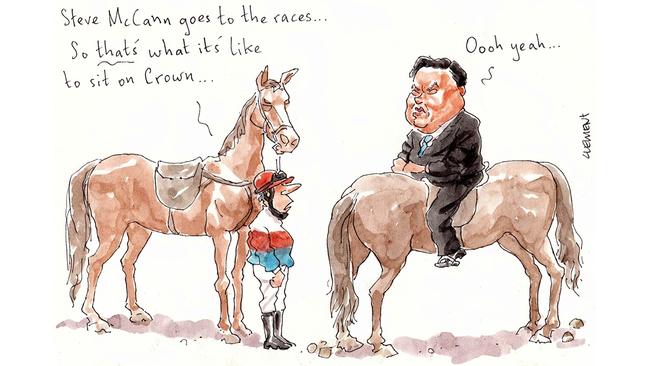

Crown Resorts boss Steve McCann looking for a win with Masked Crusader

Crown Resorts chief executive Steve McCann has shown he’s more than up for backing a roughie, joining the casino outfit in the midst of its regulatory overhaul, but he won’t have to this weekend as his Masked Crusader leads the odds for the return to the track in Sydney.

Lining up for the “richest race on turf” on Saturday, Masked Crusader is the odds-on favourite for the Everest following a strong performance in the lead-up.

The Hawkes Racing-trained sprinter, whose part-owners also include racing heavyweight Rupert Legh and lawyer Colin Madden, took out the Premier Stakes at Randwick just weeks ago and is tipped as the one to beat for the soon-to-be-expanded “race that stops the hibernation”.

Any proceeds from the $15m race will be a coup for the syndicate, adding to $1.5m in prize money already amassed by the five-year-old.

McCann has long been a racing tragic, at one point tipped even being tipped to take on the top job at Tabcorp before he was ultimately installed as boss at James Packer’s Crown.

Recall it was his experience working for a bookie while at uni that was referenced in his “baptism by Fink” as his only anti-money-laundering or gaming regulation experience.

The Crown boss is part-owner of the heavy-hitting Vinery Stud based in Scone, where he rubs shoulders with fellow owners and corporate heavyweights the likes of Gerry Harvey and Katie Page, fundie David Paradice, Quiksilver founder Alan Green and VRC board member Neil Werrett, best known for his ownership of undefeated mare Black Caviar.

McCann and wife Fika’s $8.1m Duffys Forrest estate even has full stabling facilities and an oversized dressage arena, with direct access to riding trails in the adjoining Kuringai National Park.

In the lead-up to the race, and as the Australian Turf Club braces to double capacity to 10,000 patrons pending final cabinet approval, Sportsbet is tipping Masked Crusader as its best bet at $6.50.

The horse is racing in the slot held by Max Whitby andWerrett, with barriers to be drawn on Tuesday morning at North Bondi Surf Life Saving Club.

Meanwhile, its all systems go at McCann’s Sydney casino, with non-gaming operations reopening on Monday after Sydney’s 15-week lockdown.

The group’s many restaurants reportedly were hauling in more than 15,000 oysters, 100kg of lobster and 3000kg of beef, chicken and lamb in preparation for reopening at the weekend.

If jockey Tommy Berry can pull off a win, we wouldn’t rule out a similar shopping list for any victory party, too.

–

Bad timing for CBA

A move by the Fair Work Ombudsman to commence civil penalty proceedings against the nation’s largest bank could hardly have come at a worse time for CBA boss Matt Comyn.

The ombudsman Sandra Parker came out swinging against Commonwealth Bank and CommSec on Monday, accusing it of “knowingly” underpaying thousands of workers over five years to the tune of $16.5m.

While CBA notes it has already commenced a “comprehensive remediation program” in regards to the issue, the new action opens the bank up to face penalties of as much as $666,000 per breach.

All this just days out from the bank’s annual general meeting, where shareholders are poised to vote on the granting of a tranche of incentives for Comyn, over and above the 8.7 per cent lift in base pay to $2.5m already granted from the start of the financial year.

Chairman Catherine Livingstone and the rest of the board have recommended shareholders vote in favour of the resolution, which is set to deliver as much as $3.5m in long-term alignment awards and performance rights to Comyn over the next five years, as long as he can pass a variety of performance hurdles.

The news of the new legal action on Monday followed the deadline for proxy votes at 9.30am, though there is no doubt the issue will be of keen interest for those tuning into the virtual proceedings on Wednesday morning.

Also on the agenda, the re-election of Livingstone and Anne Templeman-Jones, who should breeze back onto the board with markedly less controversy than her other board seat at Blackmores.

Relative newcomers Peter Harmer, former chief of IAG, and Danish banking executive Julie Galbo also face their first shareholder vote for re-election since being appointed in the past 12 months.

–

Nine slow off mark

A delay of more than a year by Nine’s Australian Financial Review to provide draft documents could add to aggravated damages in its defence of a defamation case brought by PNG minister William Duma over articles claiming he had been involved in corrupt dealings with ASX-listed explorer Horizon Oil in 2011.

The latest Federal Court hearing on Monday heard the newspaper had filed a deluge of documents at the weekend as part of discovery, related to drafts of the five stories in question by journalists Jemima Whyte and Angus Grigg.

That’s no less than 15 months after the documents had been requested initially, a factor that wasn’t lost by Justice Anna Katzmann or Duma’s legal team fronted by Peter Gray.

Showing a binder of paper more than two inches thick containing just some of the 300 revisions of the stories retrieved from the Fin’s publishing system Ink, Gray told the court that “something has gone very wrong with discovery” and that the failure was “so gross”, especially given Nine’s only defence was qualified privilege.

He added that the conduct of the litigation ought to be considered in reference to aggravated damages for Duma.

As the hearing continued, the issue of another trove of paper, the very documents at the heart of the story and the basis for which the journalists laid out their claims, was also cause for debate, especially in regards to how they had been acquired.

While it was established the wide-ranging cache of internal Horizon Oil emails had been provided by the so-called confidential source 2, just how he had got his hands on them, whether illegally or through the exercise of his whistleblower provisions, remains a matter for the judge. The case continues on Tuesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout