Credit Suisse money manager Shane Galligan might be facing his own financial dramas because of the bank’s collapse

Credit Suisse’s Aussie man faces his own cash crisis

Looks like Credit Suisse’s Shane Galligan, an Australian-based money-manager for ultra high-net worth individuals, might be facing some financial turmoil of his own following the bank’s collapse over the weekend.

The whisper doing the rounds of the private banking world is that Galligan has a multimillion dollar holding of Credit Suisse deferred equity – even as much as $10m – although it remains unclear if that’s tied up in shares or the Additional Tier 1 bonds that have been rendered worthless by Swiss regulators.

Whatever the case, the equity appears to be at risk given the meagre investor allocation accounted for in the UBS takeover plan sealed on Sunday.

Galligan, who managed the wealth of former paper-billionaire Lex Greensill and British billionaire Sanjeev Gupta, is currently in Hong Kong for Credit Suisse’s Asian Investor Conference and is due to take the stage on Wednesday to interview Fortescue chairman Andrew Forrest.

Margin Call approached him for comment in relation to the Credit Suisse equity. He received our questions but declined to respond.

Hunt for Greensill DNA begins

Meanwhile, the collapse of Credit Suisse and the inevitable post-mortem of the wreckage to follow is likely to find some telltale links – a fingerprint, a stray hair – matching the profile of the abovementioned Greensill.

The disgraced Australian financier was known to be repellent to some institutions but hardly at all to a few of the risk-loving cowboys at Credit Suisse, now a creditor of Greensill’s companies – many of which are tangled in a snakepit of liquidation proceedings across the globe.

That’s UBS’s problem from here. And even if it weren’t, we suspect Greensill is preoccupied with matters closer to home.

He’s still skirmishing with his local council over an effort to purchase 502 acres of farmland next to his home in the village of Saughall, where he resides with his wife, Vicky, the local doctor.

Greensill struck a deal with Cheshire West and Chester council to buy the land and create a nature reserve – all for the purpose of protecting his views – but the transaction was paused 2021 following the collapse of his lender, Greensill Capital.

To this day the acquisition remains on ice, and locals are no longer as easy going about Greensill’s attempted purchase given his tattered reputation. Developments are expected in a couple of weeks when the council holds its annual meeting and decides for good whether his purchase of the land should proceed.

Assuming, of course, he still has the dosh to pay for it.

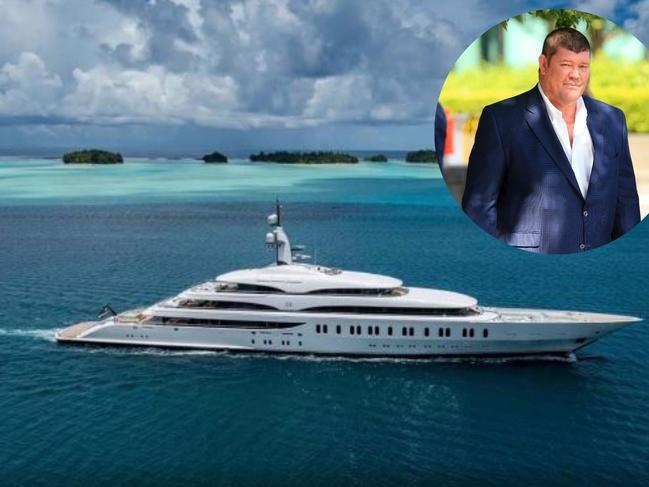

Packer’s F1 jaunt ahead of Oz return

James Packer has turned up in Saudi Arabia ahead of his plans for a 10-day visit to Australia starting this weekend. We can only assume he’ll be flying into the country on a charter flight, having sold his Bombardier last year to keep his living costs down, as he said at the time.

Packer confirmed to Margin Call that he’d sailed into Jeddah Yacht Club and Marina on his IJE superyacht for the start of the Formula 1 season, although he’s certainly not the only prominent individual gliding into the Arabian gulf for the event.

There’s former Russian minister Alexandr Tkachov, who docked on his Renegade superyacht in recent days, along with Sydney to Hobart racer Nigel Stoke on Fidelis and the Pears brothers, of British real estate fame, on Talisman C.

It was in October that Packer visited the Saudi capital of Riyadh for the country’s Future Investment Initiative, from where he heaped praise on developments in the desert kingdom and its ruler, Crown Prince Mohammed bin Salman.

“What’s happening over here is fascinating,” Packer said at the time. “MBS deserves a lot of credit for the good things he’s doing. There’s a massive misunderstanding about what’s going on in Saudi.”

Margin Call asked Packer if he’d lined up any one-on-one time with MbS while he was watching the Grand Prix, but we didn’t receive a response.

Ferrari refuses to be held for ransom

Ferrari’s Australian clients received a rude notification on Tuesday morning informing them that the luxury sports-car manufacturer had been compromised by a cyber attack. Their details – client names, addresses, phone numbers and additional personal data – are now the subject of a ransomware demand that the company is refusing to pay.

“Paying such demands continues to fund criminal activity and enables threat actors to perpetuate their attacks,” said Ferrari CEO Benedetto Vigna. “Ferrari will not be held to ransom.”

Vigna went on to say that payment details and account numbers hadn’t been compromised, nor had details of Ferrari cars owned or ordered by customers.

“Upon receipt of the ransom demand, we started an investigation in collaboration with a leading global third-party forensics firm and have confirmed the data’s authenticity,” Vigna said. “In addition, we informed the relevant authorities and are confident they will investigate to the full extent of the law.”

The Italian car company sold slightly more than 200 vehicles in Australia last year (and more than 13,000 globally) falling short of its 2019 record of 257 sales.

Among the more prominent owners of Ferraris in Australia are the Shahin family, owners of The Bend Motorsport Park and Peregrine Co, although there are certainly many others.

Margin Call contacted Ferrari for clarification about the impact of the data breach locally.

Their cars might be speedy, but their comms aren’t as nimble – we received no response by deadline.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout