It’s the Pitts at pressured Evans Dixon

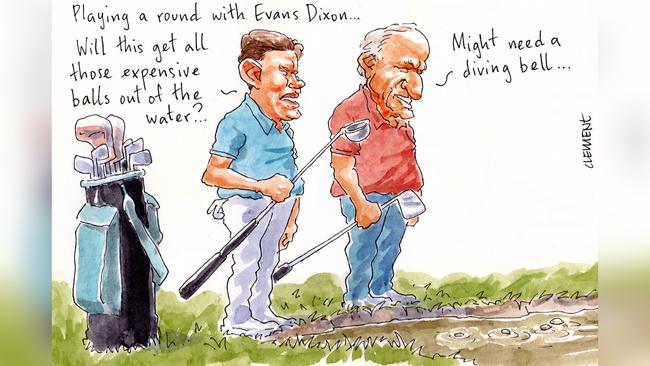

As Tony Pitt’s 360 Capital rethinks its pursuit of troubled wealth manager Evans Dixon — which is now changing its name to E&P Financial Group — we wonder how many of the firm’s big name shareholders have been bending executive chairman David Evans’ ear over recent weeks urging him to reject Pitt’s opportunistic 61c per share offer.

A quick look through the top 20 shareholders list in the latest Evans Dixon annual report shows Kerry Stokes’ Wroxby Pty Ltd still holds a 2.5 per cent stake, just above Robert Milner’s Washington Soul Patts’ 2.4 per cent. Both were investors in the 2018 float.

There’s also the firm’s staff that hold nearly 4 per cent through an entity called ED Employee Investments.

None would be keen to crystallise a massive loss on their investment given the $2.50 they paid for the shares in May 2018.

You can also add to that list Qantas and Woodside chairman Richard Goyder, who reportedly invested $1m at the initial public offering.

And golfing great Greg Norman, who through his Great White Shark Enterprises, shelled out about $400,000.

Evans Dixon’s shares are now trading at 59c, above their record low of 40c touched in September.

Evans Dixon’s wholly owned subsidiary, Dixon Advisory & Superannuation Services, is being pursued by the corporate regulator, alleging breaches of best interest obligations.

The Great White Shark long sat on the Evans & Partners advisory board, alongside the likes of Eddie McGuire, John Wyllie and Bill Kelty. It has now been disbanded.

Norman also designed David Evans’ world-class Cathedral Lodge golf course at Thornton, two hours northeast of Melbourne, for which we hear he was paid a tidy sum many times his losses on the Evans Dixon float.

Over the past year Evans Dixon chief executive Peter Anderson has unwound ties between the firm and the Cathedral Course, which in 2019 saw it spend more than $200,000 on corporate memberships.

Earlier, Margin Call suggested there were tensions between Evans and Norman. A spokeswoman for Evans maintains they are “thick as thieves”.

Ironically the disastrous tie-up between Evans & Partners and Dixon Advisory was sealed in a round of golf at Cathedral between Evans and Dixon in 2016.

Beer nuts

The Cartier watch scandal may have been her undoing, but a new explosive cache of no less than 472 documents, including handwritten executive notes and text messages, has revealed just what it is like to work with now ex-Australia Post boss Christine Holgate.

Spoiler alert: it is not pretty.

The documents, released under FOI disclosures, detail what went on behind the scenes of the One Nation stubby cooler delivery scandal over a weekend in mid-July, and the lengths the national postal service went to in order to deliver the Pauline Hanson posted parcels.

At the height of the COVID lockdown of public housing towers in Melbourne in July, the City of Melbourne, which was overseeing the management of supplies for the towers, refused to deliver more than 110 parcels of Pauline Hanson-branded stubby holders for the residents of the towers.

It was after all, just part of the organisation’s “obligation to ensure items are delivered”, according to Holgate in an email to City of Melbourne chief Justin Hanney, after he hit back at their response to the incident as “pretty disappointing”.

Further, handwritten notes from an as yet unnamed executive (with impeccable all-capitalised handwriting) note that Holgate said it would be a “cop out” not to call the police over the issue, as well as discussion whether she should call Hanson directly.

General counsel Nick Macdonald escalates the seriousness of the incident further, noting that the actions of council to stand in the way of the delivery “interfere with the integrity and security of important national infrastructure”.

Hot beers, it seems, was a big ticket issue, as was managing the press around it.

Amid the stack of documents, messages show frenzied exchanges with an adviser to Communications Minister Paul Fletcher, as well as between Holgate and her own head of external communications.

In one exchange Holgate gets a little testy, noting “my words below say consider and let me know your thoughts, that does not necessarily mean do”, the filling of which looks to Margin Call as a compliment sandwich.

Then there’s a trail discussing a potential call with Melbourne Lord Mayor Sally Capp, well known to Holgate through her Collingwood connections, as well as emails in later days detailing missing stubby coolers and the near $1000 bill to get them sent back to Hanson’s Queensland HQ.

Never a dull moment.

Belly of the beast

The annual Sohn Hearts & Minds Conference is a staple in this column’s calendar, a prime opportunity to watch the goings on of the country’s top corporate and industry names.

Such was our disappointment then when it joined the now lengthy list of events going virtual, saved though by none other than top-billed NYU professor Scott Galloway.

While the star-studded conference, including the likes of Bill Ackman and Catherine Wood, was dedicated to talking companies up, Galloway’s keynote instead was almost solely dedicated to trashing the tech giants including “damaging sociopath” Facebook chief Mark Zuckerberg, and the “anti-Christ of retail” Amazon’s Jeff Bezos.

Beginning his remarks by quoting Vladimir Lenin’s famous maxim “there are decades where nothing happens, and there are weeks where decades happen”, Comrade Galloway quickly diverted from an overview on how COVID-19 had changed the US economy to sledging some of its biggest figures.

In a claim that may be news to Donald Trump, Galloway said that the commander-in-chief (who he says is likely to end up in prison) and Zuckerberg had an “unholy alliance” by which Facebook continues to allow political advertising on its platform despite it “tearing at the fabric of Western society” because of the revenue it brings in.

Add to that the fact that Zuckerberg donated $US300m to support state and local election officials ahead of the presidential race, in Galloway’s eyes “somewhat tantamount” to the late Jeffrey Epstein financing female youth centres.

Criticising the US government’s $US2 trillion COVID-19 stimulus as the “Amazon and Walmart Shareholder Act”, Galloway said that Amazon’s gains throughout COVID had been so large that its ability to sell items at or under cost will mean it will drive out all competition.

“When the Chinese tried to consolidate the US steel market by pricing their product below cost, we call it dumping, but when Amazon comes into Australia we call it innovation,” he said.

But then came the most shocking revelation of all — Galloway admitted that 90 per cent of his net worth was once in Apple, Amazon and Facebook, and to this day he had only sold Facebook.

“I’m not sure I have total moral clarity here,” he said, adding that he was indeed a capitalist who thinks the Apple and Amazon are actually full of “decent people,” only that a little more antitrust action would help the economy out.

So who are the real culprits? The proles.

“I think the real culprits are citizens who have not elected officials that have the domain expertise or the backbone to stand up to these companies,” he said.

One wonders what Lenin would think about that.

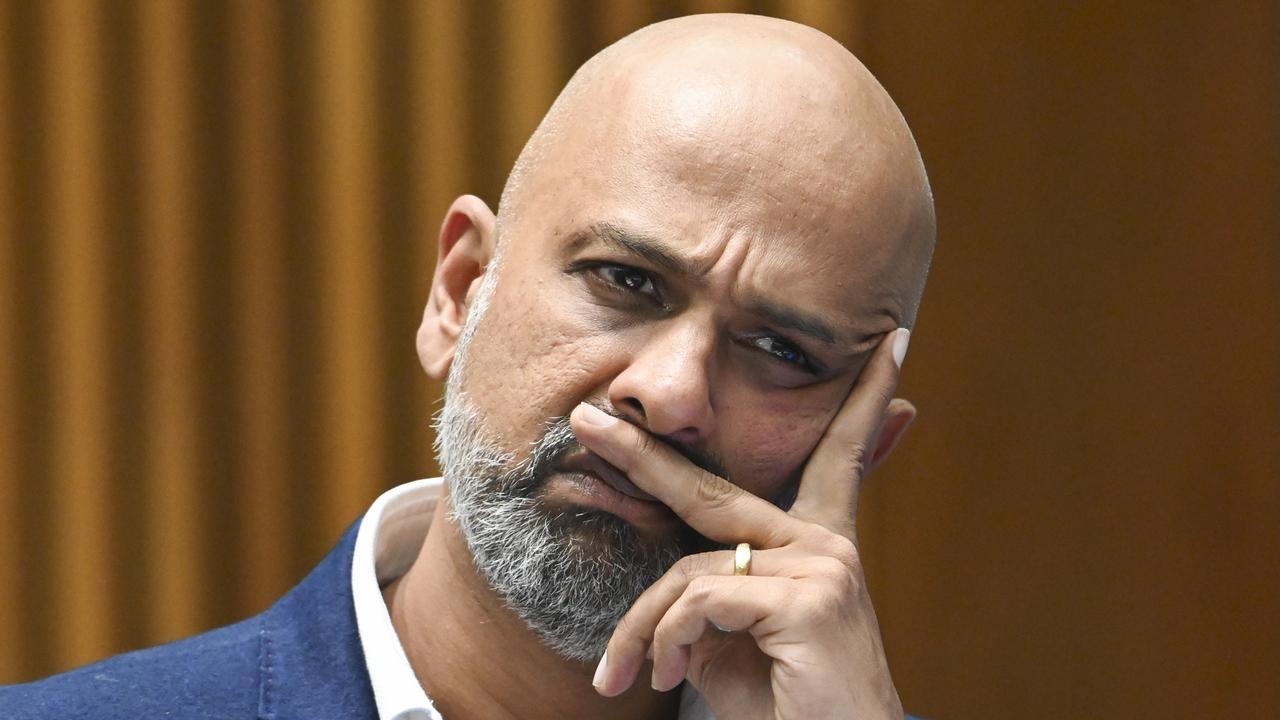

Love the beard

Transurban chief Scott Charlton’s paper wealth has taken a $15m haircut, part of the exec’s divorce settlement according to the firm’s latest filing.

In a stealth move late on Friday, the Lindsay Maxsted-chaired Transurban lodged a change of director’s interest notice, showing the disposal of more than 1 million shares by the 56-year-old’s Rossco Family Trust at $15.39 a pop.

The off-market trade, the company said, was due to a reorganisation of Charlton’s interests as part of a divorce settlement agreement.

While little is known about his now ex-wife, one can only wonder whether the loss of his bushy white beard after the $9.3bn WestConnex deal has any connection to the bust up.

Last year, Charlton took home a neat $4.6m, while he retains an interest in 750,000 shares indirectly through the Rossco entity.