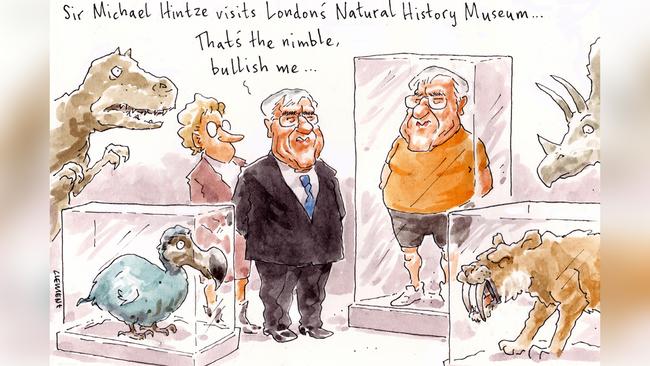

Michael Hintze, the expatriate hedge fund veteran, has been dubbed by the Financial Times as one of the highest-profile hedge fund casualties of the coronavirus crisis.

His flagship fund has lost almost half its value, so investors are looking for answers from the billionaire founder. The CQS fund lost 33 per cent during March’s rout, wiping out about $1bn in value. The fund, which trades stocks, credit and volatility, saw further losses in April and May to be down some 47 per cent, a loss of about $1.4bn.

Born in China to Russian emigres and raised in Sydney’s Wahroonga, Sir Michael has risen to the heart of the British establishment. Indeed, he’s an adviser to the board of the Duchy of Cornwall, the Prince of Wales’ private estate.

He left Sydney in 1980 for Salomon Brothers, New York. Since he established Convertible and Quantitative Strategies in 1999, the veteran trader has been seen as “a cut above the rest”.

Sir Michael gained respect in the City for his “nimble positioning” during the global financial crisis, when he limited losses in 2008 to single digits.

It seems when the coronavirus hit, many of CQS’s structured credit bets turned sour, and unusually the fund was hurt by some defaults, including Hertz car rental and its Chesapeake Energy bonds. The FT surmised these losses convinced Sir Michael to turn more cautious, which meant CQS missed out on much of the equity rally.

But Sir Michael told investors this month, on a private investor call, a recording of which was heard by the FT, that most losses remained “unrealised and mark-to-market”. He emphasised the biggest exposures were to “large, well-known corporates” such as Barclays, Altice, AT&T and Aegon.

“The key point for me is to make your money back,” Sir Michael said, adding he was “heavily” invested in the fund himself. “Not just make our money back but make the money back and then some.”

Banker on VRC board

Michael Saadie, the three-decade-long banker, has been appointed to the Victorian Racing Club board, one of the most powerful sporting bodies in Australia that is responsible for overseeing the Melbourne Cup Carnival.

The Brighton-based NAB executive, who is also chairman of JBWere, will also shortly assume the role as NAB’s executive of metropolitan business banking later this year.

Saadie has been involved in racehorses for more than 30 years, along with an interest in broodmares. He and wife Jo wed in 2003, when living in Sydney’s Haberfield while he was working at ANZ. Their best known horse was the three-time winning mare Proper Madam.

He takes the board’s casual vacancy along with Dave Barham, the award-winning sports media executive who has held positions leading Test cricket, Big Bash League, Formula One Grand Prix and AFL coverage. Barham has been a thoroughbred owner for nearly 20 years, including co-owning Fontiton, which won both the 2015 Blue Diamond Preview and Prelude.

Vin Cox, who has an international profile after decades in bloodstock, along with his low-key directorship at the Alto Group, has also been invited by chair Amanda Elliott to join the board. Cox has been Godolphin Australia’s managing director following seven years heading the Magic Millions for Katie Page and Gerry Harvey. Sheik Mohammed, his current boss, won the 2018 Melbourne Cup with Cross Counter.

Prior to his time at Magic Millions, Cox had his own bloodstock consultancy for eight years, and before that 14 years with William Inglis. And with horse welfare front of mind in the racing world, he recently joined the Thoroughbred Aftercare Welfare Working Group.

The three new directors will take their place at the June board meeting while the renewed board will meet its new chief executive officer, Steve Rosich, in September, after he relocates from Perth, where he’s seeking $2.85m-plus buyers for his Cottesloe abode.

Rosich, the 13th chief executive of the club founded in 1864, led AFL club the Fremantle Dockers for 11 years.

There will be a transition to the CEO role after the Cup, with the succession plan seeing its current chief, Neil Wilson, then becoming the VRC’s 22nd chairman.

Clive adds to portfolio

Queensland billionaire Clive Palmer is whispered to have popped another Gold Coast beachfront into his property portfolio.

The Palm Beach acquisition was a former RSL prize property on Jefferson Lane that sold pre-auction at $3.9m through prestige agent Katrina Walsh. His extensive portfolio includes a $12m beachfront abode at Mermaid Beach.

Meanwhile, entrepreneurial duo Simon and Tahnee Beard, founders of international streetwear brand Culture Kings, have splashed some of their cash elsewhere on the Gold Coast. They have emerged as the $11.5m buyers of Riverpoint, a mega-mansion. The six-bedroom, seven-bathroom Isle of Capri mansion, described as being reminiscent of a Thai resort, sits on 2625sq m with its own private beach no less.

They started Culture Kings in 2008 from a humble shopfront on the glitter strip and now employ more than 500 people. Their clothing is worn by everyone from soccer star Cristiano Ronaldo to rapper Snoop Dogg.

They’ll be moving from nearby Ashmore, where their riverfront cost $3.3m in 2014.

Mayne backs Mac

Activist Stephen Mayne, who is running for the Macquarie Group board at its virtual July annual general meeting, is more studious than showman these days.

His erudite Eureka Report column recently opined that Australia’s fifth-biggest bank was in the best shape of them all, delivering a $2.73bn net profit, just 8 per cent down on the record $2.98bn it made in 2018-19.

Mayne also credited Macquarie as the only bank to release its executive pay details.

“As the inventor of their Millionaires Factory nickname, I’m impressed they are still living up to it, even during a health crisis,” he wrote. CEO Shemara Wikramanayake pocketed $18.9m in 2017-18, $18.03m in 2018-19, and in the year to March 30 earned $14.9m, which was less than Martin Stanley, Macquarie’s head of asset management, who received $19.2m, before tax of course.

Mayne reckons Macquarie is “a very different beast” to the other big four banks as it genuinely competes with other global investment banks in trading, funds management, private equity and corporate advisory, “rather than being part of a local oligopoly profiting primarily from deposits and home loans”.

Having last run in 2015, Mayne’s board tilt was triggered after observing the way Macquarie and some of its ASX-listed clients treated retail shareholders in recent capital raisings.

Bing’s Packer link

No surprise there was a film industry connection between Los Angeles-based tycoon James Packer and film financier Steve Bing, whose death this week has rocked Hollywood.

The 55-year-old Bing, best known for films including Kangaroo Jack, Get Carter, and The Polar Express, was a student at Stanford when he inherited an estimated $600m from his grandfather Leo S. Bing, a powerful real estate developer in New York.

Bing also invested in the 2016 Warren Beatty box office flop Rules Don’t Apply alongside James Packer’s and Brett Ratner’s RatPac Entertainment. It was the film about cursed recluse Howard Hughes.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout