Crown duels a sparkling sitcom saga

We’re not the sort to get overly sentimental here at Margin Call but after 60 days of public hearings at Patricia Bergin’s inquiry into Crown, we’d be lying to say we weren’t somewhat emotionally attached to the characters in the sitcom unfolding on our screens.

Since January we’ve watched Bergin, the fierce and unapologetic matriarch, command the courtroom with her unwavering focus, and in most recent hearings, her sharp-as-a-tack BS detector.

As she aptly put it on Friday afternoon, “we’re in a very different world” to that in which the hearings started in January, not just for the pandemic-induced virtual nature of appearances but for the truths of Crown’s dealings that have been laid bare.

If the prior 59 days of hearings had been the sticking-in of the knife by her co-stars including Scott Aspinall and Naomi Sharp, then Friday’s hearing saw them give it a final twist.

Drilling down on the “merely careless or inadequate consideration” of anti-money laundering concerns raised with legal officer Josh Preston and chief Ken Barton, Aspinall raised doubts as to the very ability of Crown to adhere to regulation truthfully and completely.

“How can you possibly regulate them if you don’t know if you’re going to get an answer,” he said, visibly exasperated.

“Neither Sentinel nor new hires will solve problems — Crown is deeply unsuitable to hold the licence, and it may be in future it can be, but certainly not now.”

MinterEllison couldn’t escape the fray either, with Bergin expressing her “deep, very deep concern” in regards to legal advice reportedly dissuading Crown from reviewing suspicious bank accounts.

Still, just like any good drama, there was a point of introspection in the final moments on Friday, with Bergin spelling out a lengthy list of thanks to her counsel assisting and legal teams as well as to the inquiry’s witnesses, particularly “those who have been beyond the seas” – or on the seas in James Packer’s case.

As Bergin retreats to write her report and the credits roll, one thing is for sure, this won’t be the final episode.

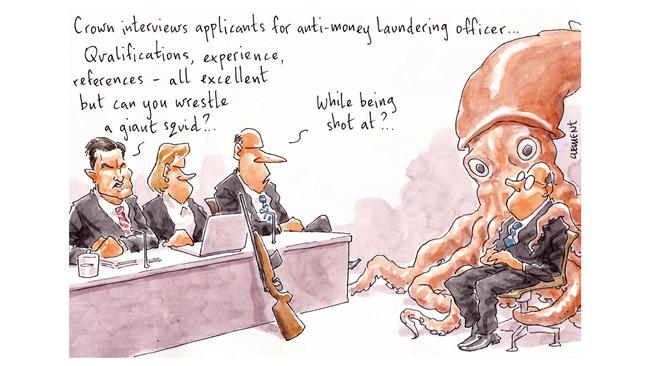

Demanding role

Upon reaching the pointy end of Patricia Bergin’s inquiry it is the casino’s plans to make amends that are in the spotlight, and it seems even they can’t keep up with the pace of change.

On Wednesday, Bergin fastidiously probed defence lawyer Robert Craig SC on the scope of Crown’s new-look anti-money laundering scheme referred to as Sentinel, under the stewardship of former Asia-Pac Credit Suisse compliance head Nick Stokes.

Craig detailed how a head of AML had been selected and served an employment contract, but it seems the rest of the team still needs a bit of work.

You see, an advertisement for an “exciting” anti-money laundering officer role at Crown Sydney was just days ago uploaded to job site Seek, calling for applicants with demonstrated knowledge of the relevant Act and regulatory obligations.

It said responsibilities would include providing assistance to the AML team to ensure timely reports were submitted to Austrac, as well as carrying out customer due diligence inquiries, with advantage to those with fluency in Mandarin or Bahasa Indonesia.

Above all, the role was said to “focus on delivering outstanding levels of service to external and internal customers at all times and in all situations”.

Let’s just hope they have better luck making noise than former AML general manager Louise Lane, whose attempts to raise concerns with the company have been a key “worrying” point for Bergin, prompting her to summon the legal advice from Minters and documents from chief legal officer Joshua Preston.

While salary expectations aren’t disclosed you would have to hope there was a notoriety premium included.

Or maybe danger money.

The last Post

Believe it or not but it has been four weeks since the Australia Post watchgate scandal when revelations of (now former) chief Christine Holgate hogged the headlines.

That means there’ll be some busy lawyers down at Mark Henry’s Maddocks this weekend, as it puts the final touches on its investigation into the incident and what part the then chairman John Stanhope, his board and management had to play.

According to a communications department spokesman, the firm has so far conducted a range of interviews (no doubt including acting chief Rodney Boys, as well as top exec and watch recipient Gary Starr), alongside a review of a range of documentation.

If it is anything like the 472 document dossier released under FOI last week, we wish them luck.

The report is scheduled to be provided to the government in coming days, with cabinet to consider its findings “in due course”. What time frame that refers to is anyone’s guess.

Meanwhile, the search continues for Holgate’s replacement, with the last update before a senate estimates hearing earlier this month that chair Lucio Di Bartolomeo had narrowed potential recruitment firms down to a final three, with a hope to “make some headway before Christmas”.

Recall that Egon Zehnder got the gig last time when Holgate was appointed, though perhaps AusPost may want to look elsewhere lest any new boss succumb to the same fate.

While Holgate has remained largely out of the public eye since announcing her exit from the government business enterprise, she remains as chair of another government-linked board, the Australia-ASEAN council, under the scope of Marise Payne’s foreign affairs ministry.

It would seem that they are largely unconcerned by any investigation by their fellow finance and communications departments, with no response to this column’s queries despite numerous attempts.

Afterpay payday

Just when you thought the millionaire’s club at Afterpay couldn’t get any greater, another swag of escrowed shares are set to be released.

The buy now, pay later juggernaut, which is responsible for shooting co-founder and now co-chief Nick Molnar to the title of Australia’s youngest billionaire, said on Friday that just over seven million shares would be released from escrow at the end of the month.

This time though, it’s not the founders left pondering their investment, but US tech fund Coatue Management, who joined the register a year ago in a $200m placement.

It’s proven to be a wise investment for founder and portfolio manager Philippe Laffont — who has more than tripled his initial investment to more than $684m.

That’s chump change for the New York-based outfit though, with latest reports that the firm had collected more than $US2.33bn for a private-equity fund it began raising last year.