Commonwealth Bank breaks ranks on chief executive Matt Comyn’s pay

Commonwealth Bank has broken away from the pack on CEO pay, a move that will inevitably lead to greater scrutiny of the lender’s remuneration structure.

Commonwealth Bank has broken away from the pack on chief executive pay, a move that will inevitably lead to greater scrutiny of the lender’s remuneration structure, according to the influential proxy advisory firm ISS.

Citi also said in a report that CBA was an emerging outlier, although chief executive pay in the sector as a multiple of staff pay was now at its lowest point since the early 2000s.

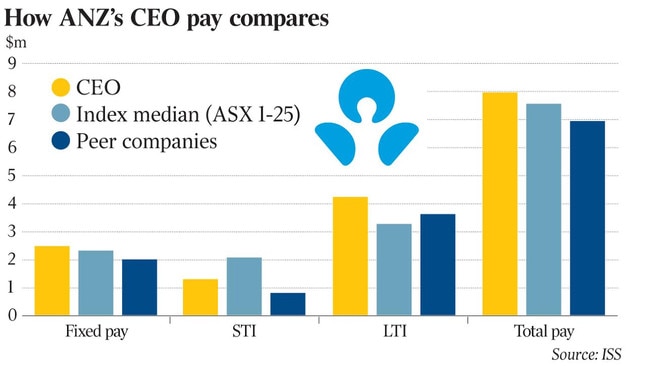

ISS recommended on Monday that investors vote in favour of all board-sponsored resolutions in the upcoming annual meetings of Westpac and ANZ, including the remuneration reports and CEO equity grants.

This was in contrast to last month’s CBA annual meeting, when a “no” recommendation from ISS against the bank’s remuneration report helped trigger a protest vote of 21 per cent — not far short of the 25 per cent threshold for a first strike.

There was a similar vote against CEO Matt Comyn’s $1.6m in restricted stock units, which was seen by some investors as a solution for long-term bonus plans that fail to vest in a bear market.

Unlike options, restricted stock units retain some value when they vest, even if the stock price declines over the deferred or restricted period. Often the only hurdle is continuing employment, typically for a three to five year period.

Last financial year CBA’s Mr Comyn was paid $5.6m, ANZ’s Shayne Elliott was paid $5.2m. National Australia Bank’s Ross McEwan was paid $2.4m and Westpac’s Peter King was paid $3.56m — the latter two appointed to the role during the year.

ISS head of Australia and New Zealand research Vas Kolesnikoff said on Monday that CBA was emerging as the bank likely to attract the most scrutiny for its CEO and senior executive pay framework.

“The divergence on its approach to pay is not matched by CBA’s results,” Mr Kolesnikoff said.

“It has excessive short-term incentives; there was the grant of the restricted stock units to the CEO, and roughly a quarter of his long-term incentives vested based on customer satisfaction in a period when the financial services royal commission was calling out customer conduct issues.

“These concerns appear to have been identified in the bank’s recent annual meeting.”

ISS gave “qualified” support to the remuneration reports of both Westpac and ANZ.

In relation to Westpac, it said pay, performance and shareholder outcomes were broadly in alignment, with no vesting of short-term or long-term incentives in 2020.

Some concerns, however, required continuing scrutiny because they could lead to misalignment between pay and performance.

They included the high skew to non-financial measures in short-term variable remuneration which effectively amounted to bonuses for “day job” duties; payment of excessive sign-on bonuses; high termination benefits; and a narrow peer group for judging relative performance.

ISS had some concerns, as well, about the ANZ remuneration report.

On the upside, short-term bonuses were slashed by 50 per cent due to the board’s discretion, and long-term incentives failed to vest because performance targets were not achieved.

However, there was ‘‘poor” disclosure about the short-term incentives, and concern about the high weighting to non-financial performance measures.

Meanwhile, a Citi report, released on Monday, said bank executive pay as a multiple of staff pay was now at its lowest point since the early 2000s.

While chief executive pay as a multiple of average staff pay hit a peak of 96.2 in 2006, it was now at 35.9 — the same as 2001.