9900.

All up, 290 online bidders ensured a 97 per cent clearance rate for Langtons.

The local drops in Halliday’s cellar will go to auction in the next month or so.

Expats rush to sell

The London-based expatriate, AMP Capital’s Ryan Watson, has sold his inner-Sydney Darlinghurst warehouse-style apartment. Not wanting to take any chances awaiting last weekend’s auction, Watson accepted a $1.61m pre-auction offer, despite seeking $1.65m.

Watson ranked among the many expatriates motivated to sell by June 30 to enjoy the final days of the federal government’s CGT exemption for expatriates.

The exemption had been in place since September 20, 1985.

But from July 1, expats will be hit with capital gains tax if they sell their property while overseas. The tax calculation will date back to the time of its purchase, not the point at which they vacated the house to move overseas.

So especially costly for anyone who purchased before the late 1980s boom. In what has been ranked as the most egregious piece of retrospective tax legislation in recent times, it seems the true liberals were found wanting in the parliament when it came to putting in the hard yards to ensure its amendment.

Margin Calls recalls there was a time when retrospective legislation triggered mass opposition, such as 1982 when 11 Coalition senators, including the late great Reg ‘Toe Cutter’ Withers, opposed treasurer John Howard’s bottom-of-the-harbour recoupment legislation during the Fraser government.

This time around, the greatest howls to the retrospectivity came from Labor.

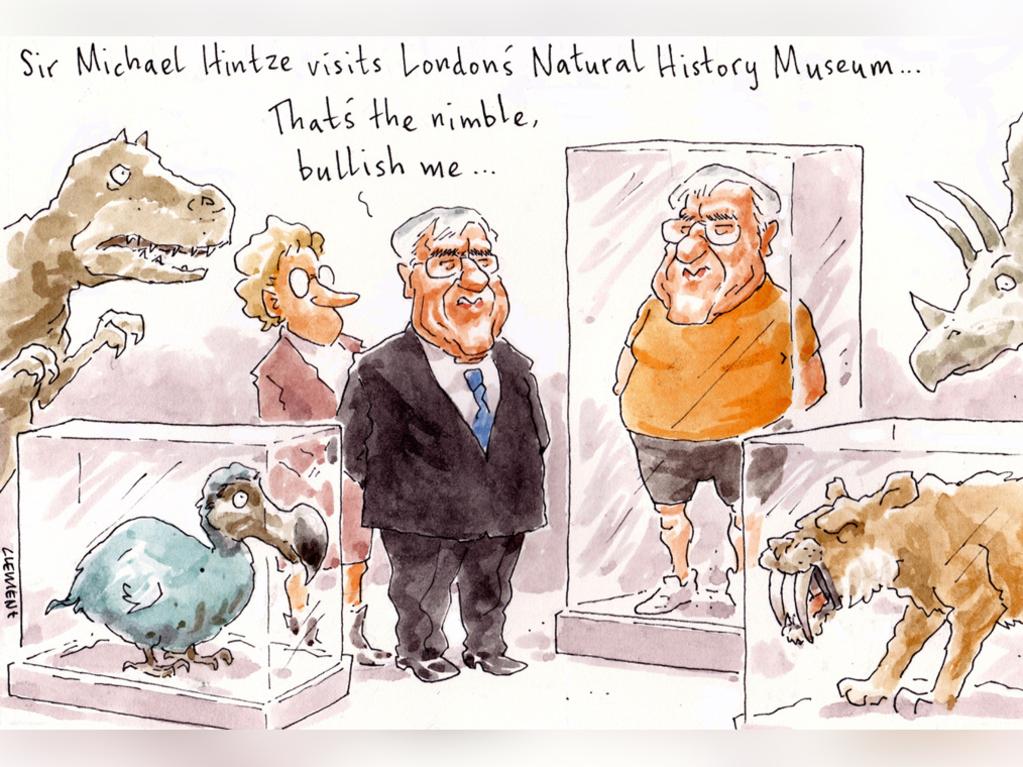

No hiding the heir

The beard didn’t quite spare the media heir Ryan Stokes from the paparazzi sighting when he escaped Sydney for a break on the weekend. The Seven Group Holdings boss, whose well maintained iso beard was evident when he collected his Queens Birthday honour, has been at Byron Bay with wife Claire.

The Darling Point-based couple, who have been knocking around the beard-loving hinterland, were spotted grabbing some takeaway snacks from Newrybar’s popular Harvest Deli. Accompanied by their one-year-old daughter Vivienne Maryon, seems there was no time to dine at the one-hatted restaurant set in the 120-year-old Queenslander.

James Packer’s former wife and fashion house owner Jodhi Meares has also been spotted at Harvest along with the Melbourne stylist Elliot Garnaut, who’s left his family’s wealth company behind, preferring Instagram acclaim. Garnaut revealed he was up at Olivia Newton John’s pamper haven Gaia Retreat & Spa with Double Bay eyebrow queen and Instagram favourite, Kristin Fisher.

Stokes seemingly left instructions for the office to boost its stake in Boral, using a dip in the share price of the embattled construction materials giant to secure more than 12 per cent.

When back in Sydney, Stokes will be embarking on another tough year of cuts. Seven were seeking $90m in savings by June 30, and this rises to $110m envisaged next financial year.

Vise’s ANZ card ire

Capital markets veteran Adam Vise has seemingly been busy tidying up his end of financial year affairs strategy. And he briefly let rip in frustration at ANZ’s credit card system.

Vise is peeved that the bank won’t let him reduce his credit card limit. “Get stuffed ANZ”, Vise told the world of LinkedIn.

“With positive reporting you want to use your market power to manage my access to credit!?,” the public post, by the group treasurer of Australian Unity, read.

“If I want to cancel it, they will delete my transaction data”, Vise advised, before calling out ANZ’s managing director of retail banking, Katherine Bray, followed by “seriously!?”.

Vise happened to be ANZ’s head of capital equity markets for eight years until 2016, and he is still the member-elected director for the ANZ Staff Super Fund, where he chairs the board’s investment committee.

His post disappeared after Margin Call emailed.

Big Issue is back

It was mid-March when the Big Issue suspended its street selling due to the COVID-19 crisis, instead offering a digital version of the magazine. The publication was back on the street on Monday with the vendors in their trademark fluoro vests. There were morning showers in Sydney, while vendors froze in Melbourne where it was first distributed around 615 issues ago on the Flinders Street Station steps in 1996.

The Big Issue CEO Steven Persson said there had been a very challenging period for those living on the margins, with the inability to work and earn an income having a big impact on some of the most disadvantaged. Costing $9, some $4.50 goes to the vendor.

The return to street selling sees COVID-safe measures to ensure the wellbeing of vendors, many of whom will be equipped with digital devices allowing Beem It payments.

The latest edition features stories about vendors’ experiences during the lockdown.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout