Christine Holgate spotted at Sydney luxury boutique Hermes

Its been a rough week for former top postie Christine Holgate, who this week secured mediation with her former employer Australia Post over the circumstances surrounding her exit and alleged treatment by chairman Lucio Di Bartolomeo.

But while her lawyer Rebekah Giles goes back and forth with AusPost’s legal team on matters of whether details of the mediation are made public, at least there can be some normalcy.

Margin Call spies spotted the former chief in downtown Sydney on Friday afternoon, dressed in casual white jeans and platform trainers, waiting outside King Street’s French luxury boutique Hermes.

NSW Premier Gladys Berejiklian’s snap restrictions on indoor spaces meant Holgate was left out in the cold, queuing for her turn to enter the high-end store.

Of course, Holgate’s taste for labels is well known, with her spending of $20,000 on Cartier watches the start of this whole debacle, which is now getting into its sixth month.

There is an end in sight, however, with Sarah Hanson-Young’s committee looking into the matter set to hand down its final report in the next two weeks.

Those in Holgate’s camp have confirmed she was indeed shopping in the Sydney store on Friday, merely buying a scarf as a present for a friend.

How generous.

Hotel deadline

The controversial owners of the Port of Darwin will decide within weeks whether to proceed with their $200m development of a luxury hotel in the Northern Territory capital.

The Chinese conglomerate Landbridge has imposed a June 30 deadline by which to resume its construction of the 200-room Westin hotel.

The company, which paid the state government $506m for Darwin Port in late 2015, has said if work on the hotel development has not recommenced by the end of next month then Landbridge will not proceed with the project.

The seven-week deadline comes as Defence Minister Peter Dutton’s department is inquiring into the Chinese ownership of the port infrastructure, after Prime Minister Scott Morrison last week visited Darwin and vowed to reconsider whether the state government’s privatisation of the port was in Australia’s national interest.

The Westin Darwin project was first awarded to Landbridge in 2016, to be built on waterfront land gifted to Chinese billionaire Ye Cheng’s company by the NT government.

Ye is said to have close links to the Chinese Communist Party.

The land for the hotel had an estimated value of $21.8m, with the territory government also offering $10m for infrastructure works, $7.3m for a skywalk to connect the hotel to the CBD and touting the development as a significant job-creating project.

The first stage of construction works began in April 2019, but in September last year Landbridge said COVID-19 and related economic impacts had affected the feasibility of the development.

Local Landbridge boss Mike Hughes is responsible for running the port and hotel development for the Chinese group.

Margin Call understands that Landbridge is yet to hear from Dutton’s defence officials as part of their review of the port deal, which was exempt from requiring Foreign Investment Review Board Approval.

At the time of the transaction, then defence secretary Dennis Richardson concluded that the sale to Landbridge did not risk Australia’s security, although he did concede that not telling the Americans of the planned deal was an oversight.

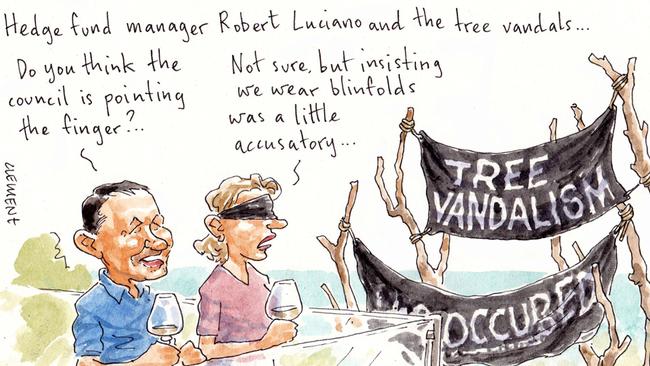

Hunt for tree vandals

There are tree vandals on the loose in the leafy streets of Sydney’s prestigious harbourside suburb of Mosman, but far from the usual products of their work, they seem intent on driving the area’s property values even higher.

Take for example the expansive abode of none other than hedge fund manager Robert Luciano and wife Samantha.

The family upgraded to the $18m mansion last year, paying top dollar to Siobhan Downe, former wife of veteran Macquarie exec Andrew Downe, for the double block with all the trimmings that included a tennis court, pool and no less than a 10-car garage.

The home, just a stone’s throw from Chinaman’s Beach, boasts views over the Middle Harbour, which have only recently been enhanced thanks to the efforts of such aforementioned vandals.

Don’t you just hate that.

Large eucalypt trees outside of the fund manager’s boundary now stand largely stripped of their foliage, and in their place are two black banners erected by the local Mosman Council, that read: “Tree vandalism has occurred in this area”, and threaten fines of up to $5m.

Good thing Luciano is spending more time at home lately, and the fundie, with an eagle eye for financial indiscretions, will no doubt be able to lend his detective work to the cause.

As they notch just over 12 months in the new digs, the couple have held off from any major works — the only upgrade lodged with council is the change of use of the plot’s second dwelling into Luciano’s home office.

The application, which was passed by council in November, notes “recent changes to workplace functions as a result of COVID-19”, saying the space overlooking the tennis court had been converted to a home office.

Here’s hoping he can get to the bottom of the crime.

Sisterhood

The Gaines sisters long ago conquered Perth business circles, but are quickly doing the same when it comes to the ASX.

Middle child Elizabeth Gaines is of course the chief executive of Twiggy’s Fortescue Metals, and has held a multitude of listed board seats over the past 10 years. But elder sister Alison Gaines is now hot on her heels.

Next week, on budget day no less, Gaines will make her ASX chairmanship debut, a key name in the float of recruitment platform Hiremii alongside chief Christopher Brophy after its $6m IPO.

She is no stranger to the boardroom, running her own recruitment firm Gaines Advisory for the past year, after a long career at executive search firm Gerard Daniels.

At listing, the group, Perth-based of course, is set to have a market capitalisation of around $14m, which, even adding in her recent directorship at minnow Blackstone Minerals, still puts her well behind her younger sister in terms of any market cap rivalry.

As for compensation, Gaines’ annual director fees are just shy of six figures, although she also receives 1.5 million options post-admission, exercisable at a 50 per cent premium to the offer price at 30c a pop.

Far be it for the elder two sisters to have all the fun however. Youngest Jo Gaines has made news recently after calling time on her near-decade tenure as deputy chief of staff to WA Premier Mark McGowan.

Despite his resounding victory in the most recent election, Gaines followed chief of staff Guy Houston out the door, with no word yet as to her next venture.

Margin Call can only wonder whether the local bourse beckons.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout