Bitter note in sugar city as Greensill legacy rocks markets

Billions loaned to Lex Greensill’s business are under the spotlight once again for helping to bring down the 166-year-old Swiss bank.

The Queensland sugar city of Bundaberg, best known for its rich red soil and rum, is now gaining a reputation for something else – a role in bringing down a 166-year-old Swiss bank.

The global banking crisis initially sparked by the failure of Silicon Valley Bank has now engulfed Credit Suisse, the Swiss banking giant that for many years bankrolled the activities of one of Bundaberg’s favourite sons Lex Greensill.

Some banking insiders say Credit Suisse’s problems had their genesis through its exposure to Greensill – who provided supply chain financing that quickly ballooned to a $US10bn exposure for the investment bank. Greensill built a global financial empire from the frustration of seeing his farming parents waiting months to be paid for their crops.

But the business model spectacularly crashed in 2021 with London-based Greensill Capital collapsing and owing in excess of a billion dollars to creditors. The company’s registered office was listed at rural Qunaba in Bundaberg.

Publicly available property records show Lex Greensill still owns a $4.1m waterfront mansion in the nearby town of Bargara, where the Greensills are sponsors of the local golf club.

The Greensill family, including younger brother Peter, run a successful agribusiness in Bundaberg that is independent of failed Greensill Capital.

The Greensills have snapped up more than $40m of land in the Bundaberg region over the past five years as they expanded their agricultural operations into one of the biggest in the state.

The acquisitions have allowed the Greensills to expand their broadacre production of sweet potatoes, peanuts and cane to gain lucrative supply contracts with national food brands.

Swiss regulators say Credit Suisse – which this week announced it was being taken by UBS – “seriously breached” its obligations in its dealing with Greensill Capital with red flags about flaws in its business model ignored.

Some insiders in the notoriously conservative Swiss banking sector have described it as a failure of ‘Risk 101’.

An investigation by the Swiss Financial Market Supervisory Authority FINMA has found that Credit Suisse had “little knowledge and control” over some of its dealings with Greensill Capital, which financed some companies whose creditworthiness was doubtful.

“The bank used employees who were themselves responsible for the business relationship with Greensill and were therefore not independent to deal with critical questions or warnings,” the FINMA report said.

“Credit Suisse even repeatedly asked Lex Greensill himself and relied on answers in his own statements. For these reasons, the bank made partly false and overly positive statements.”

FINMA concluded that Credit Suisse has seriously breached its duty to “adequately identify, limit and monitor risks in the context of the business relationship with Lex Greensill over a number of years.”

At one stage, a Credit Suisse risk manager responsible for a bridging loan to Greensill identified a number of risks in the business model and recommended the bank not grant the loan but a senior manager overruled that decision.

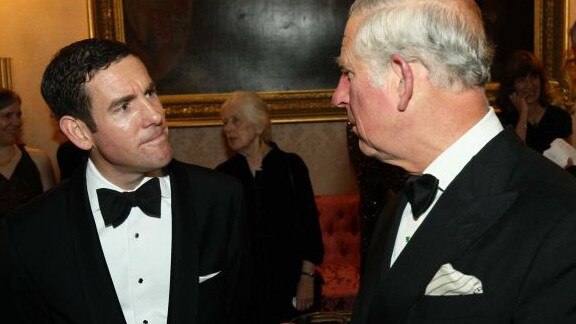

Greensill, whose motivation to start Greensill Capital came from the fact his farming parents sometimes waited years to be paid for crops, is still well regarded in Bundaberg after rising from his hard-scrabble upbringing to in 2017 being awarded a Member of the British Empire by Prince Charles.

The family have been consistently tight-lipped about the problems facing Lex Greensill, who remains based in the UK, but last year Suellen Cusack-Greensill, who is married to Peter Greensill, attacked the release of a book that purports to be the true story of Lex Greensill and the rise and fall of Greensill Capital.

Mrs Greensill took to social media to condemn a local bookshop for stocking the book titled Pyramid of Lies.

“The only thing that really disappoints me (other than a book full of lies and propaganda) is the fact that Dymocks are selling it,” Mrs Greensill posted. “All those years of supporting a local business. You’ve lost a customer.”

Lex Greensill, 46, graduated from Kepnock State High School in Bundaberg’s western outskirts before doing a law degree by correspondence through the Queensland University of Technology. After working as an articled clerk at a local law firm, he moved to Sydney in his early 20s and worked for number of start-ups – including Fifth Finger, one of the pioneers for the technology behind text messaging. Mr Greensill met his future wife Vicky, a doctor, at Bundaberg Hospital, and moved to London.

The father of two went on to work at Morgan Stanley and Citibank before becoming an adviser to then British prime minister David Cameron working on small businesses credit.

“I had big dreams and I’m obviously thrilled but I would be lying if I said this was what I expected,” Mr Greensill told the Bundaberg News-Mail in 2019.

That year Peter and Lex Greensill were listed in The Australian’s Richest 250 list with an estimated wealth of $1.52bn.

Neither Lex or Peter Greensill could be reached for comment on Monday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout